Powell Sets Recession Warning Lights Blinking

- Fed Chair Jerome Powell sparked a sell-off

- FTSE 100 opens lower

- Fresh warning light of recession in bond markets

- German retail sales fell 0.3% in January

- RMT union suspends Network Rail strike

Above: File image of Federal Reserve Chair Jerome Powell. Image © European Central Bank.

The global stock sell-off is continuing with investors jolted by the realisation that the work of the Federal Reserve in trying to tame wild inflation in the US far from over.

Wall Street ended in sharp retreat, and the risk-off sentiment has spilled over to trade in Asia, with European indices also heading for falls in early trading.

An unexpected fall in retail sales in Germany in January added to the downbeat picture, showing that consumers are proving a lot more cautious, worried about what could be ahead for the economy amid steep inflation and rising rates.

Powell Shakes it Up

In his testimony before Congress, the Fed chair Jerome Powell indicated that hotter-than-expected readings of the labour market, business activity and core prices in January show that inflation is proving much stronger than policymakers anticipated when they last met to decide monetary policy.

Three fresh rate rises in March, May and June now look likely and the chances of a steeper 0.5% hike later this month are increasing if the February jobs snapshot and consumer price data doesn’t show significant signs of cooling.

As borrowing costs are set to shoot up yet again, it’ll pile more pressure on consumers and companies.

It’s adding to worries that the US economy won’t fall like a feather into a mild downturn but slam into a recession.

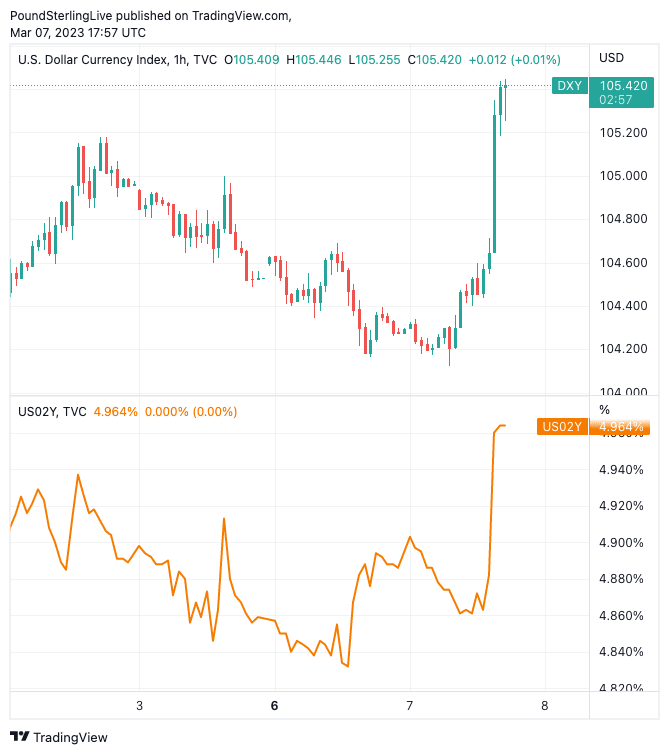

Above: The Dollar index spikes, drawn higher by U.S. two-year bond yields (bottom pane), confirming the bond market is driving FX markets.

Recession Warnings Lights Began Blinking

Investors have had to strap in for another twist on the stock market rollercoaster and the volatility is set to continue until central banks finally press pause on rate rises.

As Jerome Powell prepares to give further testimony before the House of Representatives today, investors will be all ears for any further signs about the likely trajectory of rates and just what impact this will have on the mighty US economy.

