Pound-New Zealand Dollar Rate Surges Above 2.0, ANZ Forecast Negative Interest Rates at RBNZ in Early 2020

- NZD remains a laggard in global FX

- GBP/NZD pops back above 2.0

- ANZ say RBNZ to cut rates below 0% in early 2020

Image © Adobe Stock

- GBP/NZD spot rate at time of writing: 2.0095

- Bank transfer rates (indicative guide): 1.9372-1.9513

- FX specialist rates (indicative guide): 1.9550-1.9895

- More information on bank beating exchange rates, here

The Pound-New Zealand Dollar exchange rate has this week broken above the psychologically significant 2.0 level, courtesy of an ongoing rout of the New Zealand Dollar linked to lingering expectations for negative interest rates to be introduced by the Reserve Bank of New Zealand (RBNZ) at some point in coming months.

The New Zealand Dollar lost a further 1.15% to the Pound last week with the lion's share of losses being driven by a the RBNZ policy decision where Governor Adrian Orr indicated negative interest rates were being seriously considered.

"The Kiwi dollar is the key laggard in G10... after the dovish message sent by the Reserve Bank of New Zealand," says Francesco Pesole, FX Strategist at ING Bank N.V. "We continue to think that the RBNZ will have to deliver on its threat to cut rates to negative to substantially dampen the NZD."

The Pound has now risen against the New Zealand Dollar for four weeks in succession and while it would be unwise to stand in front of the trend we also remain of the view that GBP/NZD is now overbought on a daily basis. A look at the Relative Strength Index (RSI) on the daily chart shows it to be in overbought territory at 74.35. The RSI rarely spends time above 70 or below 30, and the only way it can correct lower is if the GBP/NZD pulls back or enters into a period of sideways trade.

"There is more room for some NZD rebound after a grim week," says Pesole.

However, calling the timing of any rebound in the New Zealand Dollar is fraught with difficulty given the market's ongoing focus on the RBNZ and domestic policy.

Typically we would expect the broader backdrop of improving global commodity and equity market prices to be supportive of the New Zealand Dollar, given its status as a 'commodity currency'. Both equity and commodity markets remain in a strong uptrend and this would typically translate into a stronger New Zealand Dollar.

The currency's underperformance does however confirm that domestic considerations are currently potentially more important than external drivers and we would therefore pay more attention to domestic data and political events than would normally be the case.

This shift in focus owes itself to the increased prominence of RBNZ policy in NZ Dollar moves, as the RBNZ is likely to cut interest rates further if the domestic economy continues to struggle.

"We are now forecasting the RBNZ to cut the OCR by 50bp to -0.25% in April 2021. Beyond that, further easing is possible, but there are constraints on the OCR going below -0.75%," says Sharon Zollner, Chief Economist at ANZ Bank. "New Zealand with a closed border is an economy that is around 5% smaller. Because of the extreme seasonality of tourism, the blow will fall most heavily from October to March."

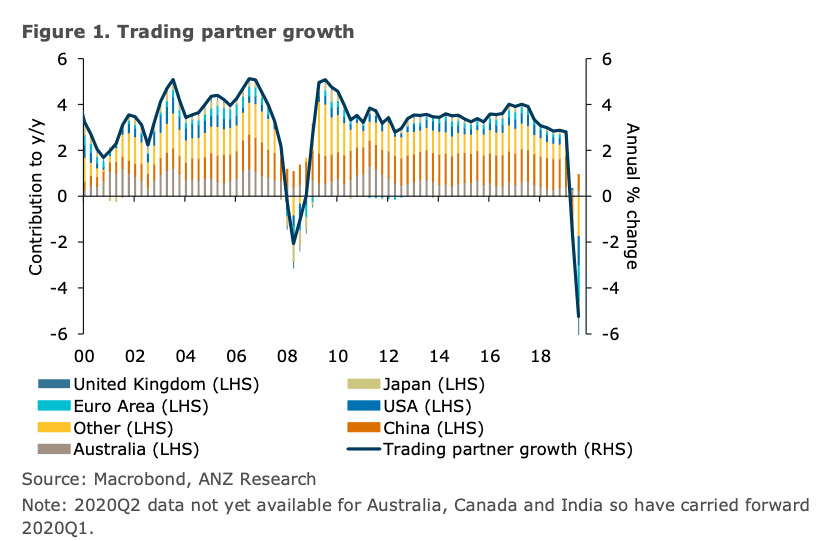

Zollner also says global growth "is looking dreadful".

"While people have to eat, they don’t necessarily have to fork out a bit extra for New Zealand’s premium, high-quality produce. Food supply disruptions globally are providing price support, but also logistical headaches. On the whole, New Zealand’s commodity prices are holding up pretty well, but downside risks are evident, and non-commodity exporters are finding the going very tough," says Zollner.

"In addition, the robust NZD is doing our exporters no favours," adds Zollner. "All up, health-wise, New Zealand has dodged one bullet and is weaving, Matrix-style, around the second as we speak. However, we wrote our own name on an economic bullet when we closed the border."

Cutting interest rates to below 0% would represent a remarkable turn around for New Zealand which was, a mere year ago, boasting one of the highest bank interest rates on offer amongst the world's developing economies.

This interest rate advantage meant substantial volumes of foreign capital found its way into New Zealand driven by investors seeking higher returns, a process that provided a significant source of support to NZ Dollar valuations.

The series of interest rate cuts during 2019 and 2020, and the prospect of a cut to below 0%, means this advantage will have completely evaporated and if anything the incentive is for capital to move out of New Zealand and into other foreign money accounts.

The significance of RBNZ policy on promoting a weaker NZ Dollar can therefore not be underestimated.

If you have NZD related payments and are interested in locking in current levels, or automatically securing higher or lower levels when the market reaches them, we would recommend getting in touch with an international payments specialist. Our partners at Global Reach would be more than happy to hear from you.