New Zealand Dollar Tipped as a Sell ahead of Next Week's RBNZ Decision

- Written by: James Skinner

© Naru Edom, Adobe Stock

- NZD outperforms after 1st Fed rate cut since crisis.

- As earlier falls saw Fed's decision priced into NZD.

- But NZD tipped as a sell at Westpac ahead of RBNZ.

- RBNZ rate cut and threat of more easing set to weigh.

- CBA also argues for more NZD downside next week.

The New Zealand Dollar was riding high near the top of the G10 league table Thursday but the Kiwi currency is now being tipped as a sell at Westpac and is also forecast to fall by Commonwealth Bank of Australia (CBA), both of whom are warning that the Antipodean unit will suffer losses next week.

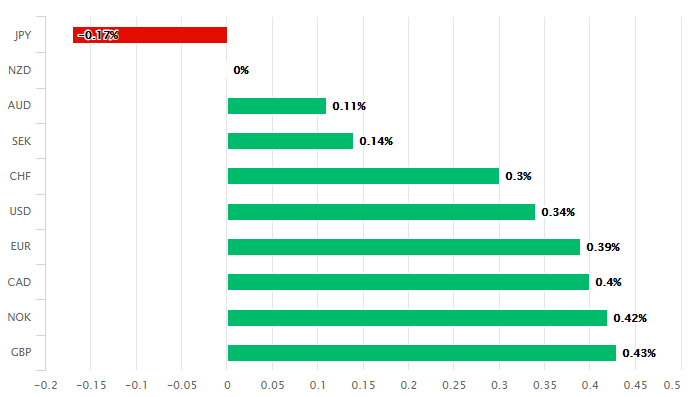

New Zealand's Dollar was second placed in the G10 table during the noon session Thursday, behind only its Japanese counterpart, after earlier falls in the NZD/USD rate left the Kiwi well positioned for a market disappointment over the outlook for Federal Reserve (Fed) interest rates.

The Fed cut its cash rate 25 basis points to 2.25% late Wednesday, in line with expectations, but while providing guidance on the outlook for rates the bank neglected to indulge financial markets that had come to expect three cuts to reduce the Fed Funds rate to 1.75% by year-end.

Those additional cuts are now seen as less likely due to a combination of the Fed's suggestion that it's not yet made up its mind on whether it will need to be cut again in the months ahead, and a recent improvement in U.S. economic data, both of which helped lift the U.S. Dollar broadly Thursday.

The Kiwi was one of only a few currencies not to yield to the greenback. However, analysts at Westpac and Commonwealth Bank of Australia say the strong performance won't last for long. Westpac has even told clients to sell the New Zealand Dollar, anticipating a return to its June lows in the next week.

Above: New Zealand Dollar performance Vs G10 rivals Thursday. Source: Pound Sterling Live.

"It’s hard not to see more upside for DXY. While we see further losses in EUR and GBP, we prefer to play this move through NZD into next week’s monetary policy statement," says Robert Rennie, a strategist at Westpac. "NZD/USD momentum remains downward, targeting the 0.6500 area next."

Rennie and the Westpac team have betting against the Kiwi ever since last Thursday when the NZD/USD rate was quoted at 0.6705. It was trading around 0.6562 during the London session Thursday. They say the Kiwi economy is weaker than the Reserve Bank of New Zealand (RBNZ) had forecast that it would be so Governor Adrian Orr and the new monetary policy committee are likely to decide to cut the cash rate for a second time next Wednesday, leaving it at a new record low of 1.25%.

Currency markets are well prepared for such an outcome but they're not yet where they'd likely be if the RBNZ was to cut again this year. Pricing in the overnight-index-swap (OIS) market implies a cash rate of 1.26% for next Wednesday, which is almost identical to the 1.25% forecast by Westpac. But the implied rate for November 13, the RBNZ's final 2019 decision, was 1.05% Thursday and some distance above the 1% that would prevail following a third cut.

"The RBNZ will almost surely cut the OCR by 25bp to 1.25% and signal further easing potential," Rennie says. "Yield spreads remain the dominant force on NZD/USD at present, coinciding with a 2.5c fall in the pair recently. The yield spread should retain downward momentum during the week ahead, following today’s “hawkish” Fed cut, and with the RBNZ's ”more dovish” easing to come."

Above: Westpac graph showing NZD following NZ-U.S. bond yield 'spread'.

The NZD/USD rate normally follows the rates implied in the OIS market and the difference between bond yields in New Zealand and the U.S., which means if the market comes around to Westpac's view at any point in the days ahead, it could hurt the Kiwi.

The RBNZ is obliged to use interest rate policy to ensure inflation, which is sensitive to growth, averages around 2% over the medium term. However, Kiwi inflation has been below the midpoint of the 1%-to-3% target for years and the RBNZ says it could be some time before the consumer price index is back where it wants it.

Inflation was just 1.7% in the second-quarter and the economy is expected to slow in the months ahead, which implies lesser price pressures further down the line and that more rate cuts might be needed to get it back to the target.

"The RBNZ June post meeting statement warned of continued concern over the impact of “subdued business sentiment” in dampening domestic spending. Consequently, weaker New Zealand business confidence maintains the case for additional policy support," says Elias Haddad, a strategist at CBA.

Above: NZD/USD rate at daily intervals alongside the Dollar Index (orange line, left axis).

Westpac is not alone in looking for New Zealand rates to be cut further and for the Kiwi to be hit by fresh selling pressure in the weeks and months ahead because the CBA team is also flagging the prospect of more downside.

CBA says Wednesday's business confidence data from ANZ will mean the RBNZ is more minded to cut its interest rate again next week. The ANZ survey showed confidence among companies falling back toward its recent post-crisis low.

Those falling levels of confidence give credence to analyst forecasts that the Kiwi economy will slow further this year and ultimately undermine the RBNZ in its quest to get the consumer price index sustainably above the 2% level.

"Our colleagues at ASB expect the RBNZ to cut the OCR by a further 50bps over 2019 (25bps in August and November) to 1.00%, with growing risk of further cuts beyond this. This is largely discounted by New Zealand’s OIS curve but expectations of more RBNZ easing will continue to weigh on NZD.

Above: NZD/USD rate at daily intervals alongside NZ-U.S. 2-year yield 'spread' (green line, left axis).

CBA may have a point too, if a report published by Bloomberg News last week is anything to go by. Bloomberg reported that the RBNZ was revising its strategy for stimulating the economy with "unconventional" monetary policy measures, which was widely interpreted as a reference to quantitative easing (QE).

QE involves a central bank buying bonds from the domestic market with the aim of forcing down yields, which are effectively the real-time borrowing cost for governments and large companies although they 'float' like exchange rates and in accordance with market factors.

Lowering borrowing costs directly on the market is thought by central bankers to speed up the transmission of interest rate cuts into the real economy, but currencies tend to follow those yields lower because they represent the cash return offered to investors who own bonds denominated in the relevant unit.

Changes in rates are normally only made in response to movements in inflation, which is sensitive to growth, but impact currencies because of the push and pull influence they have over capital flows. Those flows tend to move in the direction of the most advantageous or improving returns, with a threat of lower rates normally seeing investors driven out of and deterred away from a currency.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement