The New Zealand Dollar: No More Rate Cuts from RBNZ this Year says Standard Chartered

- Written by: James Skinner

Above: RBNZ Governor Adrian Orr. File Image © Pound Sterling, Still Courtesy of Financial Services Council NZ

- NZD Q1 GDP seen topping RBNZ's downbeat expectations.

- Data could see markets pare back bets on further rate cuts.

- Surprise could offer a boost to beleaguered NZD in short-term.

- But Westpac forecasts NZD near current levels through 2020.

The New Zealand Dollar is still carrying a 2019 loss against the U.S. Dollar and Pound Sterling but the Kiwi currency might find support over the coming weeks if some analysts at Standard Chartered are right in their forecasts for the economy and central bank.

New Zealand's Dollar has been crushed this year by a combination of factors including a strong U.S. Dollar, rising risk aversion in financial markets and a central bank that's cut domestic interest rates to a new record low and primed the market to expect more easing over the coming months.

However, economists are now beginning to suggest the Reserve Bank of New Zealand (RBNZ) might have become a bit too downbeat on the outlook for growth and are forecasting that next week's first-quarter GDP data will emphasise this point.

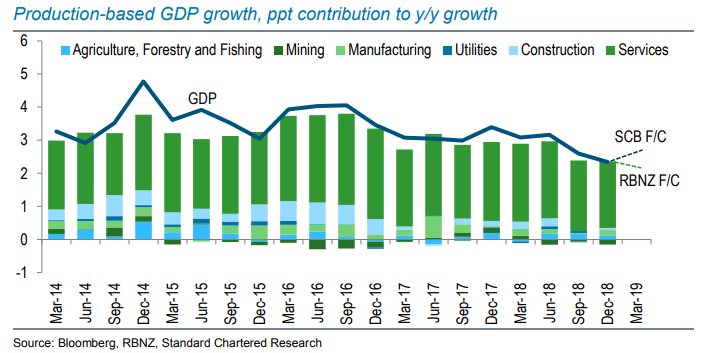

"We expect the economy to have expanded 0.8% q/q (2.6% y/y) in Q1, a faster pace of growth than Q4’s 0.6%," says Jonathan Koh at Standard Chartered. "Stronger-than-expected Q1 GDP growth should support our base case for RBNZ to remain on hold for the rest of the year after it cut the official cash rate by 25bps to 1.50% in May."

Above: Standard Chartered graph showing Kiwi GDP growth and sectoral contributions.

Koh says the Reserve Bank of New Zealand is expecting GDP growth of only 0.4% for the three months to the end of March and that financial markets are also anticipating a GDP reading below that of Standard Chartered's forecast.

The data will be released at 23:45 Wednesday 19, June and will come at a time when financial markets are betting heavily that the RBNZ will cut its cash rate again before the year is out. Those bets are to some extent the result of downbeat expectations for Kiwi growth.

The bank cut the Kiwi cash rate to 1.5% last month, a new record low, citing below-target inflation and a slowing economy that's reducing already-weak consumer price pressures and putting attainment of the inflation target further from view.

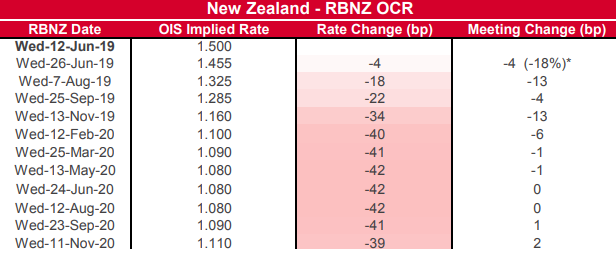

"Markets are pricing in a further c.35bps of cuts (as of 11 June) by end-2019. Better-than-expected data should see markets pare back their rate-cut expectations," Koh writes, in a recent briefing to clients.

Above: Market expectations of Reserve Bank of New Zealand cash rate.

Overnight-index-swap pricing implied on Wednesday an RBNZ cash rate of 1.16% for November 13, the date of the bank's final interest rate meeting for 2019, whichThat suggests financial markets are looking for at least one more interest rate cut from the RBNZ before year-end.

Anything that causes markets to pare back their bets on RBNZ cuts can be expected to boost the New Zealand Dollar, even if only temporarily, because of the impact such change would have on the outlook for relative interest rates. But forecasters still maintain a bearish view on the Kiwi for year-end.

Changes in interest rates are only normally made in response to movements in inflation, but impact currencies because of the influence they have on capital flows, which tend to move in the direction of the most advantageous or improving returns. Inflation is sensitive to changes in GDP growth, among other things.

"New Zealand has had an extended period of low inflation. With signs that the economy was losing steam in the early part of this year, the RBNZ decided that more stimulus was needed to achieve its inflation target," explains Satish Ranchhod, an economist at Westpac.

Above: Pound-to-Kiwi rate at weekly intervals alongside NZD/USD rate (orange line, left axis).

New Zealand GDP growth slowed to 2.8% in 2018, down from 3.1% the previous year, while economists and analysts have feared a further slowdown in 2019 and 2020 due to a deceleration of the global economy in the face of the U.S.-China trade war.

Westpac, one of Australia's four largest lenders, forecasts New Zealand GDP growth of 0.6% in the first quarter of 2019, which is beneath the projection of Standard Chartered and unchanged from the rate of growth seen in the final months of 2018.

The bank also says the RBNZ is unlikely to cut its interest rate again this year, which is a view that was encouraged by deputy governor Christian Hawkesby last week, who said in a panel discussion in Tokyo the cash rate is expected to remain at 1.5% for the foreseeable future.

"Our GDP forecast appears to be in line with other market forecasts, but is higher than the 0.4% that the Reserve Bank assumed in its May Monetary Policy Statement," says Michael Gordon, an economist at Westpac. "The New Zealand economy looks to be a little more robust than the RBNZ expected – not by enough to take OCR cuts off the table, but enough leave the RBNZ in watch and wait mode for now."

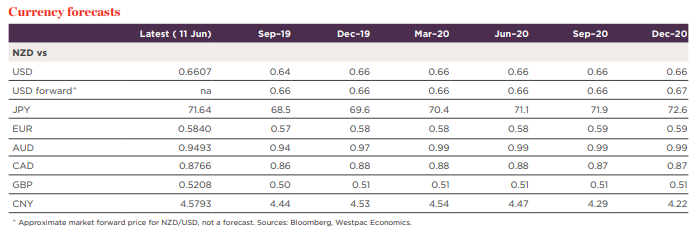

Westpac forecasts that slower growth combined with a steady cash rate and a resilient performance from the U.S. economy will see the NZD/USD rate remain around its current 0.66 level until the end of 2020, although the Pound-to-New-Zealand-Dollar rate is expected to rise from 1.93 to 1.96 by year-end.

Above: Westpac New Zealand Dollar forecasts. June 2019.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement