Turkish Lira Outlook Helped by Hint of Steady CBRT Cash Rate Ahead

- Written by: James Skinner

- TRY steady after CBRT leaves rates unchanged

- Outlook bolstered by hint of stable rates ahead

- Inflation expected to ease as base effects wane

- Could imply stable rates through much of 2022

Above: CBRT Governor Şahap Kavcıoğlu. Image © CBRT

The Turkish Lira was well supported against the Dollar and Pound while the outlook for it was helped on Thursday after the Central Bank of the Republic of Turkey (CBRT) left its interest rate unchanged and suggested the benchmark could potentially remain stable through much of 2022.

Turkish exchange rates appeared to welcome a widely expected decision by the CBRT to leave its cash rate at 14% until at least the next meeting in mid-February, although the bank’s remarks about inflation hinted that borrowing costs could remain stable for somewhat longer than that.

The CBRT attributed recent increase in inflation to a host of factors including exchange rate fluctuations and the impact they’ve had on the pricing practices of domestic businesses, as well as things like international supply chain disruption and higher global food and agricultural commodity prices.

“The Board anticipates that the disinflationary process will begin when the base effects in inflation disappear, together with the steps taken to establish sustainable price stability and financial stability. In this framework, the Board decided to keep the policy rate constant,” the CBRT said in its statement.

With the impact of recent price fluctuations expected to wane later this year, the bank saw no need to reduce its cash rate further from the 19% it was at as recently as September 2021, which is potentially significant for the Lira if it reflects the CBRT’s likely approach over the coming months.

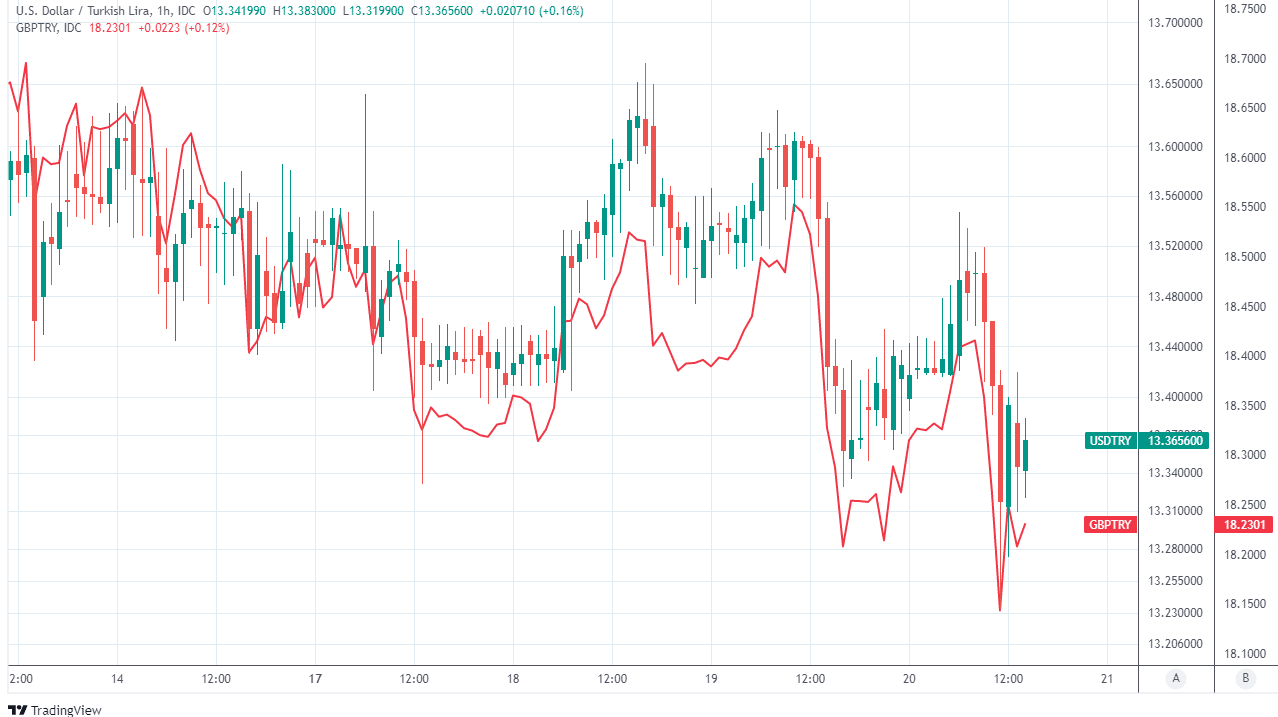

Above: USD/TRY shown at hourly intervals alongside GBP/TRY.

- GBP/TRY rates at publication:

Spot: 18.25 - High street bank rates (indicative band): 17.61-17.74

- Payment specialist rates (indicative band): 18.09-18.16

- Find out about specialist rates, here

- Set up an exchange rate alert, here

“Inflation spiked to 36%yoy in December and our economist now projects it will stay close to 50%yoy until November 2022. We see no indication that policy makers are ready to tighten monetary or fiscal policy,” says Anezka Christovova, an analyst at J.P. Morgan, writing in a recent research note.

Some economists expect it could take until the final quarter for Turkish inflation to begin to fall, and if the CBRT was to leave its interest rate unchanged throughout the intervening period then it would potentially come as a surprise to the currency market and may be likely to help the Lira.

The Lira had been besieged by speculative sellers during the final quarter of 2021 after the bank cut its cash rate from 19% to 14% between September and December, leading to sharp declines in Turkish exchange rates that risked harming domestic confidence in and appetite for the currency.

