The Pound-to-New-Zealand-Dollar in the Week Ahead: Breakout From Channel Still Supports Bearish Outlook

© DragonImages, Adobe Stock

- GBP/NZD likely to extend downtrend lower

- Major moving averages still acting as hard floor

- Speculation about new PM to drive Pound; global risk NZD

The Pound-to-New-Zealand-Dollar rate was trading around 1.9310 at the start of the new week, a cent lower from the previous close, but studies of the charts suggest the exchange rate is set to continue its downtrend in the days ahead.

From a technical perspective, the pair has extended the downtrend that started at the beginning of May. Given the old adage that the ‘trend is your friend’, the bias is for it to continue lower.

Above: Pound-to-New-Zealand-Dollar Rate shown at daily intervals.

The pair has also now broken below the lower borderline of the multi-month trend channel, another bearish sign, which suggests a probable decline equal to the height of the existing channel extrapolated lower.

This would indicate a target range of between 1.9135 and 1.896. The first target should be achievable over a 2-3 week time horizon and the secon target, over a 3-12 week period.

However, a formidable floor of support lies just below the current level of the exchange rate, which is composed of the 200-day moving average (MA) at 1.9301 and the 50-week MA at 1.9298. These could prove difficult to break.

Above: Pound-to-New-Zealand-Dollar Rate shown at weekly intervals.

The relative-strength-index momentum indicator is not oversold on either the daily or weekly charts, which suggests bearish momentum will remain a feature of the market for a while yet.

Ideally we would like to a see a clear break below these moving averages on a closing basis, or a move below 1.9250 on a non-closing basis, for confirmation of more downside.

The next target would then be 1.9135, followed by the March/April lows at 1.9050 (reached in 2-4 weeks) and the full 100% extension of the channel at 1.8960.

AA

The New Zealand Dollar: What to Watch

The main factor driving the New Zealand Dollar (Kiwi) is the state of global risk appetite, especially in relation to the outlook for Chinese growth. This includes trade war dynamics between the U.S. and China.

A more general tone of risk aversion is permeating markets and expected to continue, with negative implications for NZD.

The trade war is escalating, with China now threatening to stop exports of rare-earth metals to the U.S. which are used in a wide range of technology products including battery systems, and of which China is the largest exporter.

There are also reports the Chinese have stopped importing soybeans from the U.S, which is a problem for U.S. farmers. The U.S, meanwhile is threatening to increase tariffs on a wider range of imports from China.

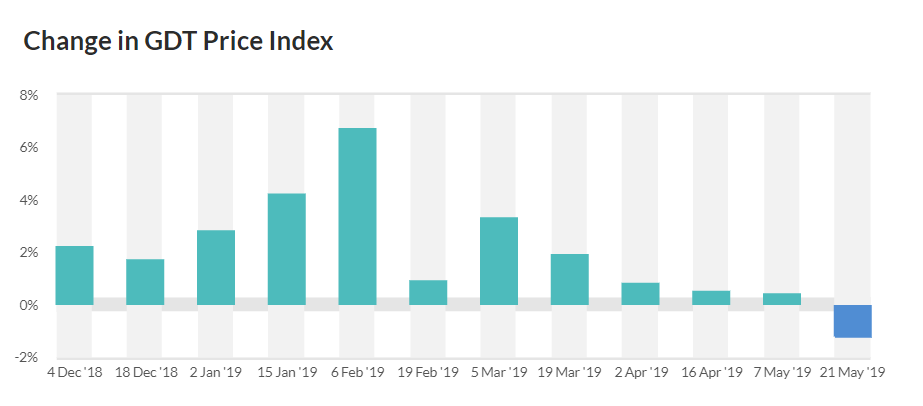

From a domestic perspective, the main event in the coming week for Kiwi is the release of results from the latest dairy auction, which come in the form of the Global Dairy Trade Index.

Dried whole milk is a component of the index and New Zealand's largest export. The GDT fell by -1.2% at the previous auction 2-weeks ago. Results have generally been positive recently, suggesting a more supportive backdrop for trade balance and currency.

