New Zealand Dollar Taunts RBNZ from Top of Currency Leaderboard as Central Bank Speeches Dominate

- Written by: James Skinner

- NZD outperforms following RBNZ chatter, amid upbeat sentiment.

- But still an August & 2020 straggler as GBP/NZD holds above 2.0.

- RBNZ policy bent and Brexit trade talks key to GBP/NZD outlook.

File image of RBNZ Governor Adrian Orr at a press conference. Image courtesy of RBNZ. Webpage © Adobe Stock

- GBP/NZD spot rate at time of writing: 2.0048

- Bank transfer rate (indicative guide): 1.9346-19487

- FX specialist providers (indicative guide): 1.9747-1.9868

- More information on FX specialist rates here

The New Zealand Dollar appeared to taunt Reserve Bank of New Zealand (RBNZ) policymakers on Wednesday when scaling the top of the major currency performance table following a series of remarks seemingly aimed at coaxing it lower, in a market dominated by looming speeches from central bankers.

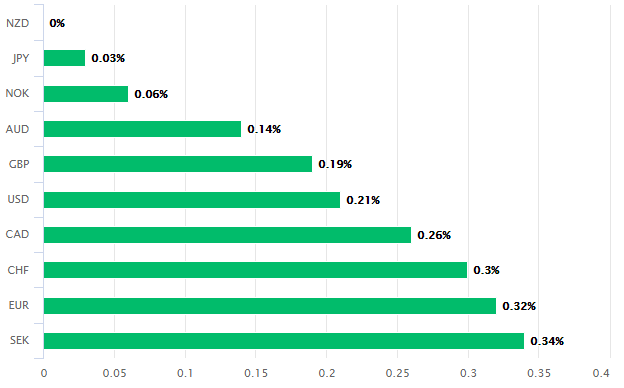

New Zealand's Dollar topped the leaderboard of major currencies having risen against all of its 10 largest rivals amid a mixed performance from stock markets and a tentative revival of appetite for the U.S. Dollar.

The U.S. greenback was higher and so too were major economy bond yields including those of New Zealand, even after Reserve Bank of New Zealand Deputy Governor Christian Hawkesby was reported to have further alluded to a preference for unorthodox monetary policies.

New Zealand's Dollar was the best performing major currency Wednesday but was bottom of the bucket for both the last month as well as the 2020 year and in part because of the increasingly unorthodox bent in RBNZ monetary policy, which may be as much about keeping a lid on the Kiwi as it is dealing with immediate policy challenges.

"NZX 50 was buoyed (+1.5%) by confirmation at the RBNZ’s streaming Q&A of the more dovish (clearly warming to a negative OCR potential) stance of the RBNZ which had been outlined by Hawkesby yesterday," says Tim Riddell, a strategist at Westpac. "NZ PM Ardern stood firm that there would be no sudden alteration in the current Alert levels in NZ (Auckland Level 3, rest of NZ Level 2 are set to continue through Wednesday), but announced that, given the COVID case count is now low with 11 in the past 24hours, there would be a Cabinet reassessment of restrictions on Monday."

Above: New Zealand Dollar performance against major currencies on Wednesday. Source: Pound Sterling Live.

The RBNZ increased the upper limit for government bond purchases this month from NZ$60bn to NZ$100bn under its quantitative easing programme, which has succeeded in driving short-term Kiwi bond yields close to zero while bringing the 10-year yield down to barely more than half a percent.

Much like elsewhere, Kiwi borrowing costs are as low as they've ever been following swift and sustained action by the RBNZ but the bank has made clear that it views itself as being a long way from having ran out of ammunition.

Kiwi policymakers have been clear that they won't rule out a Frankenstein's monster style monetary policy where savers are penalised by subzero cash rate below , or direct financing of the government, which is one step away from hicopter money flown to households straight off the printing presses.

It's not clear how far the bank will actually go in reality although even when New Zealand was thought to have vanquished the coronavirus and been well on its way to economic recovery, the RBNZ continued to threaten further, with remarks mostly being heard amid an earlier recovery of the Kiwi Dollar.

Above: NZD/USD ratre shown at daily intervals.

"NZD/USD is trading firmly around 0.6560. New Zealand posted a smaller trade surplus in July than the previous month but the annual trade deficit shrunk to the lowest level since October 2014. New Zealand’s more favourable trade deficit backdrop can further narrow New Zealand’s current account deficit (‑2.7% of GDP) and improve the long‑term fundamental value of NZD," Elias Haddad, a strategist at Commonwealth Bank of Australia.

The Kiwi currency and economy benefit from strong commodity prices, low pre-pandemic debt-to-GDP and exposure to a Chinese economy that's widely thought to be recovering, although New Zealand was dealt a setback in August when thrown back into 'lockdown.'

Prime Minister Jacinda Ardern has tightened restrictions on acitivity and delayed an election once planned for September due to a resurgent coronavirus.

New Zealand had just 1,682 confirmed infections in total since the beginning of the pandemic as of Wednesday but had discovered more than 100 in August, months after the country was thought to have vanquished the disease.

Above: Pound-to-New Zealand Dollar rate shown at daily intervals with Fibonacci retracements of 2020 fall.

"Eyeballing the chart, the last few days have been one of the longer stretches of stability this year, more reminiscent of past European summers. The USD DXY is neither rebounding or turning lower, and is more likely just treading water ahead of tomorrow night’s (NZT) Fed chair Powell speech on the Fed’s monetary policy framework review, the outcome of which could have significant consequences for currency markets," says David Croy a strategist at ANZ.

Hawkesby's remarks and Kiwi outperformance came as investors await an address from Federal Reserve Chairman Jerome Powell at 14:10 Thursday. Markets will listen for clues on any likely changes to U.S. monetary policy in the short-term as well as for thoughts on the long-term impact that coronavirus-related policy actions might have on monetary policy and what is considered to be the standard toolbox of a central banker, which has typically been limited to interest rate changes and quantitative easing.

Thereafter, Bank of England Governor Andrew Bailey takes to a digital stage at 16:10 on Friday to address the Fed's Jackson Hole Symposium with remarks that will be following closely by Sterling. The Pound has been one of the better performers of the last month after having lagged other major currencies previously which, when combined with the Kiwi's August underperformance, has lifted the Pound-to-New Zealand Dollar rate by around 10 cents back to 2.0.

ANZ says the longer that Sterling holds above 2.0 the greater the odds are of it establishing itself above that level and averting a return to 1.90 and below. However, the evolution of RBNZ monetary policy as well as the still-deadlocked Brexit talks will both be key influences on price action heading into year-end.