New Zealand Dollar Forecast to Remain Vulnerable to Further Setbacks: Westpac

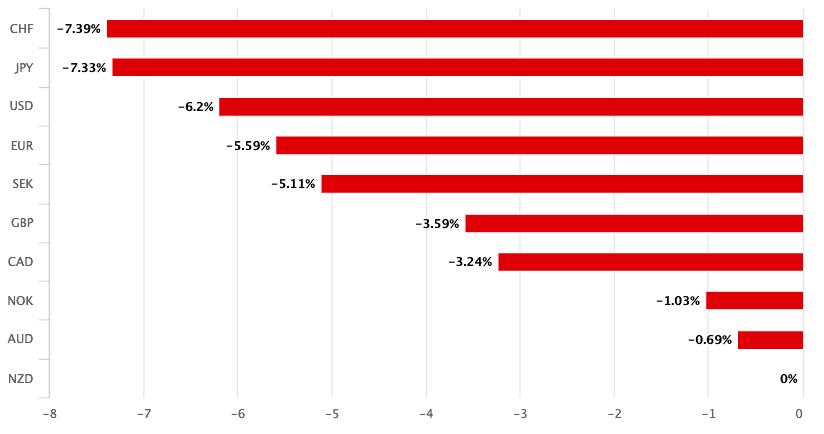

- NZD is worst performer of 2020

- Coronavirus having significant impact

- RBNZ tipped to cut interest rates soon

- NZD forecast to maintain soft tone

Image © Adobe Stock

- GBP/NZD spot: 2.0430, +0.01%

- Bank transfer rates (indicative): 1.9715-1.9858

- FX specialist rates (indicative): 2.00-2.0246 >> More details

A sharp decline in the number of visitor arrivals to New Zealand should contribute to a fundamental backdrop that will likely add further downside pressures to the New Zealand Dollar say economists at Aussie and Kiwi lender Westpac.

"The flow of NZ economic data over the next month or two will be unflattering, and should weigh on NZ markets. The main impact will initially be seen in visitor arrivals, in turn affecting services exports," says Imre Speizer, Chief Economist with Westpac in Auckland.

The New Zealand Dollar has lost notable purchasing power in 2020 owing to the coronavirus outbreak in China, which has since morphed into a global outbreak that promises the effect will weigh on the global economy for some time.

The New Zealand Dollar is particularly sensitive to Chinese economic performance - owing to the strong trade ties between New Zealand and China - while global investor sentiment is another channel that impacts NZ Dollar value.

The currency is in fact 2020's worst performing major, a performance that has largely resulted from the Chinese economic slowdown:

Upcoming domestic data releases are expect to show the impact of the coronavirus outbreak are starting to impact domestic data pulses, with manufacturing and construction numbers due for release.

"But those will be of little relevance to near term activity outlooks," says Speizer. "NZ visitor arrivals are a major casualty of COVID-19."

Speizer says high frequency weekly data shows Chinese arrivals fell to zero by mid-February, and Westpac expects other countries’ arrivals to fall sharply in the ensuing weeks.

"Our forecast for overall visitor arrivals is at risk of further downgrades," says Speizer.

With domestic pressures growing, money market pricing shows investors expect the Reserve Bank of New Zealand (RBNZ) to cut interest rates at its next policy meeting on March 25.

Westpac are forecasting a 25 basis point cut, rather than the 50 basis point cut markets have priced.

The New Zealand Dollar could actually find some temporary relief if the RBNZ cuts by 0.25%, as this would disappoint markets which expect a greater commitment.

The general rule of thumb is that when a central bank cuts interest rates, the currency it issues falls in value. However, the currency reaction can be more nuanced, for instance the currency can rise if cuts are softer than expected.

An example of such a reaction can be found in the appreciation of the Australian Dollar earlier this week in the wake of the Reserve Bank of Australia's decision to cut interest rates from 0.75% to 0.50%. Markets had expected a deeper 50 basis point cut.

Regardless, Westpac says the overall trajectory of the New Zealand Dollar appears to be lower.

"The multi-week path of NZD/USD remains at the mercy of COVID-19 developments," says Speizer. "The former has been stuck around 0.6300 during the past couple of days but is vulnerable to falling to the 0.6100 area during the month ahead if pandemic severity increases."

Declines in NZD/USD would likely aid further gains in the Pound-to-New Zealand Dollar exchange rate which is currently at 2.0444 and has been in a trend of appreciation for much of 2020.

Economists at ANZ meanwhile see the RBNZ taking a particularly aggressive approach to interest rate cuts, which if correct could spell significantly lower New Zealand Dollar values.

"We now expect the RBNZ to cut the OCR 50bp in March and a further 25bp in May, taking the OCR to just 0.25%," says Sharon Zollner Chief Economist at ANZ Bank. "The COVID-19 situation is evolving very rapidly."

"A marked global slowdown is guaranteed, due to both demand and supply disruptions. Our forecasts assume New Zealand GDP stalls in the first half of the year, with a gradual recovery from there," adds Zollner.

NZ say New Zealand's economy is well placed to weather this shock, they see clear risks of a larger slowdown or even recession.

"Fiscal policy will need to do the heavy lifting, but lowering the OCR will ease financial pressure, facilitate a lower NZD, aid confidence at the margin, and support the recovery," says Zollner.

The latest data on how traders in the global foreign exchange market place are positioned on various currencies meanwhile shows selling interest in the NZ Dollar has continued to rise.

"The New Zealand dollar was the biggest short in the G10 and has likely remained under heavy selling pressure in the past few days amid the risk-off environment," says Francesco Pesole, FX Strategist at ING Bank. "The current highly volatile situation tied to the Covid-19 outbreak suggests further downside risks ahead for currencies that are highly exposed to risk, such as the Australian and New Zealand Dollars."