New Zealand Dollar Forecast: Too Soon to Call End to Downside

- NZD best performer at start of new week

- Market rally proves supportive

- Rabobank see further downside

- Rise of nationalism in NZ could benefit NZD

Pine timber being exported from Wellington, New Zealand. Photo by James Anderson, World Resources Institute.

- GBP/NZD spot rate at time of writing: 2.0748

- Bank transfer rates (indicative): 2.00-2.01

- FX specialist rates (indicative): 2.0500-2.0560 >> More information

The New Zealand Dollar is the best performing major currency at the start of the new week, with a broad uplift in global investor sentiment proving beneficial to the antipodean currency as typically tends to be the case.

New Zealand's Dollar tends to benefit in times of stock market appreciation while it tends to fall when investors are running scared, as is often the case for currencies belonging to small and open economies.

Stock markets are on the up at the time of writing, with investors eyeing an apparent flattening in the global spread of the coronavirus that suggests there is in fact light at the end of the tunnel.

"European markets have kicked off the week in impressive fashion, with the FTSE 100 seeing the first weekend gap higher since the selloff began back in February. Coming off the back of a week which saw huge declines in payrolls and a record-breaking spike in initial jobless claims, the current outperformance highlights the relatively robust nature for stock markets compared with the weeks gone by," says Joshua Mahony, Senior Market Analyst at IG.

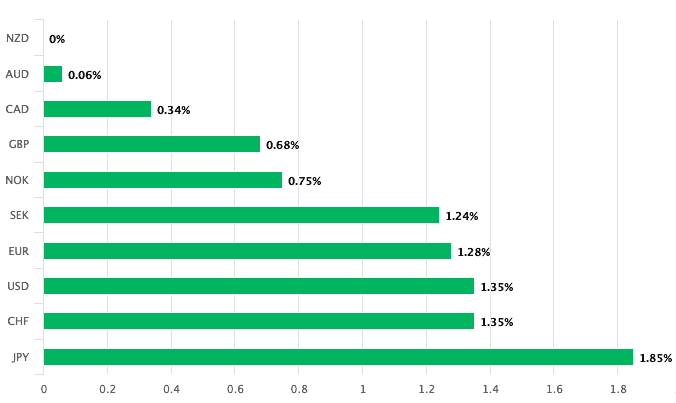

With stock markets on the up, the positive sentiment is being reflected in the valuation of the New Zealand Dollar which is the best performing major currency on April 06:

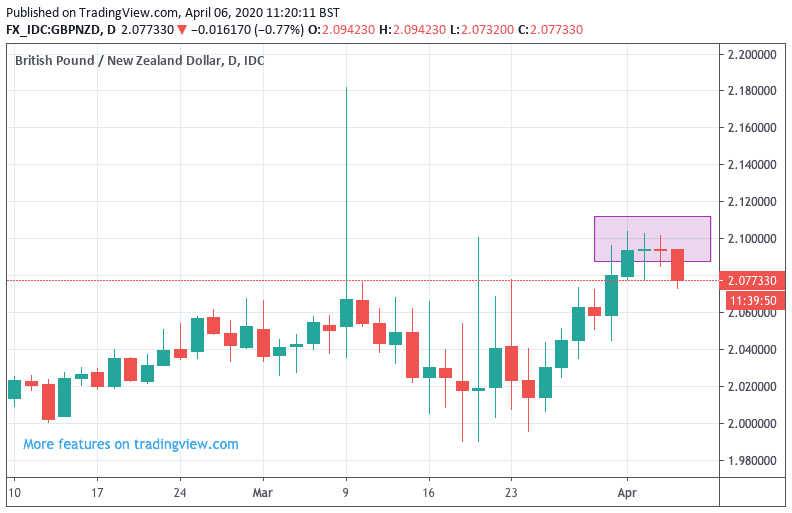

The Pound-to-New Zealand Dollar has faded back on the renewed impetus being seen across the NZ Dollar complex, the pair is quoted at 2.0780, with last week's successive attempts at taking the 2.10 mark proving futile.

From a short-term technical perspective we would pencil in 2.10 as being a high-water mark as it appears this psychologically significant level is layered with sell orders, suggesting there could be a technical element to trade around this level that thwarts Sterling strength.

A break above here could therefore open the door to an acceleration in Sterling gains, but we believe such an outcome would be a hard fought development.

The New Zealand-U.S. Dollar exchange rate is meanwhile a sizeable 1.25% higher at 0.5924 with the Dollar proving to be particularly exposed to any feel-good market sentiment. Indeed, for now we would expect the New Zealand Dollar's short-term performance - and indeed longer-term performance - to be tied to trends in global sentient.

"With a decline in daily mortality rates across the likes of France, Italy, and New York, we are seeing some optimism that the current restrictions could be shorter than many had previously speculated. However, without a cure or vaccine, any easing on the current restrictions would likely short-term in nature, sparking a likely surge in cases before long," says Mahony.

While sentiment in the New Zealand Dollar is improving, we remain firmly of the view that the economic costs of the virus are still hard to fathom which should ensure stock markets and the New Zealand Dollar remain at risk of any setbacks in investor appetite.

"Relative to their G10 peers the AUD and the NZD have been hard-hit by the events of recent weeks and the rise in risk aversion," says Jane Foley, Senior FX Strategist at Rabobank. "While any bear market will be characterised by periods of consolidation and modest pullbacks, we see risk of the both the AUD and the NZD dropping again."

Last week we got a flavour of the scale of the economic impact of the coronavirus crisis with labour market statistics from the U.S. showing 10 million Americans have applied for unemployment benefits in the past two weeks alone while official non-farm payroll numbers showed unemployment jumped 700K, suggesting there was an unexpected surge in unemployment even before the strict lockdowns were enforced and bodes ill for coming weeks.

The scale of the upsurge in unemployment is unprecedented and creates an air of uncertainty that would suggest further deteriorations in sentiment over coming days and weeks.

We would expect the New Zealand Dollar to come under pressure in any bouts of market anxiety while the U.S. Dollar and other safe havens like the Yen and Franc would also likely appreciate.

Turning to New Zealand's domestic outlook, it is considered by the majority of economists that the country has entered into a recession alongside the rest of the world.

Global recessions tend to hamper trade, and a free trading nation like New Zealand would likely see its export basket decline in value as a result.

"While iron ore and coal dominate Australian exports to China, dairy, meat and logs are New Zealand’s key exports to China. New Zealand meat exports benefitted last year from China’s hog crisis. There may be more inelastic demand for food through the downturn which could also benefit New Zealand farmers. However, supply disruptions have impacted all of these industries," says Foley.

Recessions are also typically associated with falls in global investment flows which will leave New Zealand exposed to a drop-off in foreign direct investment, which has long been a pillar of support for the New Zealand Dollar.

"How the NZD trades in the months ahead will very much depend on how the economy holds up to recessionary headwinds," says Foley.

Foley is however also cognizant of the long-term implications of current events for the New Zealand Dollar, saying an outburst of nationalism is one likely outcome of the coronacrisis.

Foley says the leader of New Zealand’s NZ First party, Winston Peters looks well placed to capture a wave of anti-globalisation.

"That said, while Peters has been the nationalistic face of New Zealand politics for many years, he was only the king-maker in the last election. Voters again go to the polls in September (lock-downs permitting). If the New Zealand economy is in a tail- spin then it is feasible that PM Ardern’s Labour party may stumble and that Bridges and his National party could be propelled to the premiership," says Foley.

Bridges, refuses to work with NZ First, but pledges to light a "bonfire of regulations".

"This signals a leadership which would be market friendly and beneficial to the outlook for the NZD," says Foley.

However, political trends and dynamics are a question for the second half of the year and should the virus be overcome and the world's economy enter a sustained recovery then we could see the prospect of a change in New Zealand governance becoming a fading prospect.