'Overbought' GBP/NZD Touches 2.0 as RBNZ Continues to Weigh on New Zealand Dollar

- GBP/NZD rally hits 2.0

- NZD down against all peers in 2020

- But charts warn of oversold conditions

Image © Adobe Stock

- GBP/NZD spot rate at time of writing: 1.9973

- Bank transfer rates (indicative guide): 1.9276-1.9416

- FX specialist rates (indicative guide): 1.9650-1.9790

Fore more information on market beating rates, please see here

The British Pound has advanced a further 1.0% against the New Zealand Dollar this week with gains ensuring the GBP/NZD exchange rate touched the psychologically significant 2.0 level for the first time since early June ahead of the weekend.

The Pound has now undergone four consecutive weeks of advance against its New Zealand counterpart, with a recent rally in GBP/NZD coming on the back of signals from the Reserve Bank of New Zealand (RBNZ) that further easing aimed at supporting the economy is on its way.

"The key takeaway from the RBNZ meeting is that they’re preparing more loosening measures to use if necessary, including not only negative rates but also buying foreign assets – a deliberate effort to weaken the currency. The market is just doing it for them, thereby saving the RBNZ some money," says Marshall Gittler, Head of Investment Research at BDSwiss Group.

The NZ Dollar fell against all its G10 rivals after the RBNZ increased the quantitative easing (LSAP) programme to $100BN while lengthening the period in which the programme must be carried out from 12 to 22 months.

But the RBNZ also indicated it was considering further measures to help the economy including cutting interest rates below 0.25% and potentially into negative territory while the purchase of foreign bonds was also said to be a consideration.

"It is hard to imagine a more dovish set of policies," says Sharon Zollner, Chief Economist at ANZ.

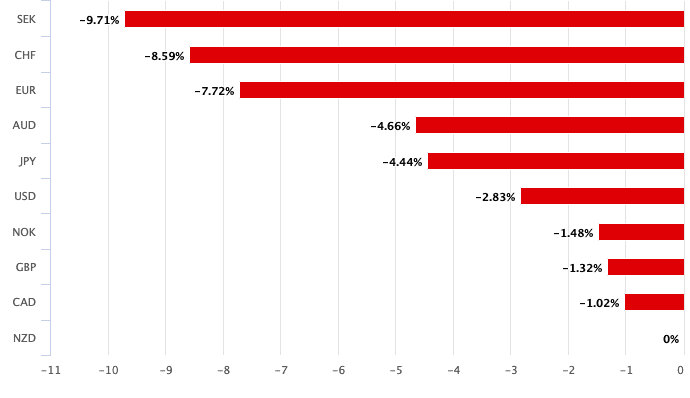

The New Zealand Dollar now screens as the worst performing currency of the past week, month and of 2020 after it supplanted the Canadian Dollar in the underperformance department.

Above: NZD has lost value against all its peers in 2020

The New Zealand Dollar has fallen against the U.S. Dollar from 0.6602 at the start of the week to trade at 0.6535 at the time of writing, the Euro-New Zealand Dollar has risen from an opening rate of 1.7856 and is currently at 1.8040 while the Pound-to-New Zealand Dollar exchange rate opened the week at 1.9775 and is now at 1.9973.

While the overall trend in the New Zealand Dollar remains down we do note that the move is starting to look overdone, for instance the GBP/NZD exchange rate is now overbought on the daily chart and is therefore increasingly at risk of setback.

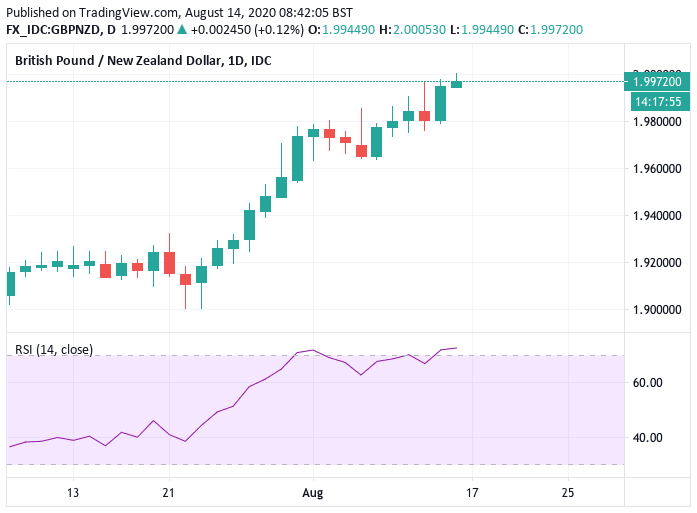

The Relative Strength Index (RSI) on the GBP/NZD daily chart reads at 72.69 (the bottom pane in the below), any reading above 70 on the RSI indicates overbought conditions:

Above: GBP/NZD daily chart showing overbought conditions in the lower panel.

