Turkish Lira Loss Lifts GBP/TRY to 20.00+ after CBRT’s Final Cut

- Written by: James Skinner

- GBP/TRY breaks above 20.0 & closes in on 21.00

- USD/TRY rises past 15.0 & clocks 107% 2021 gain

- As CBRT cuts again & opens door to 2022 rate cuts

Above: CBRT Governor Şahap Kavcıoğlu. Image © CBRT

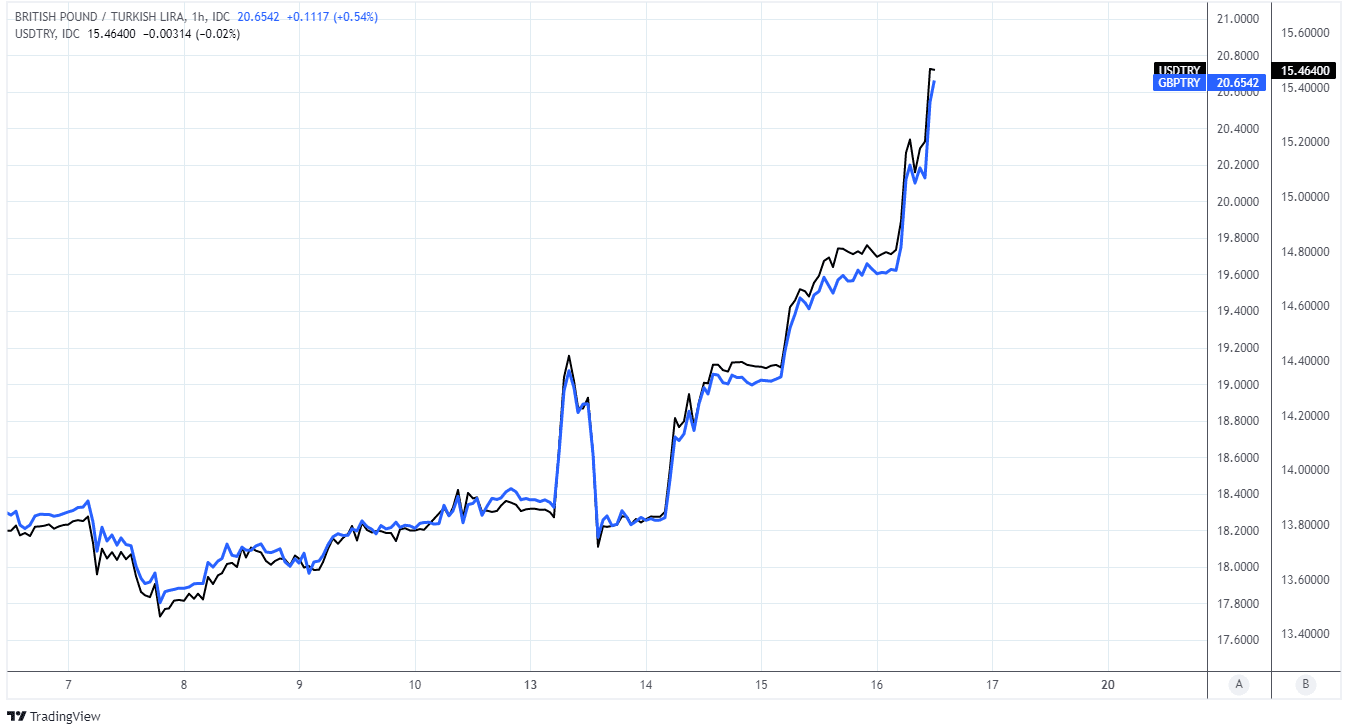

Fresh declines in the Turkish Lira saw the USD/TRY exchange rate rise above the 15.0 handle for the first time on Thursday, lifting the Pound-to-Lira exchange rate sharply above 20.00 in the process and leaving it trading closer to 21.00.

USD/TRY’s 2021 increase reached 107% on Thursday while the Pound to Lira exchange rate has risen more than 105% after the CBRT announced its fourth cut to the cash rate of the final quarter, taking it down to 14% just as many other central banks are preparing to lift interest rates.

“In the rise in inflation observed in November; Exchange rate developments, increases in global food and agricultural commodity prices, supply-side factors such as disruptions in supply processes and demand developments are influential,” the CBRT said in its statement.

“The Board decided to complete the use of the area implied by the temporary effects of supply-side and incidental factors outside the monetary policy impact on price increases, by reducing the policy rate by 100 basis points,” the bank also explained.

The decision to “complete the use of the area implied by temporary effects” suggests that the CBRT’s interest rate cutting cycle may have reached at least a temporary end in December, although despite this the Lira tumbled to new lows against many currencies.

“The lira has weakened immediately after the decision and, we think, will continue to do so in the coming periods, forcing the CBRT to U-turn and hike rates in 2022,” says Cristian Maggio, head of portfolio strategy at TD Securities.

Above: GBP/TRY and USD/TRY shown at hourly intervals.

- GBP/TRY rates at publication:

Spot: 20.73 - High street bank rates (indicative band): 20.00-20.15

- Payment specialist rates (indicative band): 20.54-20.62

- Find out about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

The CBRT said the effects of recent interest rate cuts will be monitored over the coming months and taken into account in a forthcoming “policy framework review process” that is set to “reshape price stability on a sustainable basis” during the first quarter of 2022.

