Pound-to-New Zealand Dollar Rate in the Week Ahead: Weakness Could Fade

Image © Adobe Stock

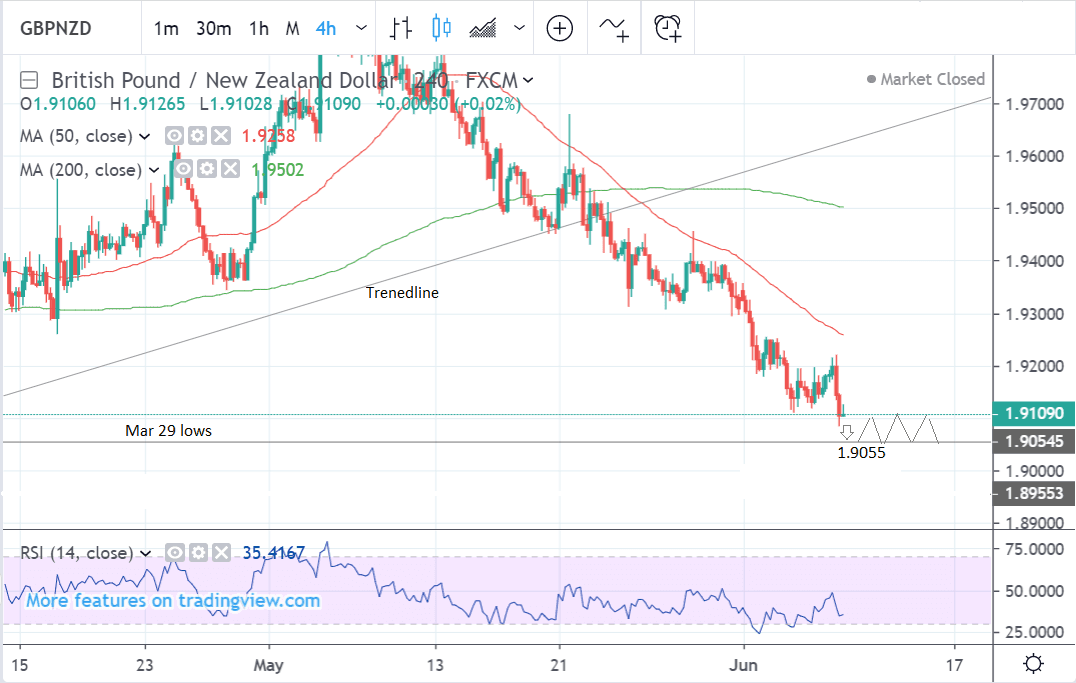

- GBP/NZD reaches target generated by trendline break

- Likely to plateau before eventually breaking lower

- Pound to be impacted by leadership race; New Zealand Dollar by China data

The GBP/NZD exchange rate is trading at around 1.9109 at the start of the new week, after falling over a percentage point in the week before. Studies of the charts suggest that the exchange rate is set to fall marginally before plateauing in the next five days.

The 4 hour chart shows the pair in a very strong downtrend which now looks even more bearish following the break below the major multi-month trendline drawn from the 2018 lows. This is a very negative sign suggesting a longer-term change of trend.

The pair has already moved quite far since the break, however, and this suggests a risk that it could plateau as traders take profit on their bearish bets.

We see a strong possibility of the pair moving down to the 1.9055 March 29 lows and thereafter range trading over the coming week, the time horizon for our short-term forecast, for which we use the 4 hour chart.

The daily chart suggests more downside is expected in the medium-term after a short period of range trading.

It shows the trendline break more clearly and how the follow-through after the break labeled ‘Y’ is now almost the same length as the move prior to the trendline break labeled ‘X’, which is the normal expectation.

This explains why we see a heightened risk of a sideways move evolving at this juncture - the pair has now reached its target based on the trendline break.

The other sign a pull-back may evolve is the RSI momentum indicator which is at 29, and in oversold territory (defined as below 30). This suggests increased risks that the pair may plateau because it is so oversold, however, it is not necessarily a sign of the end of a trend. RSI can remain oversold for long periods during downtrending markets.

Eventually, the sheer strength of the downtrend leads us to believe it will go lower and hit a target at 1.8800 in medium-term, which we define as between 1-4 weeks in the future, and for which we employ the daily chart in our analysis.

