New Zealand Dollar Outperforms as RBNZ Tapers, Activity Rises and Virus Retreats

- Written by: James Skinner

- NZD a relative outperformer, vies with USD, JPY for top spot this week.

- As RBNZ tapers QE buys, NZ activity rallys back & coronavirus retreats.

- NZD outperformance keeps a lid on GBP/NZD despite Brexit progress.

© Filipe Frazao, Adobe Stock

- GBP/NZD spot rate at time of writing: 1.9519

- Bank transfer rate (indicative guide): 1.8836-1.8972

- FX specialist providers (indicative guide): 1.9226-1.9343

- More information on FX specialist rates here

The New Zealand Dollar was lifted back into the black against most major rivals for the week Friday as the Reserve Bank of New Zealand (RBNZ) detailed plans to taper its bond purchases, economic activity rose and the coronavirus beat a fresh retreat in the antipodean country.

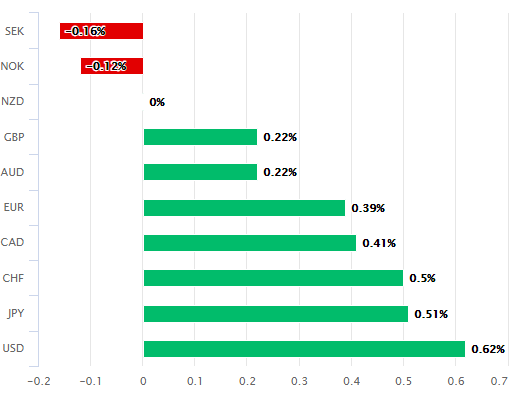

New Zealand's Dollar was a relative outperformer having risen against all major currencies barring the Norwegian Krone and Swedish Krona on Friday, lifting it into the black for the week against many, although it couldn't quite close the gap between it and the safe-haven U.S. Dollar and Japanese Yen.

"In its QE auction schedule for next week, the RBNZ revealed a slight taper. The RBNZ will buy NZD870mn of bonds next week, which is down from NZD880mn this week. This puts the RBNZ in the taper club with the BoC, which announced a bigger 20% taper in bond purchases, but sought to offset the quantity effect by extending the duration of its purchases," says Stephen Gallo, European head of FX strategy at BMO Capital Markets. "The next RBNZ monetary policy statement is November-11."

The RBNZ will buy a slightly lesser volume of government bonds next week, potentially easing downward pressure on Kiwi yields, although the bank is still expected to cut its interest rate below zero from April 2021 and could announce other action at its November policy meeting in a fortnight.

The RBNZ is easily the most 'dovish' in the major economy universe but with much of the anticipated change telegraphed in advance, derivative, bond and currency traders have already taken a 0.75% rate cut all the way to the bank.

Above: Overnight-index-swap implied changes to G10 cash rates. RBNZ in purple. Source: Westpac.

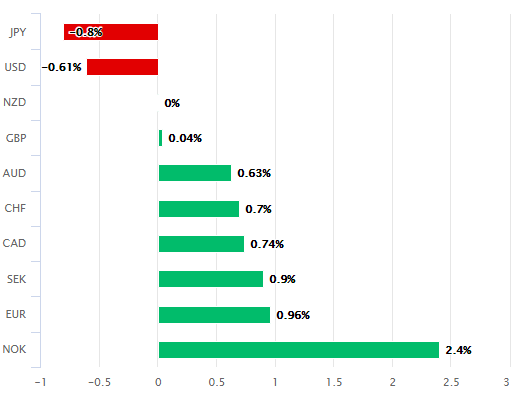

Safe-havens have received a bid this week, with the Japanese Yen the top performer for the period albeit followed closely by a U.S. Dollar that faces a regime change one way or the other next week when in the early hours of Thursday morning, investors will have a clearer idea of the likely outcome from the 2020 the presidential election.

Risk aversion rose as some European economies went back into 'lockdown' and as investors appeared to reconsider their bearishness on the Dollar, but observers wouldn't necessarily have witnessed this investor preference for safe-havens if looking solely at Kiwi Dollar exchange rates.

"October consumer confidence from ANZ lifted firmly (+8.7% to 108.7) and noted the strong performance of the housing sector as supporting consumers. However, there is also clear concern over the risks to employment and actual spending plans remain contained, therefore the impact was somewhat subdued," says Tim Riddell, a London-based strategist at Westpac.

