New Zealand Dollar Stutters as Covid-19 Restrictions Extended

- NZD mixed at start of new week

- Aukland lockdown extended

- NZ Govt's covid-19 response to hold NZD down

- GBP/NZD looks set to consolidate near-term

- NZD/USD looking to break lower

Image © Adobe Stock

- GBP/NZD spot rate at time of writing: 2.0020

- Bank transfer rates (indicative guide): 1.9320-1.9459

- FX specialist rates (indicative guide): 1.9550-1.9840

- More information on bank beating rates, here

The New Zealand Dollar was seen higher against the Euro, U.S. Dollar and Pound at the start of the new week but lagged the Australian Dollar, Norwegian Krone and Swedish Krona as foreign exchange markets displayed a classic response to rising stock markets.

In short, the currencies that tend to outperform when stock markets are rising are doing just that, while the safer havens of the Yen, Franc and U.S. Dollar are lagging.

Yet, there is a sense that the New Zealand Dollar should be doing better at the start of the new week: the currency has traditionally rallied in robust fashion when global stock markets and commodity prices are rallying in the manner that they are.

The gains it is currently recording against the likes of the Pound and Euro are anaemic at best and on a one-month timeframe the currency remains the worst performing major in the G10 universe.

The underperformance is largely because New Zealand-specific factors have crept back into the currency's valuation in 2020 - where once the New Zealand Dollar was considered to be more reliant on global factors it is now paying attention to domestic developments surrounding covid-19 and the Reserve Bank of New Zealand.

The domestic economy's ability to rebound from the covid-19 crisis has been dealt a severe blow after the government said on Monday it would extend current coronavirus restrictions in Auckland until Sunday night.

Prime Minister Jacinda Ardern said on Monday the extension was needed to ensure the fledgling outbreak, which first emerged two weeks ago, was fully overcome. A total of 101 people have now been infected by the outbreak in south Auckland.

New Zealand continues to pursue a policy of covid-19 eradication which requires severe lockdowns which ultimately force businesses to close and schools to shut and exacts a significant toll on the economy.

Economists at BNZ Bank say the move to Level 3 lockdown in the Auckland region, and a Level 2 lockdown across the rest of the country, will likely knock 1-2% off the country's GDP in the third quarter. The longer the lockdown extends, the greater the economic impact.

"This estimate will grow if the restrictions are extended. It is clear the government is still on an elimination rather than suppression strategy, which ultimately raises the question of whether the country will face ongoing lockdown restrictions over the next year or two. If that is the modus operandi then, economically speaking, this could potentially be quite damaging and is clearly NZD-negative, a possibility that needs to be priced in," says Jason Wong, Senior Markets Strategist at BNZ Bank in New Zealand.

New Zealand's covid-19 policy contrasts to other developed nations which instead look to keep the outbreak contained, recognising that the disease is ultimately here to stay and that the economic costs of a New Zealand-style response is simply too severe.

So where New Zealand's response was once lauded as being supportive of the Kiwi Dollar's outlook, it could well now be an all-out negative as the government's policy response looks to be unable to evolve with the medical understanding of the oubreak. (If you have NZD based payments, and would like to secure current levels for a point in the future, or automatically book more advantageous rates when reached, please see here).

The New Zealand Dollar is looking distinctly unremarkable at a time when stock markets are rallying in response to some positive developments concerning covid-19 treatments and vaccines. The New Zealand Dollar's relative underperformance stands in contrast to the stronger Australian Dollar and confirms that the Kiwi's positive relationship with stocks has broken down of late.

The main culprit for this underperformance remains the Reserve Bank of New Zealand which is pursuing an aggressive monetary policy aimed at supporting the New Zealand economy in the face of the covid-19 slowdown, a side effect of which is a weaker New Zealand Dollar.

"In addition to the government’s COVID19 strategy, the 2.0% RBNZ’s determination to lower interest rates and crank up its money printing operations are also NZD-negative," says Wong. "We believe it is prudent, in the first instance, to lower our NZD projections."

The Pound-to-New Zealand Dollar exchange rate underwent some notable volatility last week with a surge higher on Thursday that delivered a new multi-month high at 2.0270 reversing dramatically on Friday, ensuring the market is back on the cusp of the psychologically significant 2.0 level.

There is a heightened chance that consolidation becomes the theme for GBP/NZD over coming days and we look for the pair to remain capped by last week's high at 2.0270 until such a point as a fresh impulse of New Zealand Dollar selling takes hold.

Despite the reversal in the GBP/NZD exchange rate, the broader outlook for the New Zealand currency remains fragile with further broad-based losses being anticipated. With this in mind, developments in the New Zealand-U.S. Dollar exchange rate could well prove crucial.

