Equities Extend Cautious Rebound, Dollar Slips as Bank Stocks Rally

Image © Adobe Images

Despite the steadier tone in the markets reflected in equities and bond yields, which are ticking higher today, investors are still pricing in about 50 basis points of rate cuts from the Fed by December.

This likely suggests that the stress in the financial sector is seen to be significant enough to leave a damaging mark on the US economy and that probably explains why the greenback remains on the backfoot.

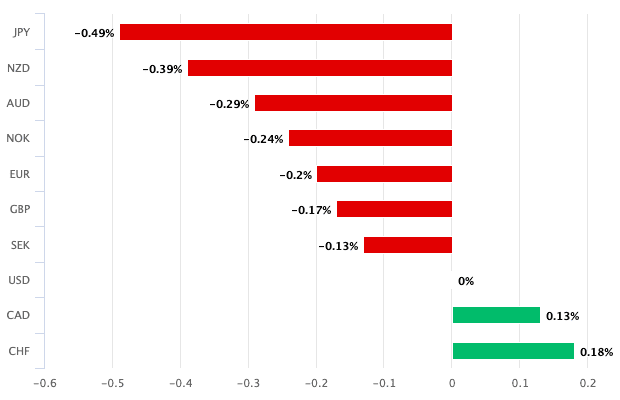

The US dollar is down against all of its major peers today, bar the Swiss franc and Canadian dollar.

However, the lingering anxiety about the health of the global financial system is providing some support to the safe-haven dollar, making it difficult for the likes of the euro and pound to convincingly reclaim key levels.

Above: USD performance on March 28.

Fears about a deeper banking crisis receded further on Tuesday, giving risky assets another leg up as beaten-down bank stocks attempted a rebound.

Concerted efforts by the US Treasury and Federal Reserve to prop up the banking sector seem to be slowly but surely calming nerves about more dominos falling from SVB’s collapse.

The latest intervention came as it was announced that First Citizens Bank would buy most of Silicon Valley Bank’s assets, while the Fed is considering expanding its emergency lending facility to maximise its support to troubled First Republic Bank.

Meanwhile in Europe, EU leaders provided more reassuring words that the banking sector "is resilient, with strong capital and liquidity positions" after Deutsche Bank’s credit default swaps spiked last week in a worrying sign of ongoing contagion risks.

The absence of a policy response to quell the panic about Germany’s largest bank suggests that EU regulators and the ECB must have some confidence in Deutsche Bank’s finances.

And although the stock is now recovering, that has more to do with the rebound on Wall Street.

The S&P 500 closed up for a second day on Monday, but failed to hold onto earlier gains that briefly took the index above the 4,000 level.

The reason for the pullback was the drag from technology shares, specifically, the big tech, as the easing of the crisis sparked some rotation away from defensive names such as Microsoft, Apple and Alphabet back into financials.

The S&P 500 Banks index gained about 3% yesterday, while the STOXX Europe 600 Banks index is up 1% so far today.

With not a lot on the economic agenda over the next couple of days, this cautious pickup in risk appetite might just persevere.

However, investors will be on the lookout for any comments from Fed officials during the week amid intensifying speculation of rate cuts in the second half of this year.

Raffi Boyadjian is Lead Investment Analyst at XM.com. An original of this article can be viewed here.