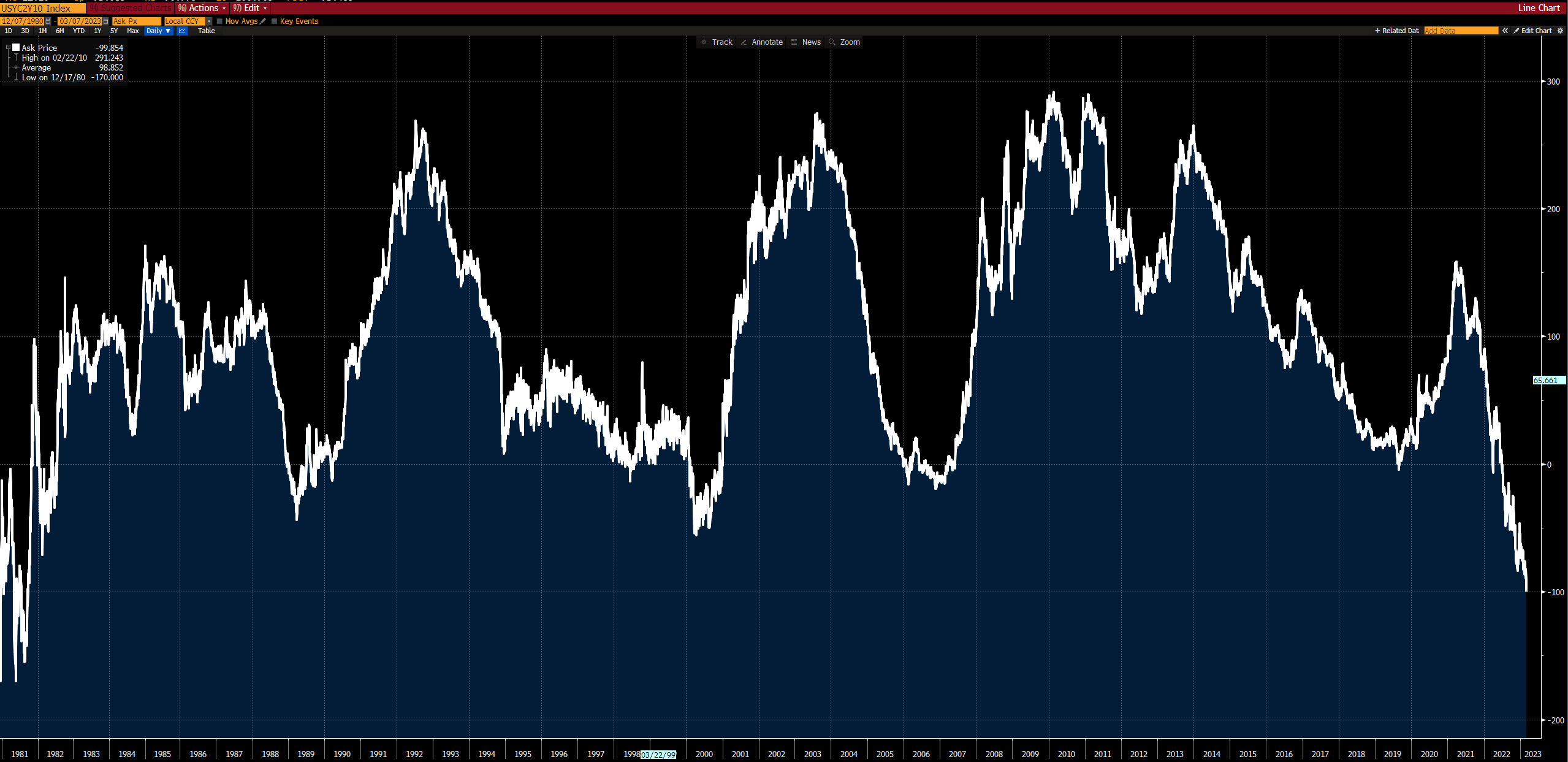

Recession warning lights began blinking more furiously in the bond markets, with the 2-year and 10-year Treasuries bond yields inverting further.

Above: "The 2yr/10yr yield curve is now 100 basis points inverted" - John Authers, Senior Editor at Bloomberg. Image courtesy of @johnauthers / Bloomberg.

An inverted yield curve is seen as a canary in the coal mine for a recession, signifying it’s much more expensive to borrow money in the short term than in the long term. Usually, investors want more reward for locking away their money for longer but yields on two-year bonds have gone above 5% while ten-year note yields are under 4%.

Worries about a harder landing for the US is feeding into expectations of further fragility for the global economy which has pushed down the price of oil, amid forecasts of lower demand.

Rail Strikes: Closer to the End

One bar to improved productivity in the UK has been removed with a breakthrough in the rail strike. The RMT union has suspended strike action on the 16 March and although workers at individual rail companies will walk out, the impact won’t be quite so severe now that network rail staff won’t be joining the industrial action.

Mass strikes have been a big thorn in the Chancellor’s side as he tries to come up with a longer-term plan to spark growth in the British economy, while promising to pay down debt.

Although the strikes have had a negligible effect on spending patterns, according to the ONS, there may be some extra cheer today for hospitality businesses, hoping that they’ll find it easier to attract the custom of domestic tourists and the after-work commuter crowd if train timetables offer more reliability.

Market Report by Susannah Streeter, Head of Money and Markets at Hargreaves Lansdown.

Market Report by Susannah Streeter, Head of Money and Markets at Hargreaves Lansdown.