“While the decision had been well-signalled in advance, the Turkish lira still reacted positively to the announcement, as it took some pressure off of investors’ shoulders after the aggressive easing cycle seen over the last year,” says Ima Sammani, a currency analyst at Monex Europe.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“The rally in the lira also came as the CBRT referenced the lira in its statement today The addition of the phrase around prioritising the exchange rate suggests to markets that the central bank is finally admitting to having an FX target, which is welcomed in Turkish assets along with the regulatory measures that have been announced recently,” Sammani also said.

Earlier losses for the Lira were seen as likely to encourage a trend of ‘Dollarisation’ that had seen locals shifting their savings out of the domestic currency and into foreign alternatives, which would merely have added more pressure onto Turkish exchange rates.

However, December appeared to mark a turning point for the currency after the government launched a new scheme that protects the value of savings deposits against fluctuations in the Lira, which was followed by an almost record-breaking rally in Turkish exchange rates.

“The monetary policy imposed by Recep Erdoğan aims to accelerate growth above all, but also to transform the Turkish economy and in particular to correct some of its structural weaknesses: a chronically negative current account balance, a considerable fragility to international capital movements and a high unemployment rate,” says Lysu Paez Cortez, a senior EMEA emerging markets economist at Natixis.

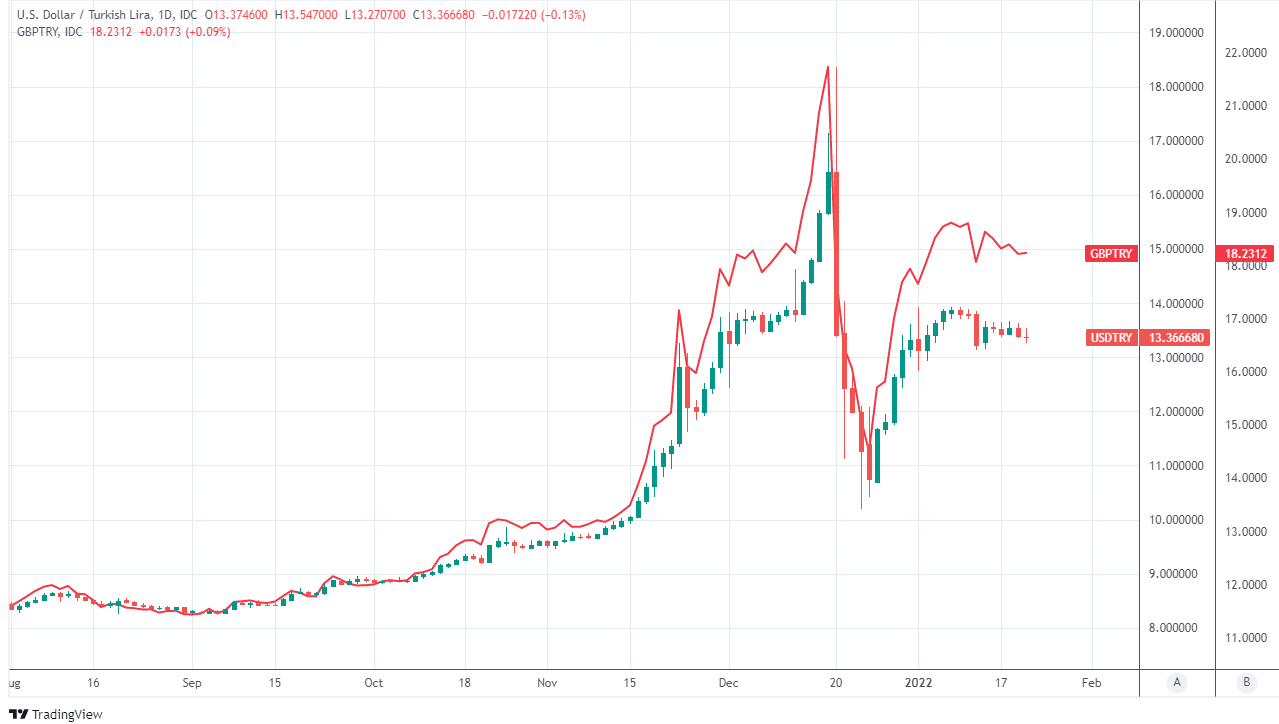

Above: USD/TRY shown at daily intervals alongside GBP/TRY.

While the new deposit scheme has turned the tide for the Lira since December, it doesn’t address the market’s grievance with Turkish monetary policy and this is why many analysts are unconvinced that the currency’s recovery can last.

CBRT policy has increasingly come to reflect President Recep Tayyip Erdogan’s unorthodox view that “interest is the cause, inflation is the result,” with interest rates cut repeatedly during periods of high and rising inflation, which is the opposite to the approach generally taken by other central banks.

“Turkey's $5bn FX swap deal with the UAE boosts the nation's gross FX reserves and is a welcome change in tone. President Erdogan has called for interest rates to fall “gradually,” says Kenneth Broux, a strategist at Societe Generale.

President Erdogan was reported to have said on Tuesday that Turkish interest rates “will fall slowly, gradually and without hurry” in policy steps that would be intended to make 2022 “our best year.”

The remarks suggest Turkish borrowing costs will eventually fall again, although it’s not clear if this will be in the immediate months ahead, closer toward year-end or after that.

For its part the CBRT had indicated in December that it could wait until at least the second quarter of this year before reducing borrowing costs again.