Pound's Uptrend vs. Indian Rupee Tipped to Extend

Image © Adobe Stock

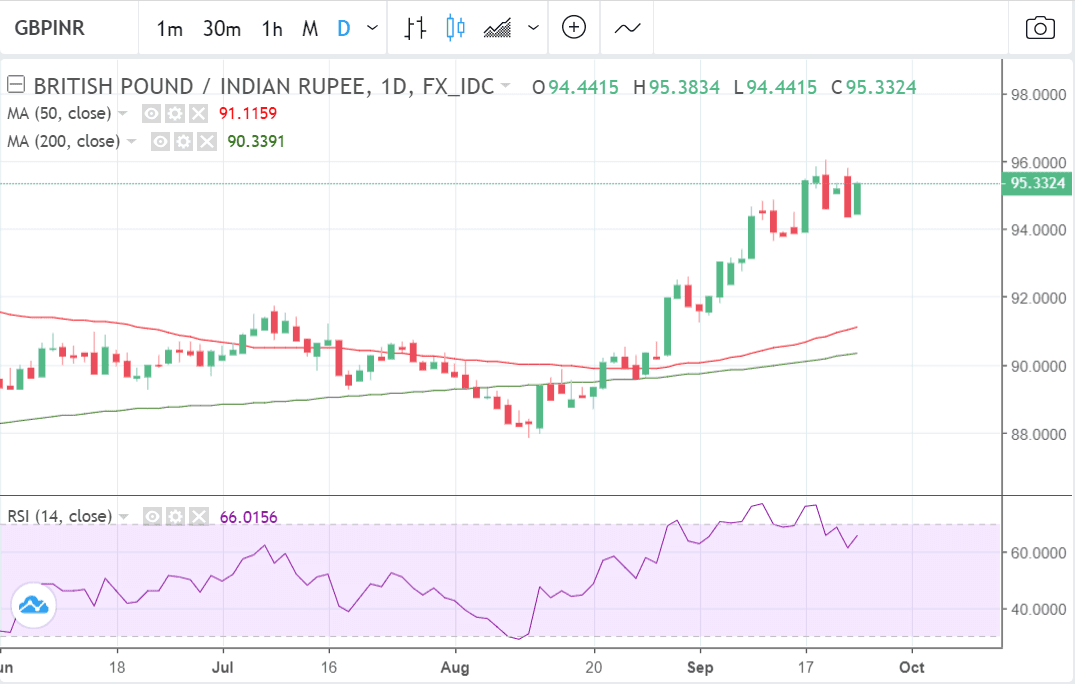

- GBP/INR is rising in an established uptrend

- Pair has broken through some key levels

- Rupee subject to emerging market sentiment this week

GBP/INR is in a strong uptrend which continues to remain intact despite weakness in the previous week due to negative Brexit headlines.

The pair has pushed higher more as a result of Rupee weakness than Sterling strength and this also explains why the recent sell-off was so muted - the weakening Pound struggled to fall much against the weakening Rupee.

The Rupee has fallen recently due to rising oil prices; India has to import most of its fuel so the Rupee is sensitive to the price of oil - when it goes up traders have to sell more INR to afford the same amount of oil.

Another depressor for INR was foreign investor flight from Indian assets on fears of an EM financial crisis and the pair remains vulnerable to news of trade wars and any reports of a global slowdown, should they materialise.

The technical picture on the longer-term weekly chart appears to favour more upside for GBP/INR since it is in an established uptrend.

The pair has broken above the April highs and risen on all of the last seven weeks, and although the uninterrupted run may not last it is a bullish sign in itself, and a break above the 96.06 highs would probably lead to a continuation to the next target at 97.00.

The pair has now broken above both the 200 and 50-day MAs which is another bullish sign.

The RSI momentum indicator is now above 70 suggesting the exchange rate is overbought and due a pull-back but it has to move back down out of overbought to give a sell signal.

As it stands, a reading in overbought merely indicates traders are taking a risk of losing their equity if they open any new long orders.

The Pound to Rupee: What to Watch

Most of this week's key data for the Rupee is out on Friday, September 28, although none of the releases are likely to be market-moving.

One of the releases will show the amount of FX reserves held by the Reserve Bank of India (RBI) in the week ending September 28, and this will probably indicate the extent of the bank's involvement in trying to manipulate FX markets. In the previous week, it stood at 400bn.

Deposit growth, bank loan growth, and external debt are all also likely to be released next Friday, as well as infrastructure output and the value of the government's budget.

The price of oil is likely to continue having an impact on the Rupee in the week ahead too. On Monday, oil prices rose to a fresh 10-week high of 72.38 on supply fears.

International trade conflict is another macro factor which could impact on the Rupee.

On Monday trade fears worsened after China canceled trade talks with the U.S. as well as a proposed visit to Washington by Vice Premier Liu He which had been scheduled for this week, the Wall Street Journal reported.

The breakdown in the relationship between China and the US could weigh on emerging market assets, strengthen the Dollar and weigh on countries like India which have high levels of external debt as well as a current account deficit.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here