New Zealand Dollar Outlook: Downside Risks Increase, Economy to Shrink in Q1

- ANZ say economy to shrink in Q1

- Say downside risks to NZD increasing

- Economy can handle short-lived coronavirus episode

- Economy still highly exposed to agricultural sector

Image © Adobe Stock

- GBP/NZD spot: 2.0390, -0.30%

- Bank transfer rates (indicative): 1.9677-1.9820

- FX specialist transfer rates (indicative): 1.9950-2.020 >> More details

ANZ - one of New Zealand's top lenders - have downgraded their forecasts for the local economy in the first quarter of 2020 and warned downside risks to the New Zealand Dollar are increasing.

Driving the downgrade in expectations for economic performance and direction of the currency is the hit to Chinese economic activity caused by the ongoing coronavirus outbreak.

While the full impact of the shutdown to the Chinese economy is yet to be known, ANZ economists say the New Zealand economy is well positioned to withstand a short-term drop in Chinese economic activity, but the longer the crisis persists then more damaging the impact to the local economy becomes.

"For now, it’s an air bubble in the supply pipeline, but it could become a bigger issue if it persists. It remains impossible to put a timeline on China returning to normality. We’ve updated our GDP forecasts to take into account the latest developments," says Sharon Zollner, Chief Economist at ANZ.

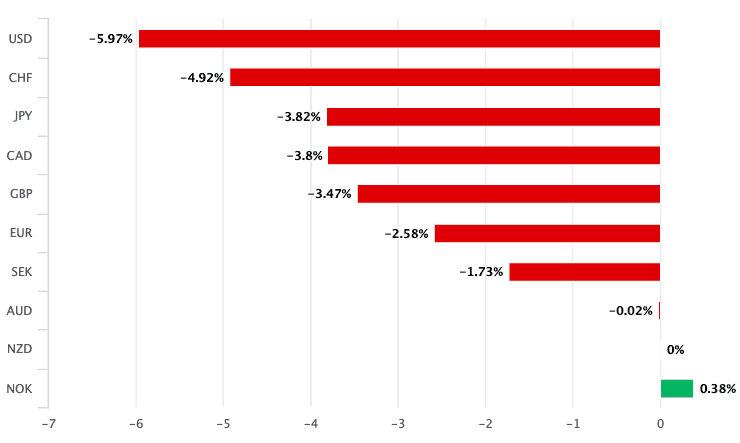

The call comes as the New Zealand Dollar underperforms its peers in the global foreign exchange space and a look at the currency's relative performance shows it to be battling it out with Norway's Krone for 2020's worst-performer title.

Image (C) Pound Sterling Live.

The Pound-to-New Zealand Dollar continues to trend higher as a result and has at the start of the new week hit a fresh four-month high after it attained a level of 2.0537. The U.S.-New Zealand Dollar exchange rate is meanwhile at 0.6335, having been at its lowest price since October 2019 at 0.6339 earlier in the day.

"Downside risks to the NZD growth outlook have increased, creating further headwinds for the Kiwi," says Zollner.

New Zealand is particularly exposed to China's economic fortunes courtesy of a reliance on China's demand for goods such as milk, lamb, beef and timber.

"Primary exports have been immediately impacted. China’s cool chain is currently heavily congested, meaning meat and seafood exports to China are severely impaired," says Zollner.

According to Stats NZ, annual goods exports to China reached NZ$15BN for the first time in 2019, driven by rising demand for beef and lamb, as well as logs and dairy products.

Above: Composition of New Zealand's lamb exports.

"large log inventories have built up that may take months to clear. China takes over 50% of New Zealand’s log harvest, so the impact has juddered rapidly through the New Zealand supply chain," adds Zollner.

Dairy prices have meanwhile dropped 8% over in the previous two GlobalDairyTrade auctions, however there is still some way to go before the lows plugged in 2015 are repeated owing to the country's drought conditions which are propping up prices, for now at least.

Stats NZ data showed milk powder exports to China was up $501 million to $2.4BN in 2019.

"Alternative markets do exist for New Zealand’s export products, but their size relative to China is often small, and competitors will be targeting them as well," says Zollner. "Agriculture remains this economy’s income-earning backbone, and always will be, with water and pastoral land New Zealand’s comparative advantages."

While the relative importance of agriculture and primary production has continued to steadily fall as a percentage of the country's GDP over recent years, the overarching impact of the successes and woes experienced by this sector of the economy are still sizeable.

"When commodity prices fall, it’s everybody’s problem, just as when they go up, the economic benefits go well beyond the farmer. The NZD typically does its part to ensure the joy and pain is spread around, by following commodity prices up and down and making imports less or more expensive," says Zollner.

How long the coronavirus-inspired shutdown to the Chinese economy lasts will matter for the economy, and the New Zealand Dollar. Zollner says the impact of the coronavirus to Chinese consumption patterns might mean that the effect on New Zealand's exports lasts longer than many assume.

"Most New Zealand food exports sit at the luxury end of the spectrum. This is where the biggest profits lie but also where demand is most elastic. In short, if you’re worried about your job or the state of your business, you’re less likely to buy New Zealand lamb to serve to your dinner guests," says Zollner.

But it is not just exports that will feel the effect of China's slowdown, ANZ see the potential for a drop in imports from China to hit the New Zealand economy as the country relies heavily on imports required to produce goods locally.

The country also relies heavily on China for items such as plastics, fertilisers, chemicals, animal feed and tractors. When China sneezes, global trade catches a cold.

"Where the rubber really hits the road in GDP terms is imports of capital and intermediate goods. Consumption goods are actually in the minority when it comes to New Zealand’s imports from China. There’s actually a lot more of the stuff we use to make other stuff, namely intermediate and capital goods," says Zollner.

Heading into 2020 economists at ANZ had believed the outlook for GDP to be looking more positive, but they now expect the coronavirus crisis to dent growth in the near term, with downside risks.

Economists now expect that GDP will be 0.5-0.9% lower over the first half of the year than previously assumed (0.3-0.7%) as a result of the virus.

ANZ now expect -0.1% growth in the first quarter of 2020, and 0.5% growth in Q2.

"Over the medium term, and assuming a relatively fast resolution to the COVID-19 situation, we still view the outlook as bright, even if we are currently experiencing a challenging bump in the road. We see growth running at about 3% in 2021/22, above where we see potential," says Zollner.

ANZ expect the RBNZ to keep interest rates unchanged for the foreseeable future, but downside risks to that assumption have increased.

"Market pricing for a small chance of cuts is appropriate," says Zollner.

Should the impact of the coronavirus on the global and New Zealand economy become more acute, the Reserve Bank of New Zealand will likely telegraph their concerns and prepare the market for a potential interest rate cut.

Under such a scenario the New Zealand Dollar would likely come under further pressure and extend the poor run it has already endured in 2020.

However, current expectations and assumptions at ANZ see the bank forecasting the Pound-New Zealand Dollar exchange rate back down at 2.0 by June 2020, the Euro-New Zealand Dollar exchange rate is forecast at 1.66 and the New Zealand Dollar-U.S. Dollar rate at 0.66.

The Australian-New Zealand Dollar exchange rate is forecast at 0.97 by mid-year.