An asset can trade at oversold or overbought conditions for a period of time, but almost never for extended periods of time, and we would therefore be increasingly alert to a potential decline or consolidation in the GBP/NZD pair. Given the strength of the trend higher, we would however expect weakness to be short-lived at this juncture.

The EUR/NZD daily chart is also displaying overbought conditions, and we would also look for some consolidation to set in here over coming days as the move unwinds.

That said, we note that for the headline NZD/USD exchange rate the trend is not yet overdone (oversold in this case) and momentum here remains comfortably negative in the short-term at 43.25, if further New Zealand Dollar losses against the U.S. Dollar transpire over the coming days we could see those overbought conditions in both GBP/NZD and EUR/NZD remain in place.

A question readers have asked us is whether the sell-off in the New Zealand Dollar is justified, particularly given the popular narrative that the country has dealt with the covid-19 pandemic so effectively.

While the domestic economy might benefit from the country's fight with the pandemic, it must be noted that New Zealand remains a small and open economy that relies heavily on the health of the global economy. It is therefore unable to escape recession as tourism and global trade suffers. "We expect the coronavirus outbreak to have a significant negative impact on world trade over the long term. We forecast the next decade will see both world trade growth and the ratio of trade to GDP growth at their lowest levels over a 10-year period since WWII," says Ben May, Director of Global Macroeconomic Research at Oxford Economics.

The key to understanding the New Zealand Dollar lies with the RBNZ's response to the economic downturn in that they have been particularly aggressive in cutting interest rates and engaging in quantitative easing, which sees the RBNZ buy government bonds in order to keep the cost of lending across the economy low.

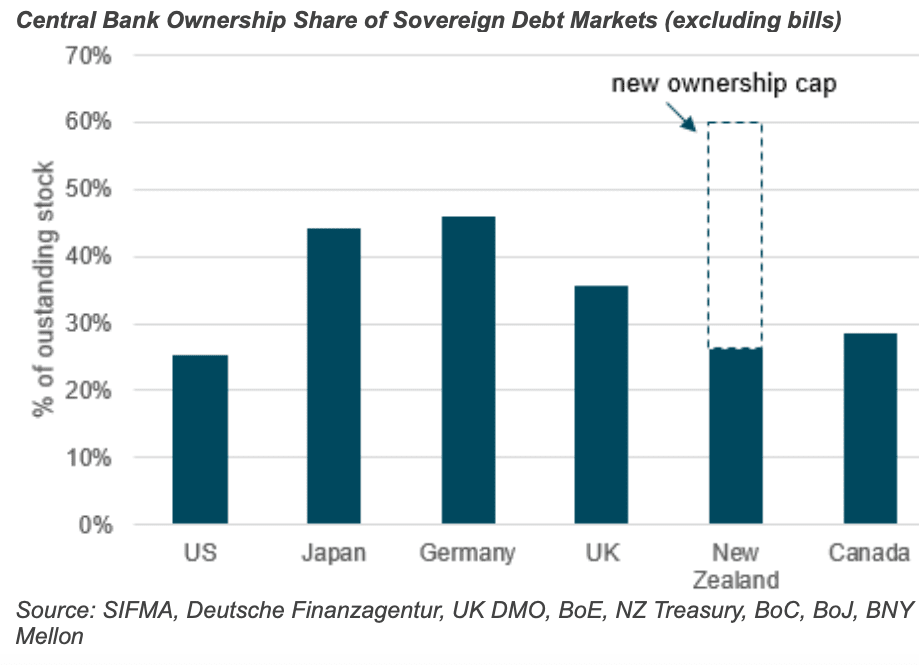

The RBNZ’s holdings of New Zealand Government Bonds (NZGBs) currently stands at just under NZD24BN, or 26% of outstanding, "this is actually towards the lower end of the scale relative to other asset purchase programmes," says Geoff Yu, Senior EMEA Market Strategist at BNY Mellon.

The rule of thumb is that when a central bank engages in interest rate cuts and quantitative easing the currency it issues falls in value. Refining this rule further, when all central banks are engaged in this activity the more aggressive central bank relative to peers will tend to see its currency weaken.

"What makes the RBNZ stand out is its forward commitment in absolute and relative terms. An NZD100bn large-scale asset purchase (LSAP) program would bring its balance sheet to close to NZD140bn, a seven-fold increase from pre-COVD-19 levels," says Yu. "Before the pandemic, the Bank of Japan was the most aggressive central bank in owning government debt, but it had openly shied away from the 50% threshold due to market functioning concerns. The newly-raised cap of 60% of total bonds outstanding could also open the RBNZ more than any central bank to suspicions of debt monetisation."

The RBNZ therefore is the single most significant contributor to the NZ Dollar's ongoing appreciation and by all accounts it appears the impact of its aggressive stance will linger longer and contribute to further weakness.

"Keeping a lid on NZD strength is a key goal," adds Yu.

If you have any NZD requirements and are thinking of locking in current rates, or would like to secure higher rates automatically in the future we would suggest reaching out to our partners at Global Reach for assistance.