The weekly chart shows how the pair appears to be forming a bearish ABCD or Gartley pattern which has very bearish connotations and encourages a view that supports an extension of the downtrend even further.

These patterns are composed of three waves in a zig-zag formation. The length of A-B can be used to forecast the length of C-D. In this case, it suggests an end target for C-D of around 1.7600.

Whilst it is possible this could be reached in the long-term,

We prefer a more conservative target at 1.8500 for now.

We use the weekly chart to give us an idea of the longer-term outlook, which includes the next few months.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The New Zealand Dollar: Watching Chinese Dara

The most important drivers for the New Zealand Dollar in the short-term is Chinese data and global investor sentiment.

China is New Zealand’s largest trading partner so the state of the Chinese economy can have a big impact on the currency. If the Chinese economy weakens it can dampen demand for NZ exports, especially dairy products and lamb, both major exports.

The Chinese trade balance is probably the most significant release as it will show the impact of the U.S.-China trade war on exports. It is forecast to rise to a surplus of $20.50bn in May, from 13.8 previously, when it is released on Monday, June 10 at 03.00 BST.

A higher-than-expected surplus will be a positive sign, both from the point of view of showing China’s resilience in spite of the trade war and because higher net exports raise GDP.

Chinese new loans data is also quite important because it reflects the ‘credit impulse’. This is also a contributing factor of growth as most businesses rely on credit to expand. It is expected to show a rise to $1.225tr in May.

Assuming actual data meets expectations it should support the Kiwi. If it falls well below expectations it could raise concerns about the availability of credit to spur new business formation and growth.

Chinese inflation is forecast to show a rise of 2.7% in May compared to a year ago and 0.1% from the previous month, when released at 02.30 on Wednesday, June 12.

A higher-than-expected reading should be taken as positive/bullish for the NZD, while a lower-than-expected reading should be taken as negative/bearish for the NZD.

Higher inflation, when accompanied by economic growth is normally a positive sign.

Industrial production data is forecast to show a 5.5% rise in April, when it is released at 03.00 on Friday, June 14.

Fixed asset investment is forecast to rise 6.1% when it is released at the same time.

These are also both linked to growth and could impact the outlook for China and therefore its trading neighbours.

On the domestic data front the main releases for the Kiwi are electronic card retail sales for May out on Tuesday at 23.45 and Business NZ PMI - a survey based leading business activity indicator - out at 23.30 on Thursday.

The Pound: Politics and Labour Market Data

Brexit politics are still likely to have the greatest impact on Sterling, with UK monthly GDP, unemployment and trade balance as the main hard data releases.

The next step in the conservative leadership contest will unfold on Monday, June 10, when candidates must declare at least eight nominations from fellow Conservative MPs in order to stay in the race. This will probably result in many of the weaker candidates being knocked out.

After that all candidates will need the votes of 17 Conservative MPs to stay in the first round ballot and at least 33 – or 10% of Tory MPs – to stay in the second round of voting.

At the moment, the leading contenders are Johnson, Gove, and Hunt, but if that changes - which is unlikely - and one of the big names gets knocked out it could impact on Sterling.

Johnson appears to be in favour of endorsing a ‘leave at all costs’ Brexit on October 31.

Michael Gove has a softer stance, aiming for a Canada-style free trade agreement and a possible further delay if necessary, which has infuriated the right of the party.

Jeremy Hunt has suggested he might be against leaving without a deal, although would so “with a heavy heart”.

The main data release is April GDP which is forecast to show a -0.1% fall compared to the previous month and a 1.7% rise compared to a year ago, when it is released at 9.30 BST on Monday, June 10. Any unexpected fall in GDP will probably weaken the Pound.

Unemployment data is expected to show the unemployment rate remain at 3.8% in April, when it is released at 9.30, on Tuesday, June 11.

Also important is average earnings which are forecast to rise by 3.1% (excluding bonus) and 3.0% (including bonus). If earnings are lower-than-expected, it will probably lead to a sell-off in Sterling.

The trade balance is expected to show a narrower -£12.96 deficit when it is released on Monday at 9.30. Generally, this is considered a positive background factor for the Pound.

Industrial and manufacturing production are expected to show a -0.7% and -1.0% decline in April when data is released on Monday, also at 9.30.

Since these are indicative of GDP growth they can also have an impact on the Pound, weakening it if they undershoot expectations and vice versa if they overshoot.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement