Pound-Krona: SEK a Sell

- Written by: Sam Coventry

Image © Adobe Images

The Krona is a sell against the Pound says an investment bank strategist.

Lee Hardman, FX analyst at MUFG Bank Ltd says he looks for SEK to fall further this month after failing to extend its advance over the previous two months.

An issue for Sweden's currency is domestic inflation falling more quickly than expected in June, which means Riksbank can cut interest rates up to three more times in 2024.

Swedish inflation fell to 2.3%, whereas UK inflation fell to 2.0%.

However, economists are in agreement that there are upside risks to UK inflation over the remainder of the year, which means the Bank of England will be cautious when approaching the question of rate cuts.

Divergence in monetary policy leads MUFG to go "long" GBP/SEK.

"The GBP currently has the strongest upward momentum amongst G10 currencies. The UK election result has created a more favourable backdrop for the GBP. The large majority for Labour should ensure a period of much-needed political stability in the UK," says Hardman.

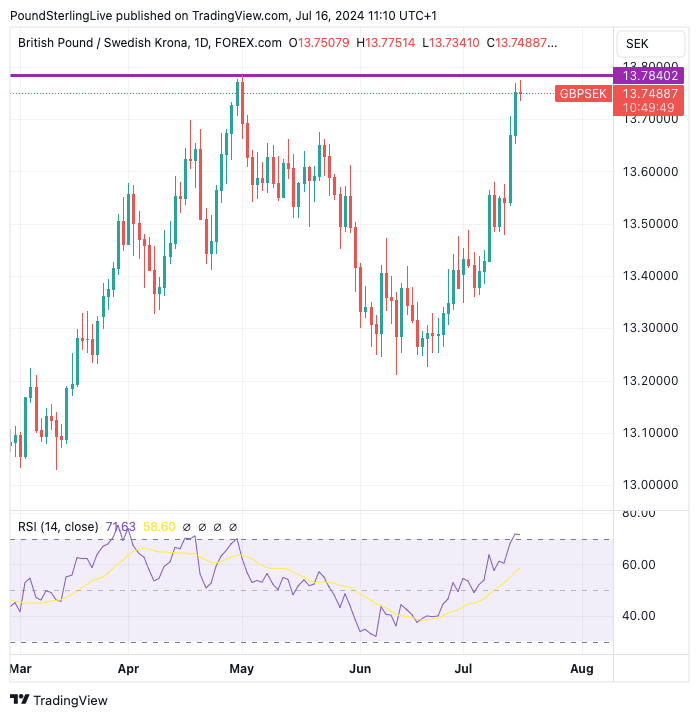

The Pound to Krona exchange rate has rallied to 13.74, which brings it to a notable line of resistance:

Track GBP/SEK with your custom alerts; find out more here.

We note that the daily RSI is now oversold, which, when combined with the overhead resistance, could mean a short-term pullback is warranted.

But fundamentals suggest to MUFG the pair can extend higher.

"There has been further evidence that the UK economy is rebounding much more strongly than expected in the 1H of this year," says Hardman.

UK GDP surprised last week by printing at 0.4% month-on-month in June, doubling consensus expectations and extending a run of economic growth.

"Stronger cyclical momentum and the BoE’s ongoing concerns over persistent inflation risks in the UK have increased the risk that the BoE delays cutting rates until later this year rather than in August," says Hardman.

Pound-Krona's advance will be tested on Wednesday and Thursday this week when the UK releases inflation and wage data. Any undershoot in expectations can see those aforementioned overbought conditions unwind.

However, the train will keep moving forward if the data comes in on the stronger side of expectations.

"Further evidence of softening services inflation and wage growth will be needed to support our forecast for an August rate cut. If there is any disappoint, the GBP’s upward momentum will be reinforced," says Hardman.