New Zealand Dollar Rally Dented, But Not Yet Dead

- NZD hits speed bump

- Market stutter through mid-week into Thursday

- "Tremendous" acceleration in NZD seen in June

- Rally can continue says NAB

Image © Rafael Ben-Ari, Adobe Images

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The New Zealand Dollar has suffered a rare setback and fallen against the U.S. Dollar, Euro and British Pound over the course of the past 48 hours, a move that coincides with a softening in global equity prices and commodities but analysts say the currency is likely to restart its current trend of appreciation before long.

The declines come in response to a Federal Reserve update overnight that disappointed equity market bulls as well as fears of a potential second wave of covid-19 infections in the U.S.

"Stock markets remain deep in the red, and a cursory glance at market reaction to last night’s Fed would suggest that Powell was a major disappointment for investors. That is not really fair, however, since the Fed’s commitment to long-term support for the US economy is now stronger than ever," says Chris Beauchamp, Chief Market Analyst at IG. "But perhaps the lack of any fresh action meant that a short-term drop in stocks was all but guaranteed".

The Pound-to-New Zealand Dollar exchange rate recovered back to 1.9528 as the NZ Dollar was left licking its wounds: the currency is one of the most sensitive to broader investor appetite, which is typically expressed via the performance of stock markets. Meanwhile, the Euro-to-New Zealand Dollar exchange rate recovered to 1.7512.

Above: GBP/NZD has recovered over the past 24 hours, but the rally is unconvincing.

The New Zealand-to-U.S. Dollar exchange rate faded back to 0.6469 as concerns over a bump up in the number of covid-19 infections in Texas and Florida were widely cited by financial market commentators for the decline in the value of stocks and commodity prices.

Florida reported another 1,371 new cases of coronavirus Wednesday, with the state continuing a steady string of days with 1,000-plus increased cases that coincide with the state's latest phase of reopening.

Forida is among 21 states reporting an increase in cases of covid-19, which Florida's Governor Ron DeSantis says is the result of an increased testing regime and not necessarily due to more activity from stores, restaurants, bars and other businesses reopening.

It is still too early to suggest a second wave is underway, but we are extremely wary that if it does look like a spike in cases is coming out of the U.S. markets could push notably lower, and the New Zealand Dollar would likely follow in sympathy.

But should a second wave of infections be avoided in the U.S. we would expect the foreign exchange market to remain focussed on the broader trend of improving investor sentiment in anticipation of a more sustained global economic recovery, as well as New Zealand's enviable position of having no active covid-19 cases.

This places New Zealand at the forefront of economies that are able to fully shake the virus and recover, even if full potential will only be achievable once the global economy fully opens and tourism starts to recover.

"We expect the New Zealand economy to continue to recover which is NZD supportive," says Elias Haddad, FX Strategist at Commonwealth Bank of Australia. "A global economic recovery is underway, liquidity remains plentiful and financial market stress is largely contained. Moreover, the FOMC signalled yesterday that monetary policy will remain ultra‑loose for a long time."

As long as the broader recovery theme remains intact we would expect the New Zealand Dollar to remain supported and extend its current trend of appreciation against numerous currencies.

"Sentiment remains overall supported thanks to support by major central banks. Last night, the Fed re-assured investors on its QE programme and indicated interest rates will remain near-zero through to 2022. This should keep the bulls happy for a while yet despite today’s weakness. Indeed, judging by the recent stock market rally, investors feel it is bullish for the markets that the Fed is so pessimistic on the economy that they feel the need to keep monetary policy extremely loose," says Fawad Razaqzada, market analyst with ThinkMarkets.

A multi-week rally - in place since March 19 - in stock markets and commodity prices has hoisted the New Zealand Dollar higher, ensuring the currency has flipped from being one of the world's biggest losers in the first quarter of 2020 to becoming one of its outperformers by mid-year.

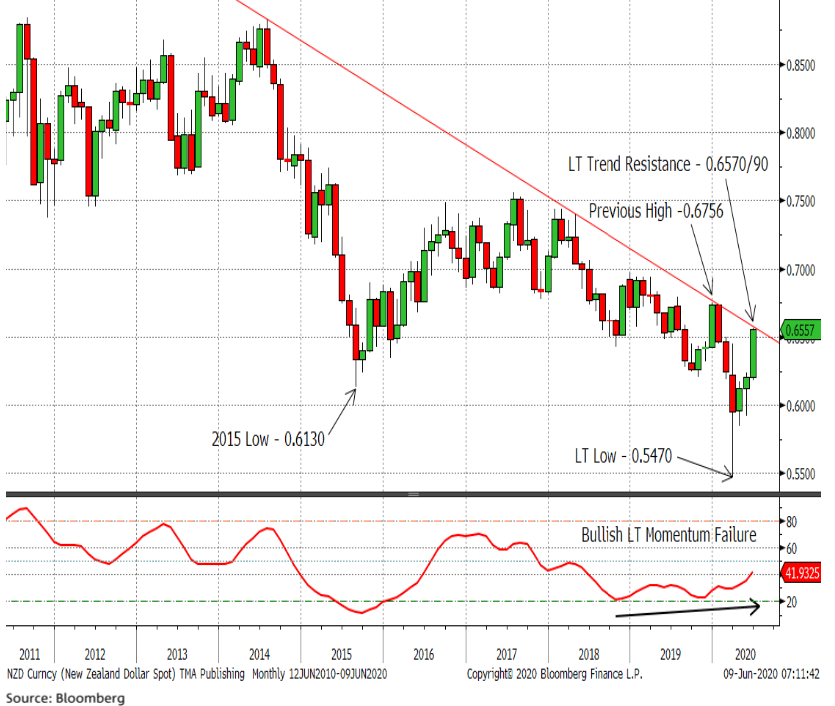

"June has produced a tremendous acceleration in the multi-month uptrend," says David Coloretti, Technical Analyst at the Market Academy Ltd, writing for a National Australia Bank client communication on June 09. "A weekly close above 0.6570/90 will confirm an ongoing medium-term uptrend bias".

Coloretti says a break of the fourth quarter 2019 correction high at 0.6756 will provide further confirmation of the medium-term uptrend. He adds multiple bullish long-term momentum triggers have subsequently emerged, confirming a bullish multi-month bias.