Last week’s government budget revealed a larger-than-expected revenue shortfall, which led to the announcement of the issuance of more government debt which briefly pushed up government bond yields. This is unlikely to strengthen the Kiwi.

Combined with NZ’s current account deficit it also means the country must go cap in hand to foreigners for financing, with pressure on the exchange rate to fall to keep demand from foreign financiers buoyant.

Above: Global Dairy Trade price index.

The British Pound: What to Watch

The main focus for the Pound over the coming week will continue to be political, as the ruling Conservative Party prepares to choose its next leader and the country's next Prime Minister.

Key for Sterling will be the future leader's stance on Brexit.

The current favourite, Boris Johnson is a known 'Brexiteer', and recently said that if he were PM, he would take the UK out of the EU on October 31 “with or without a deal”.

Johnson is more popular amongst the Conservative party membership than amongst Conservative party MPs, and there is the chance the parliamentary party won't even select him to form party of the final pair of candidates that are voted on by the party's membership.

The contest is composed of several rounds. The first is held in Parliament and only involves Conservative MPs in the vote to decide a shortlist of two who are then put to a broader vote amongst party members. If Johnson can get into the final shortlist he will probably be next leader.

"The No Deal Brexit option will likely be the defining feature of the Tory leadership contest, as opposed to a leverage tool to be used primarily to extract better conditions in negotiations with the EU. This possibility becomes more urgently negative for GBP and for UK assets if one expects, as our economists do, that Boris Johnson may be inclined as a newly minted PM to call for new elections, aiming to create a parliamentary arithmetic that does not preclude a No Deal outcome," says Shahab Jalinoos, a currency strategist with Credit Suisse.

Jeremy Hunt is the favourite amongst the party membership at present, and he opposes a 'no deal' Brexit.

Regardless, whichever candidate espouses the toughest line on Brexit and potential future negotiations with Europe will likely win the final vote held by the party's membership.

The EU said it has not changed its stance on Brexit after May’s resignation, and that “our position on the withdrawal agreement — there is no change to that,” according to EU spokesperson Mina Andreeva.

This has increased downside pressure on Sterling because if the EU is unwilling to negotiate a better deal, and the next leader is a Brexiteer, it increases the chances of a 'no deal' Brexit in October.

Further complicating the outlook for Sterling is the possibility that in the event the UK were about to leave without a deal Parliament does have the power to vote down the government in a vote of no-confidence. The chancellor Philip Hammond, for one, has already said he is so against a ‘no-deal’ that he would vote against his own party if such an eventuality happened, in order to put “the national interest before party interests”.

If the government were voted down in a vote of no-confidence there would probably be a general election with an uncertain outcome. Article 50 would probably have to be revoked in the interim with considerable consequences for the chances of a Brexit ever being revived.

The outlook is decidedly murky, and therefore it is difficult to see Sterling enjoying any upside potential until this raft of issues are decided and certainty is returned to the political outlook.

On the economic data front, the main release on the horizon for Sterling are the IHS Markit PMI surveys.

The Manufacturing PMI survey is forecast to show a fall to 52.1 from 53.0 in May. This is still above the threshold for expansion of 50 but shows slowing activity. The results are released on Monday, June 3 at 08.55 BST.

PMI’s are widely acknowledged to be reliable forward indicators of growth and so a lower-than-expected reading would probably result in a decline in the Pound and vice versa for a higher-than-expected result or rise.

Construction PMI is out on Tuesday, and forecast to remain unchanged at 50.5.

Services sector PMI is out on Wednesday 5, at 9.30 BST and it is forecast to show a rise to 50.6 from 50.4.

This is the release most likely to have an impact on Sterling as the services sector accounts for over 80% of UK economic activity and therefore offers a better gauge on where the overall economy is headed.

Besides PMIs, there is potential for volatility from the testimony of Mark Carney and other Bank of England officials as they are questioned by the Treasury select committee on Monday, however, he and his colleagues are likely to defer an opinion on interest rates until there is greater clarity on Brexit.

Halifax house prices are out on Friday at 13.30 and expected to show a slowdown in house prices in May, with a 4.5% rise compared to a year ago (down from 5.0% in April) and 0.1% monthly rise compared to 1.1% in the previous month.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement