New Zealand Dollar Rebounds from Oversold, BNZ see Negative RBNZ Rates in 2021 and Shave NZD Forecasts

- NZD rebounds from heavily oversold conditions

- Strength likely to be temporary

- GBP/NZD back below 2.0

- BNZ latest to forecast a negative % at the RBNZ in 2021

Image © Adobe Stock

- GBP/NZD spot rate at time of writing: 1.9920

- Bank transfer rates (indicative guide): 1.9226-1.9365

- FX specialist rates (indicative guide): 1.9450-1.9740

- For more information on bank beating rates, please see here

The New Zealand Dollar is rebounding back from heavily oversold conditions, a technical development that had become well overdue following a relentless multi-day sell-off driven by expectations the RBNZ would cut its main rate below 0% in coming months.

That expectation remains in place, with New Zealand lender BNZ being the latest bank to tell clients they are now forecasting negative rates to be introduced in 2021.

The fundamentals behind the New Zealand sell-off therefore remain, but for now we must expect some near-term retracement of the losses as a heavily oversubscribed trade unwinds.

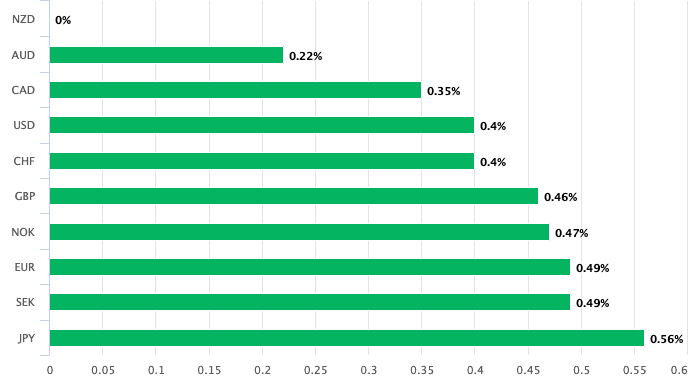

We wrote last week that the New Zealand Dollar was looking oversold (GBP/NZD overbought) and that a near-term correction would be required to rebalance the market. This does appear to be now taking place with the New Zealand Dollar being the best performing major currency of the day in mid-week trade:

Above: NZD outperforms its major peers on Wednesday, August 19

"The recovery in the NZD overnight isn’t entirely explainable, although the currency has been an underperformer over recent weeks. Yesterday we shaved a couple of cents off our NZD projections to reflect the government’s zero tolerance to any COVID19 outbreak – damaging short-term economic growth – and the evident determination by the RBNZ to drive domestic interest rates lower across the curve via its money printing operations and its revealed preference to move to a negative OCR next year, should further stimulus be required," says Jason Wong, a strategist at BNZ.

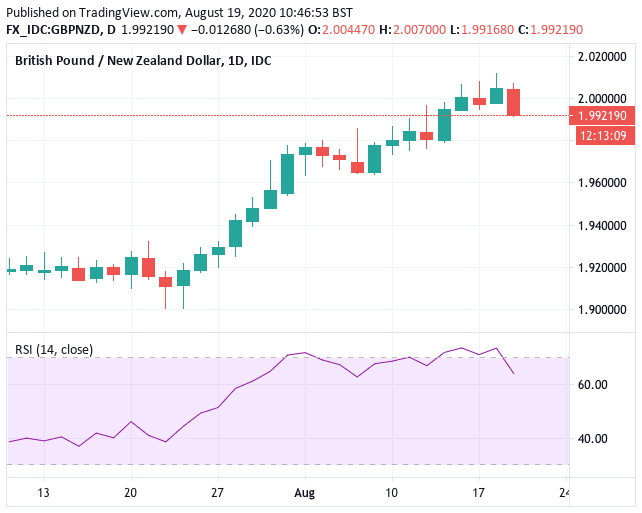

A key signal suggesting the New Zealand Dollar was reaching oversold conditions can be found in the Relative Strength Index (RSI) on the daily charts for GBP/NZD and NZD/USD; in fact most NZD crosses have been flagging the same message.

The RSI tends to reside between 30 and 70, with moves below 30 signalling oversold conditions and above 70 signalling overbought conditions. Because the RSI rarely strays outside of these parameters for too long traders view such extremes as liable to correction.

GBP/NZD's daily RSI had been trading above 70 since August 12 and this flagged to us the requirement for a correction or consolidation to set in to allow the RSI to fall back.

Above: GBP/NZD daily chart, with the RSI in the lower pane

The 0.5% fall in the Pound-to-New Zealand Dollar exchange rate to 1.9950 in the mid-week session fulfils the need for the market to correct, and we see the RSI back at 66. However, will the trend simply resume now that the RSI has calmed? Not necessarily straight away, but should a RSI reading above 50 is indicative of a positive trend and therefore advocates for further gains.

If you have NZD payment requirements and would like to lock in current levels based on recent price action, or automatically book better levels when they hit, we would suggest setting up management strategy.

The underlying fundamentals behind the NZ Dollar's recent decline still remain firmly in place, with New Zealand lender BNZ saying on Wednesday they now expect the RBNZ to cut rates to below 0% in 2021.

"We are somewhat belatedly joining the throng who believe the Reserve Bank of New Zealand will take its cash rate negative in 2021. We are doing so because the RBNZ has, for all intents and purposes, said it will. We said in our MPS review there was a 50/50 chance we’d do this, we are now over the line," says Stephen Toplis, Head of Researc at BNZ.

Toplis and his team are not "absolutely convinced as to when and by how much" but they pencil in a 50 basis point cut in the cash rate at the April Monetary Policy Review, taking the rate from its current 0.25% to -0.25%.

They see a further 25 point cut at the August Monetary Policy Statement.

The call from BNZ follows a similar made call made by ANZ at the start of the week.

Cutting interest rates to below 0% would represent a remarkable turn around for New Zealand which was, a mere year ago, boasting one of the highest bank interest rates on offer amongst the world's developing economies.

This interest rate advantage meant substantial volumes of foreign capital found its way into New Zealand driven by investors seeking higher returns, a process that provided a significant source of support to NZ Dollar valuations.

The series of interest rate cuts during 2019 and 2020, and the prospect of a cut to below 0%, means this advantage will have completely evaporated and if anything the incentive is for capital to move out of New Zealand and into other foreign money accounts.

The significance of RBNZ policy on promoting a weaker NZ Dollar can therefore not be underestimated.

BNZ's reasoning for expecting negative interest rates at the RBNZ include:

- The RBNZ's steadfast commitment to keeping rates unchanged until March 2021

- The RBNZ tends to do the “big stuff” when it releases its full Monetary Policy Statements

- "The reason we have opted for a 50 basis point move rather than 25 points is twofold. Firstly, this RBNZ regime likes to “get in front of the curve”. By April it will feel the move will have been long overdue. Secondly, we don’t think it will want to suffice with a zero cash rate at a time when it will want to assess how negative interest rates work in practice" says Toplis.

- The RBNZ will want to see the initial impact of a negative rate cut, and would therefore want to test a -0.25% rate rather than going all out on a 0.5% cut.