“This is arguably due to the phrasing around the duration of the pause in the easing cycle, which was less aggressive than we would have hoped for. Opting to pause for just one quarter in 2022,” says Simon Harvey, an analyst at Monex Europe.

“Given this, pressure on the lira is unlikely to abate in the coming months as markets remain wary of continually lower rates in Turkey heading into 2023 when the next election is scheduled,” Harvey said following Thursday’s decision.

The forthcoming framework review is to the Monex team an indication that further interest rate cuts are likely to be announced in the second quarter of 2022 or soon after and largely irrespective of what happens with Turkish inflation pressures in the interim.

This is because the CBRT might be likely to view any declines in inflation as an invitation to cut rates further, and could come under pressure from Ankara for additioanal reductions in borrowing costs should Turkish inflation pressures escalate further instead.

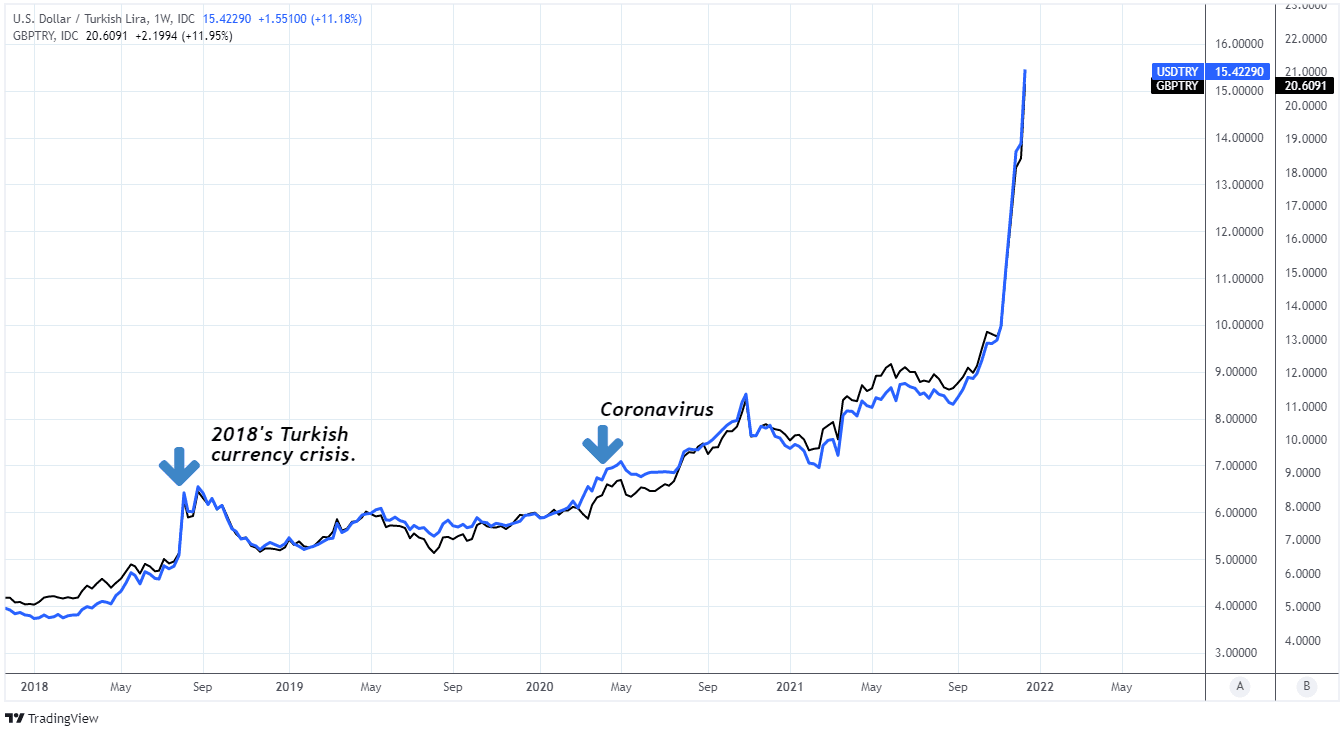

Above: USD/TRY and GBP/TRY shown at weekly intervals.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Turkish Lira’s losses have escalated dramatically in a more than fivefold increase since the CBRT began cutting the cash rate in September from its prior 19% level, leading USD/TRY and GBP/TRY to more than double for 2021.

It had however, already been carrying double digit declines even before then following the March dismissal of former CBRT Governor Nagi Agbal and replacement with incumbent Governor Sahap Kavcioglu.

“Previous episodes of lira depreciation (January 2014, August 2018 and November 2020) prompted emergency rate hikes, but this time the CBRT has opted for the uncharted path of lower rates and FX intervention,” says Kenneth Broux, a strategist at Societe Generale.

“This ploy isn't working, and FX reserves are negative (-$31bn net as of end-October). Increasing dollarization (72.9% of the banking sector and falling FX deposits) is detrimental to the position of domestic banks,” Broux told clients on Thursday.

The Lira was sold heavily from the open this week, with many analysts attributing a large slice of its losses to Finance Minister Nureddin Nebati, who told Haberturk’s Sevilay Yilman in an interview on Monday that Turkey’s government can meet its economic objectives without raising interest rates.

This is after President Recep Tayyip Erdogan said in an interview with TRT Haber this month that Turkey would no longer court “hot money” through high interest rates and would instead attempt to grow economically by developing its export sector using low interest rates, among other things.