Pound to Rise 7% against Kiwi says ANZ, as New Zealand Dollar Suffers Amid RBNZ Rate Cuts

- Written by: James Skinner

© Adobe Images

- GBP/NZD tipped by ANZ to finish 2019 more than 10% higher.

- As NZD/USD forecast implies -4% 2019 loss amid RBNZ cuts.

- But possible collapse of "risk appetite" also a threat to the NZD.

The Pound is on course for a further 7% gain over its Kiwi counterpart in 2019, according to analysts at Australia & New Zealand Banking Group (ANZ), who say the Antipodean unit will plumb new depths before the year is out as policymakers cut interest rates to fresh record lows.

Thursday's forecasts from ANZ, New Zealand's second largest bank, come at a time when the market is giving the Kiwi currency a wide berth in the wake of disappointing labour market data and ahead of the Wednesday 08, May Reserve Bank of New Zealand (RBNZ) interest rate decision.

Financial markets have bet increasingly in recent months that the RBNZ could cut its cash rate to a new low as soon as next week, with April's first-quarter inflation figures having market a step-change in that process that has weighed heavily on the New Zealand Dollar.

There's significant uncertainty over whether the RBNZ will be sufficiently concerned about the economy to cut rates that soon and given the sheer weight of market bets against the Kiwi, such a scenario is now a threat to the currency.

Above: Market bets on RBNZ rates alongisde NZD price action. Source: ANZ Research.

"With the market pricing for the May meeting currently on balance, the NZD is finely placed for a move in either direction. That said, given how swiftly the market has priced a downside scenario, should the RBNZ disappoint with its May statement, the magnitude of an upside move is likely to be significant," warns Daniel Been, head of FX strategy at ANZ.

However, and even if the RBNZ does eschew a cut next week, the ANZ team and financial markets are convinced that rates will come down before year-end because Kiwi inflation is moving further and further below its target.

New Zealand's annualised rate of inflation fell to 1.5% in the opening quarter of 2019, down from 1.9% previously, which takes it further below the midpoint of the 1%-to-3% target band. The trimmed-mean measures of inflation, which are New Zealand's equivalent of a core inflation rate, ranged between 1.7% and 1.9% last quarter.

Above: New Zealand inflation trend. Source: ANZ Research.

"The RBNZ will take comfort from stronger core inflation figures, with much of the weakness coming through the relatively volatile and transitory “tradable” component. With core inflation on target, this will likely provide the RBNZ some breathing room going into the May meeting," Been warns.

Interest rate decisions are normally taken in accordance with the outlook for inflation but impact currencies through the push and pull influence they exert over capital flows and the opportunities they present short-term speculators.

Rising rates normally encourage capital inflows and a stronger currency while hints of, or speculation about, rate cuts tend to discourage inflows and incentivise outflows. This can lead to a weaker currency.

Above: Pound-to-New-Zealand-Dollar rate shown at daily intervals.

The Pound-to-New-Zealand-Dollar rate was quoted -0.05% lower at 1.9685 during the noon session Thursday but has 3.9% in 2019, which means it will have gained more than 10% by year-end if ANZ's forecasts prove to be correct.

"Australian and New Zealand central banks hold meeting next week, and both have seen speculation they will cut rates. Markets certainly expect some increased volatility in related FX pairings, judging by the price of options expiring afterwards," says Richard Pace, a senior currency and options analyst at Thomson Reuters.

The NZD/USD rate was -0.15% lower at 0.6617 and has fallen -1.4% this year, although ANZ's forecasts imply a -4% loss at year-end.

Above: NZD/USD rate shown at daily intervals.

Employment statistics for the first-quarter further darkened the mood toward the New Zealand Dollar on Wednesday this week, leading analysts to declare that they did little to prevent RBNZ rate cuts coming later in the year.

New Zealand posted a surprise fall in its unemployment rate for the first quarter Wednesday, with the jobless figure falling from 4.3% to 4.2%, but this came only after a fall in the participation rate which artificially reduced the number of individuals classed as unemployed.

The other detail in the jobs data was less encouraging for economists, with overall employment declining by -0.3% during the period as some individuals became unemployed and in part due to growth in the working age population.

"The AUD and NZD will remain tied to their central banks’ actions. We expect easing from both, but the timing may provide tactical opportunities in the cross," says Been. "A neutral but not easing Fed, in a world where some minor central banks (like the RBA and RBNZ) are easing, is likely to be USD supportive."

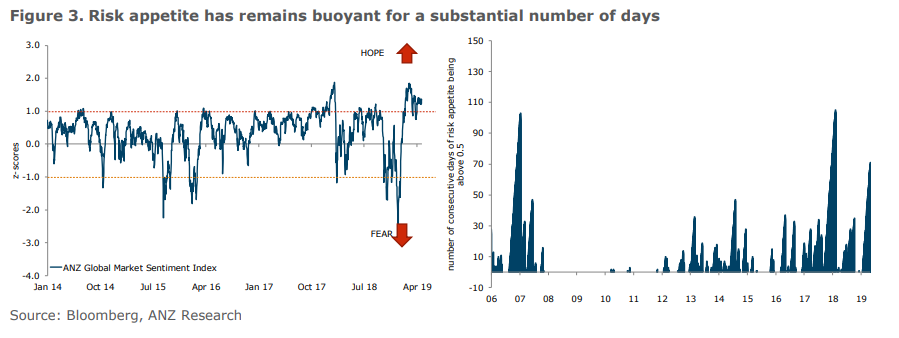

Above: Indicators of global investor risk appetite.

The market-implied RBNZ cash rate for Wednesday 08, May was 1.61% on Thursday, some way below the current 1.75%, but the implied level for August 07, 2019 was all the way down at 1.45%.

That suggests investors feel certain that a rate cut will have come before the end of summer. The implied rate for November 13, 2019 was just 1.35% Thursday, demonstrating a suspicion among investors that two rate cuts could be delivered before year-end.

However, and in spite of the sheer weight of bets that are already stacked against the Kiwi, RBNZ interest rate policy is not the only adverse factor the New Zealand currency will have to contend with over the coming months.

Above: Changes in global investor risk appetite. Source: ANZ Research.

Been says a "euphoric" appetite for risk assets among the world's investors, which has driven many stock markets to new highs even as fears for the health of the global economy reached a crescendo, means it can't be long before there's big crash or bang somewhere that could hurt the risk-sensitive Kiwi.

The Kiwi Dollar is underwritten to some extent by commodity trade flows between New Zealand and other countries and prices of those commodities are sensitive to changes in global growth and movements in the value of the U.S. Dollar. This means it can fluctuate in accordance with investors's risk appetites.

"With risk appetite once again edging towards extremes, it is possible that this dynamic is set to switch once more. If this were the case, given the extended period in which markets outside of FX have remained euphoric, the next big move for FX would be for a sell-off in risk currencies and consequent weakness across the AUD, NZD and some of Asia’s emerging markets," Been warns.

It is the interest rate and risk appetite headwinds that inform Been and the ANZ team's bearish Kiwi Dollar forecasts for this year.

They say the Pound-to-Kiwi rate will finish 2019 all the way up at 2.12, which is more than 7% above Thursday's level of around 1.97. Meanwhile, the NZD/USD rate is forecast to decline from above the 0.66 level to 0.64, which implies a near -4% full-year loss.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement