New Zealand Dollar a Sell, Strength Exagerated says Barclays

- NZD is best performer of past month

- But NZD rally might have reached its limits - Barclays

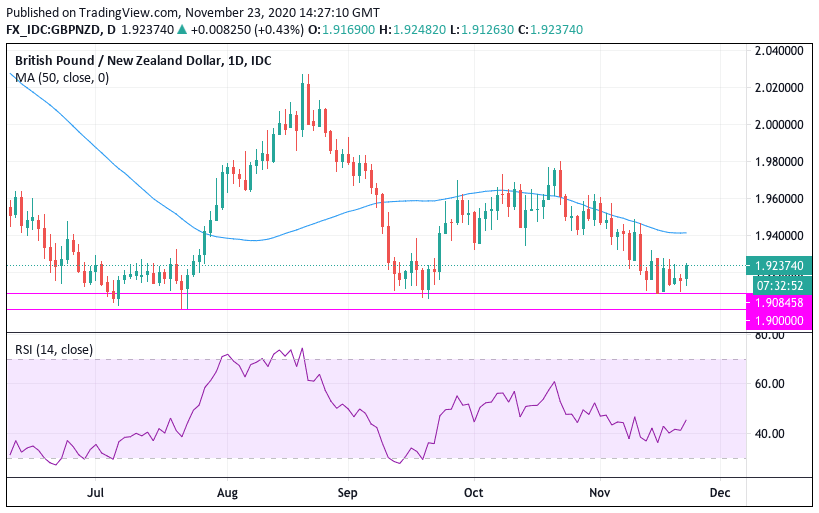

- GBP/NZD techs advocate for further declines

- AstraZeneca news could be supportive of NZD

Image © Adobe Stock

- GBP/NZD spot rate at time of publication: 1.9247

- Bank transfer rate (indicative guide): 1.8573-1.8708

- FX specialist providers (indicative guide): 1.8650-1.9074

- More information on FX specialist rates here

The New Zealand Dollar's recent strength looks "exaggerated" according to foreign exchange strategists at Barclays who make it a short-term sell target.

"We expect NZDUSD to weaken as recent NZD strength appears exaggerated and we see no incremental triggers to help extend the momentum. The NZD’s bullish momentum has likely contributed to long positioning interest," says Marek Raczko, an analyst with Barclays.

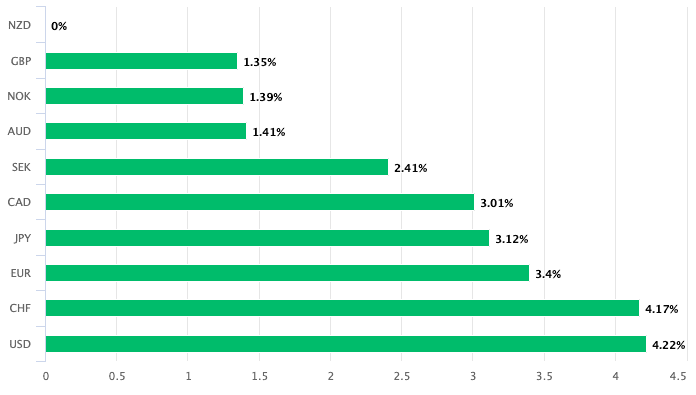

Gains for the New Zealand Dollar make it the best-performing major currency of the past month, a performance that includes a 1.35% advance against the Pound, 3.4% gain on the Euro and a 4.33% gain on the U.S. Dollar.

Much of the advance has come on the back of reduced expectations for the Reserve Bank of New Zealand to cut interest rates into negative territory in early 2021, courtesy of the New Zealand economy's ongoing resilience in the face of covid-19 headwinds. Furthermore, news of a vaccine means that the global economy is being set onto a recovery path, which tends to create the global macroeconomic conditions that tend to favour the currency.

Above: The NZD has been the best performer of the past year. Lock in your ideal exchange rate now for use over coming months, learn how here.

But, the move in New Zealand interest rate yields in favour of the New Zealand Dollar is expected to diminish according to Barclays: "We expect relative rates to move against the NZD as 1y ahead RBNZ OIS has stabilised at 10bp and on RBNZ NZGB purchases/balance sheet expansion," says Raczko.

(When expectations for an interest rate cut recede the yield paid on New Zealand government bonds stop falling and can change direction to go higher. Indeed, the rate on the one-year bond has risen from 6 basis points to 10 basis points in a week - rising rates meanwhile tend aid a currency).

"We expect the NZD to weaken against the USD and underperform the AUD," says Raczko.

A reversal in the New Zealand Dollar's fortunes - as predicted by Barclays - would meanwhile potentially benefit the Pound and allow the GBP/NZD exchange rate rally.

From a technical perspective, the New Zealand Dollar is however still favoured against its British counterpart as the Pound-to-New Zealand Dollar exchange rate has fallen to the bottom of its 2020 range with a floor visible at 1.90:

Above: GBP/NZD with technical indicators. Book your idea exchange rate to ensure you don't miss the market's moves, find out more about this here.

It appears that buying interest ahead of this formidable technical barrier - roughly between 1.9084 and 1.90 - is proving to be reliable and could arrest any declines.

Despite the later of support below, there is little to suggest the prospect of a rebound and if anything the path of least resistance remains lower. The Relative Strength Index - a popular measure of momentum is at 45.35, which is sympathetic with negative momentum.

Moreso, the exchange rate is below its 50-day moving average at 1.9413 which advocates for further near-term downside.

The trajectory of the New Zealand Dollar will of course be an important guide to the GBP/NZD in coming week and months, and signs that the global economy is likely to rebound in 2021 will likely favour the risk- and growth-sensitive Kiwi Dollar.

Positive news from AstraZeneca/Oxford University on the success of their covid-19 vaccine candidate has aided investor sentiment at the start of the new week, benefiting assets such as stocks, commodities and the 'commodity' dollars which includes AUD, NZD and CAD.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

The 'high beta' these commodity dollars display means they are positively aligned with global stock market performance, more specifically the performance of the S&P 500, therefore a strong performance by equities tends to translate to a stronger performance by the Australian Dollar.

AstraZeneca and Oxford University on Monday announced their vaccine candidate for covid-19 - AZD1222 - had proven efficacy in preventing the contraction of the disease amongst participants in phase 3 trials, a development that has lead one investment bank researcher to say the developed world is on course to reach 'herd immunity' by mid-2021.

According to AstraZeneca, two different dosing regimens demonstrated efficacy with one showing a better profile at 90%, while no hospitalisations or severe cases of COVID-19 in participants treated with AZD1222.

The developments leave Deutsche Bank negative on the U.S. Dollar's prospects over coming months, while the commodity dollars such as AUD, CAD and NZD are expected to outperform alongside Emerging Market names.

"From a market perspective, the vaccine news cements our bullish view on most pro-cyclical currencies against the dollar through the turn of the year. We believe Scandinavian, dollar block and many EM FX currencies can all make new highs into year-end and we like being short the broad trade-weighted dollar," says Winkler.