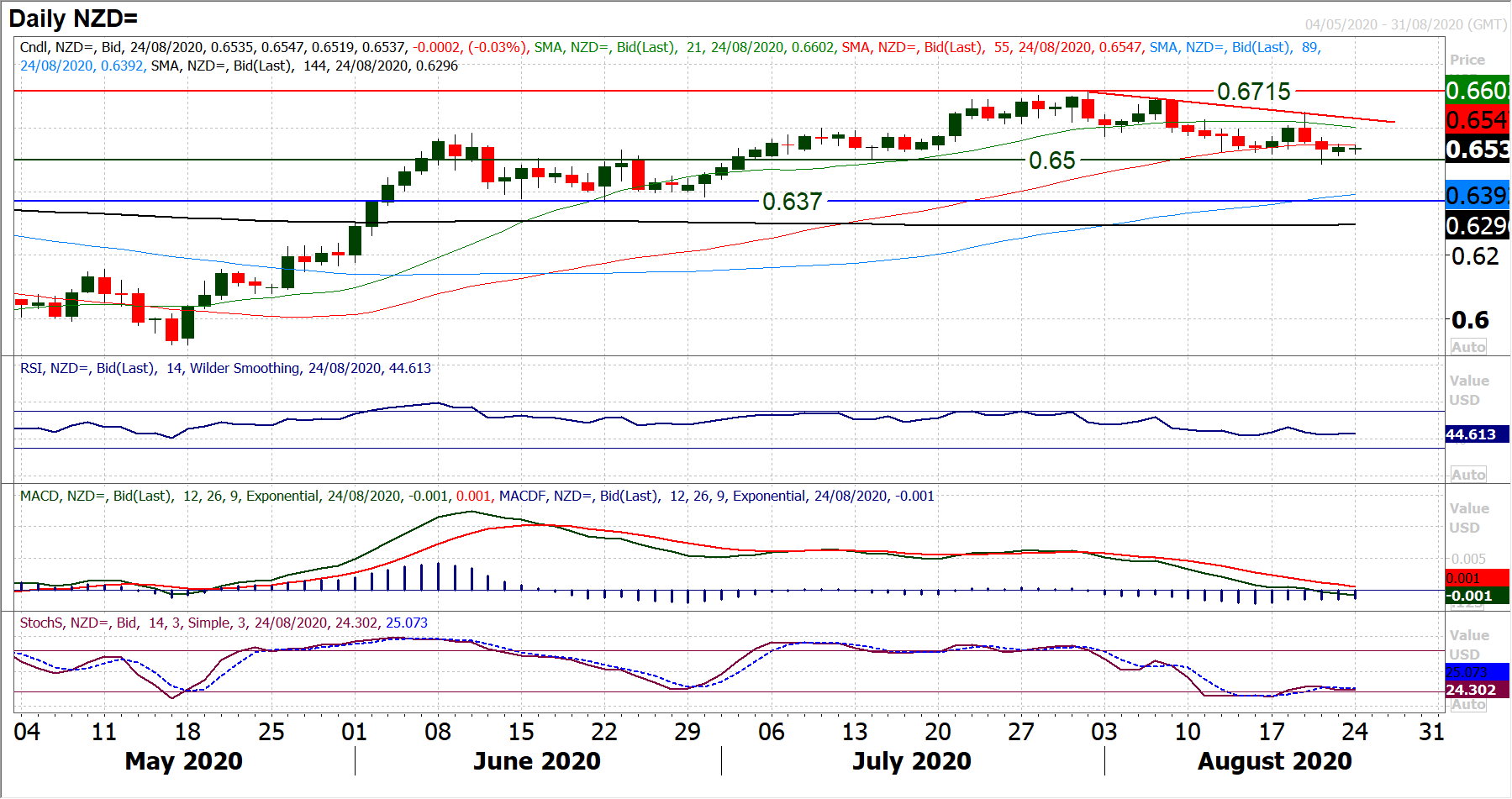

"With volatility ramping up in recent sessions across major forex pairs, the potential for a key breakdown on the Kiwi has taken hold," says Richard Perry, an analyst at Hantec Markets. "The recovery momentum has been lost and pressure has grown back on 0.6500 again."

"If the Kiwi were to close below 0.6500 it would be a seven week low and mark a key technical shift in outlook, one which would also complete a reversal top pattern (arguably a head and shoulders top," adds Perry.

Perry says a deterioration in momentum indicators already threatens a breakdown in the New Zealand Dollar against its U.S. counterpart, with the NZD/USD MACD indicator at a 10 week low, whilst RSI is already leading the market lower.

"A closing breach of 0.6500 would complete a -215 pip top pattern and certainly imply a test of the key June higher low at 0.6370 in the coming weeks. The rebound to 0.6650 (last week’s high) is now a key resistance now and any bull failure under 0.6600 area will increase the negative pressure now," says Perry.