New Zealand Dollar Breakout Faces RBNZ Scrutiny amid Vaccine Celebration

- Written by: James Skinner

- NZD outperforms on vaccine optimism ahead of RBNZ decision.

- Overcomes multi-year resistance level, could attempt run at 0.70.

- RBNZ to avoid any major changes but NZD may receive scrutiny.

Above: RBNZ Governor Adrian Orr. File Image © Pound Sterling, Still Courtesy of Financial Services Council NZ

- GBP/NZD spot rate at time of writing: 1.9404

- Bank transfer rate (indicative guide): 1.8725-1.8861

- FX specialist providers (indicative guide): 1.9113-1.9229

- More information on FX specialist rates here

The New Zealand Dollar remained an outperformer on Tuesday after breaking above an important technical resistance barrier on the charts, potentially setting it up for further gains in the weeks ahead, although this Wednesday's Reserve Bank of New Zealand (RBNZ) policy decision will test appetite for the Kiwi.

New Zealand’s Dollar extended gains over most major currencies as investors bid for risk assets in response to reports of progress in the search for a coronavirus vaccine, extending an earlier rally that was ignited by the contested victory of Democratic Party candidate Joe Biden in the U.S. election.

The Kiwi was unable to get the better of a Pound that rose against all major rivals as it pared losses sustained at the opening of the week, but did achieve a milestone against the greenback with NZD/USD having closed above 0.6742, a major Fibonacci retracement that has previously given stiff resistance to the Kiwi in its recovery from March lows.

NZD/USD could have scope to take a run at 0.70 and above after closing above the 61.8% Fibonacci retracement of the multi-year downtrend that began in early 2017, although it will first need to navigate November’s RBNZ decision, which is a risk given the bank has repeatedly frowned on the Kiwi's ongoing rally.

“NZD strength has been bulletproof of late on global news, but a test lies ahead, with the MPS expected to bring more stimulus, along with a likely reminder the RBNZ has more tricks up its sleeve,” says David Croy, a strategist at ANZ. “It may not be enough to push against the tide of global news.”

Above: NZD/USD rate shown at daily intervals, overcoming the 61.8% Fibonacci retracement of the multi-year downtrend.

The RBNZ has cut its cash rate to 0.25% and committed to buying as much as NZ$100 bn of Kiwi government debt to support the economy. It’s also put commercial banks on notice about a now-anticipated shift to a negative interest rate policy in early 2021.

However, it’s labelled the post-March New Zealand Dollar rally as a threat to its inflation outlook and headwind for the economic recovery repeatedly, even threatening to carry out foreign asset purchases that would involve large sales of Kiwi Dollars in order to reign in the currency.

But investors don't expect it to actually make any meaningful policy changes until early next year and with financial markets already having priced in a -0.75% fall in the cash rate to -0.50% over the next six months, it’s not obvious what the RBNZ could do this week to sustainably weaken the Kiwi.

“Inflation expectations are rising above 2%, the housing market is on fire, the Unemployment Rate is significantly below the RBNZ’s target and COVID has been tamed. Meanwhile, China is rebounding and the USD is weak,” says Brent Donnelly, a spot FX trader at HSBC. “I feel the RBNZ is one of the most pragmatic and flexible central banks in the world and as such I think they could deliver a message that sounds extremely hawkish relative to market pricing.”

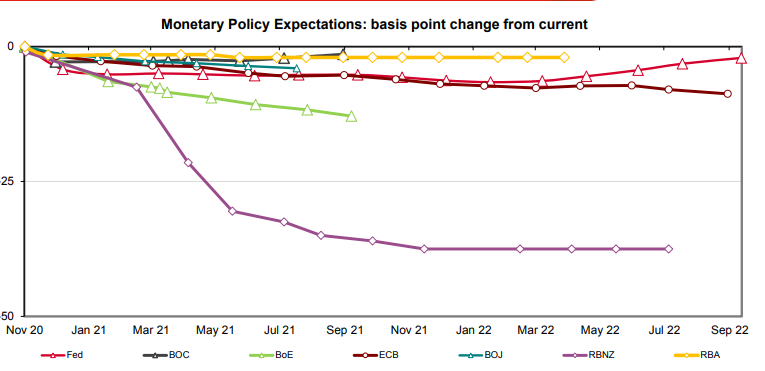

Above: Market expectations for changes in G10 central bank cash rates. Source: Westpac.