Above: New Zealand Dollar performance on Friday (left) and in October (right). Source: Pound Sterling Live.

Most Kiwi rates rose on Friday and for the week overall when in more ordinary times they tended to fair poorly during bouts of caution or outright risk aversion.

"Inflation came in slightly weaker than expected in the September quarter, while the annual trade surplus continued to grow. Jobs numbers increased in the September month (supported by hiring of voting support workers) and the improvement in business confidence seen in the October preliminary ANZ Business Outlook was confirmed in the final results," says New Zealand's Treasury. "There have been no further cases of community transmission."

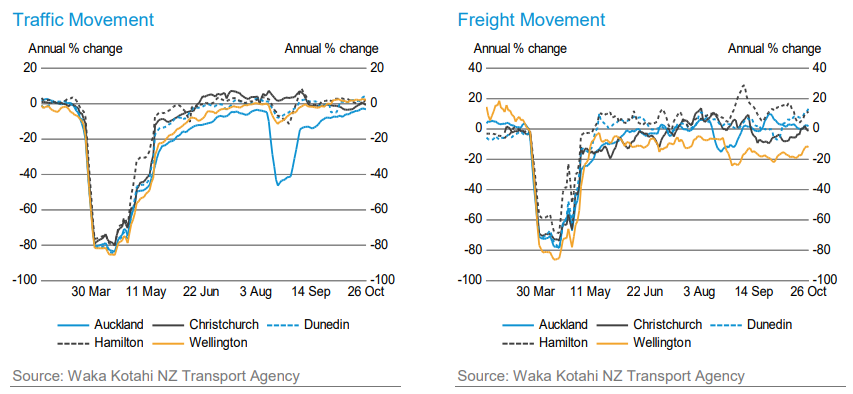

New Zealand's coronavirus-containing economy placed its recovery credentials on full display this week when Google mobility data suggested that people movements around NZ have mostly returned during the week to last Friday to levels seen in January, before the coronavirus came to town.

Above: New Zealand traffic and freight movements. Source: NZ Treasury.

Meanwhile, movements at workplaces, grocery and retail stores had recovered to their January 2020 average, after falling during the earlier 'lockdown' period. Movements in residential areas, which increased by 30% during Alert Level 4, were only slightly above the January average after continuing their post-reopening deceleration.

People movements are indicative of rising economic activity, which would come following a week in which no new community transmission of the coronavirus was detected, with all new infections found within quarantine facitlities.

It's this outperformance on virus containment, coming as Europe enters a renewed 'lockdown,' that might explain the Kiwi's relative outperformance this week and which is tipped by analysts at ANZ to drive an anticipated resilient performance over the coming weeks.

"If global lockdown fears and concerns about the pandemic continue to rage and NZ does a better job containing it, the NZD is likely to do better, as it did in May," says David Croy, a strategist at ANZ. "NZD/GBP had a burst of volatility either side of midnight but came all the way back."

Above: Pound-to-New Zealand Dollar rate shown at daily intervals alongside NZD/USD (black line, left axis).

So far Kiwi resilience has kept a lid on the Pound-to-New Zealand Dollar rate despite repeated claims of progress in the Brexit trade talks this week, but has remained supported above the technically important 1.94 threshold.

But if a deal is announced in November and is succesful in lifting the main Sterling exchange rate GBP/USD back to 1.32 and into line with the S&P 500 index NZD/USD has been following then GBP/NZD could be lifted back toward 2.0 in the absence of further outperformance by the Kiwi.

Moreover, if some strategists are right about a Brexit deal lifting GBP/USD back to 1.35, the GBP/NZD rate could be found trading back at 2.0 or above.

"Our assumption remains that a deal (or a series of deals) will eventually be concluded, but where we may differ from the consensus is on the issue of timing (i.e. before December 31 vs after). Regardless, we maintain that the forthcoming 'relief rally' in the GBP once a deal is concluded will be far smaller than the decline will be if a deal is delayed until after December 31 2020," BMO's Gallo warns. "Moreover, we think the initial phase of broad GBP appreciation once a deal is concluded should be faded - specifically because dispute arbitration will probably yield a more volatile bilateral relationship going forward (in addition to all the other factors which are already weighing on the GBP)."

Above: Pound-to-New Zealand Dollar rate shown at weekly intervals with Fibonacci retracements (supports) off post-referendum recovery and 200-week moving-average.