Analysts and economists say the RBNZ could announce a funding for lending scheme on Wednesday, which would amount to another way of channelling cheap cash to the banking sector and economy, but otherwise expect its policy settings to remain unchanged.

“If the RBNZ’s MPS conveys a tone consistent with our economists’ forecasts (for example by raising its unconstrained OCR forecast – see across), then market pricing will rise, and that should help lift the NZD,” says Imre Speizer, head of NZ strategy at Westpac. “We are happy to stick with our upbeat outlook, targeting 0.6800 by year end. That is mostly based on a weakening US dollar trend, as well as a positive outlook for risky asset classes.”

The RBNZ has adopted a trigger-happy policy stance in recent months but New Zealand’s economy has outperformed the bank’s expectations and now stands to benefit from a less challenged Chinese economic backdrop following the Democratic Party election victory in the U.S., which is seen ruling out another U.S.-China trade war.

As a result, some in the market are contemplating whether it might take a more relaxed view of the outlook Wednesday, enabling the Kiwi rally to continue.

“While the previous story has been that the Bank and its Governor Orr are aggressively dovish and preparing for new Funding-for-Lending scheme and laying the groundwork for negative rates, one wonders if a bit more uncertainty could creep into their forward guidance on the negative rates issue, given the recent vaccine news. NZD could surge on less dovish than expected guidance,” says John Hardy, head of FX strategy at Saxo Bank.

Last week’s thus-far contested U.S. election and prospect of a divided Congress have cast a shadow over the U.S. economic outlook and lowered the bar for other economies and currencies to outperform it, further entrenching earlier market expectations for protracted declines in U.S. Dollar exchange rates.

Above: NZD/USD shown at weekly intervals, overcoming the 61.8% Fibonacci retracement of the multi-year downtrend.

Slower U.S. growth and a lack of fiscal action from Washington are widely expected to leave the onus on the Federal Reserve to support the U.S. economy, possibly meaning more new money creation than would otherwise be the case, which would be supportive of other currencies including the Kiwi.

“NZD is vulnerable to a move higher near 0.7000 in the next month or so as trade‑related uncertainties ease and global reflationary policies are cranked‑up,” says Elias Haddad at Commonwealth Bank of Australia. “Our ASB colleagues anticipate the tone of the policy assessment to be cautious, downplaying potential (short‑term) upside risks to the outlook (including the housing market) and focusing more on (predominantly downside) medium‑term risks.”

A weaker U.S. Dollar burnishes the outlook for commodity and risk-sensitive currencies like the Kiwi, likewise with reports of progress from vaccine makers like Pfizer, which said on Monday its vaccine candidate was found to be more than 90% effective in preventing COVID-19 in participants without evidence of prior SARS-CoV-2 infection in the first interim efficacy analysis. By comparison, a typical flu vaccine is expected to be 40-60% effective.

Submission for Emergency Use Authorization (EUA) to the U.S. Food and Drug Administration (FDA) is planned for soon after the required safety milestone is achieved, which is currently expected to occur in the third week of November.

With immunisation seen as the most sustainable route out of ‘lockdown,' a successful vaccine could be a gamechanger for the global economic outlook and provide a powerful tailwind for risk-sensitive currencies like the Kiwi in the months ahead. But before then the Kiwi Dollar must first navigate Wednesday morning’s RBNZ decision, due at 01:00 London time in the overnight hours.