Pound-to-Indian Rupee Rate Near-Term Outlook: Uptrend to Continue say Charts

- GBP/INR is in an established uptrend which is expected to continue

- The charts are signalling a high probability of more upside

- For the Rupee, emerging market risks will dominate this week's trade

The Pound-to-Indian Rupee exchange rate has been in a strong uptrend ever since the August 10 lows and there are signs this will probably continue in the week ahead.

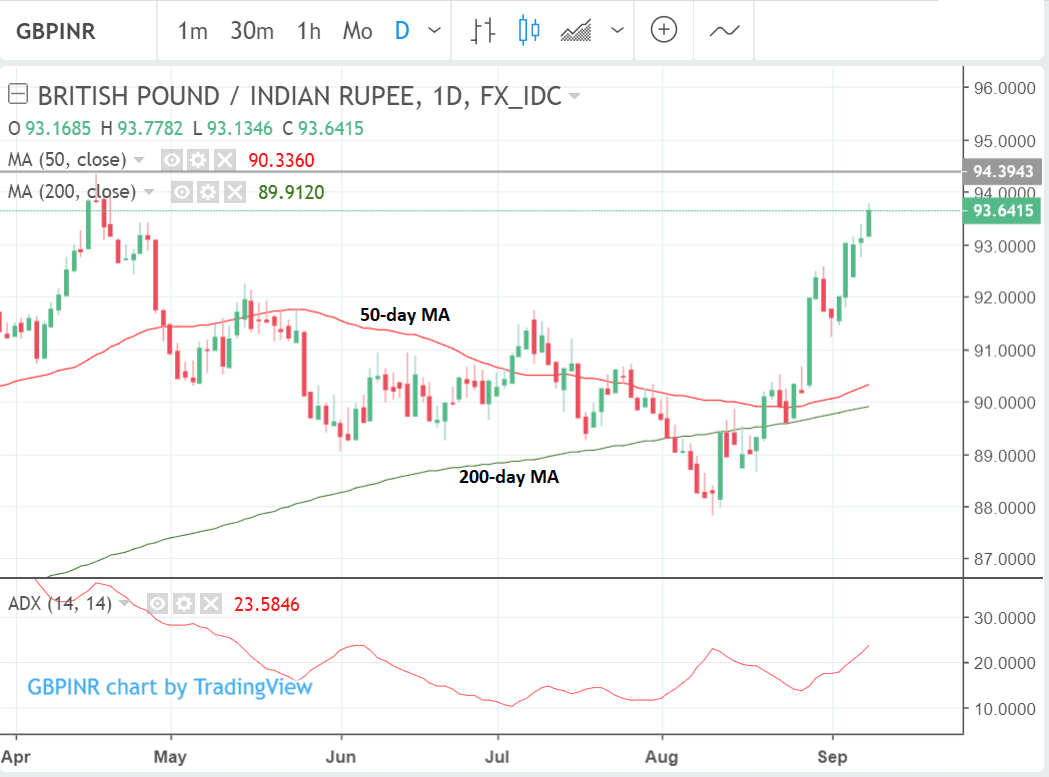

A continuation pattern is probably forming on the daily chart which - subject to a strong close today (Monday) - will provide a relatively high probability signal that the exchange rate will rise further.

A break above the current day's high at 93.78 would confirm a continuation up to the next target at the 94.39 April 17 highs.

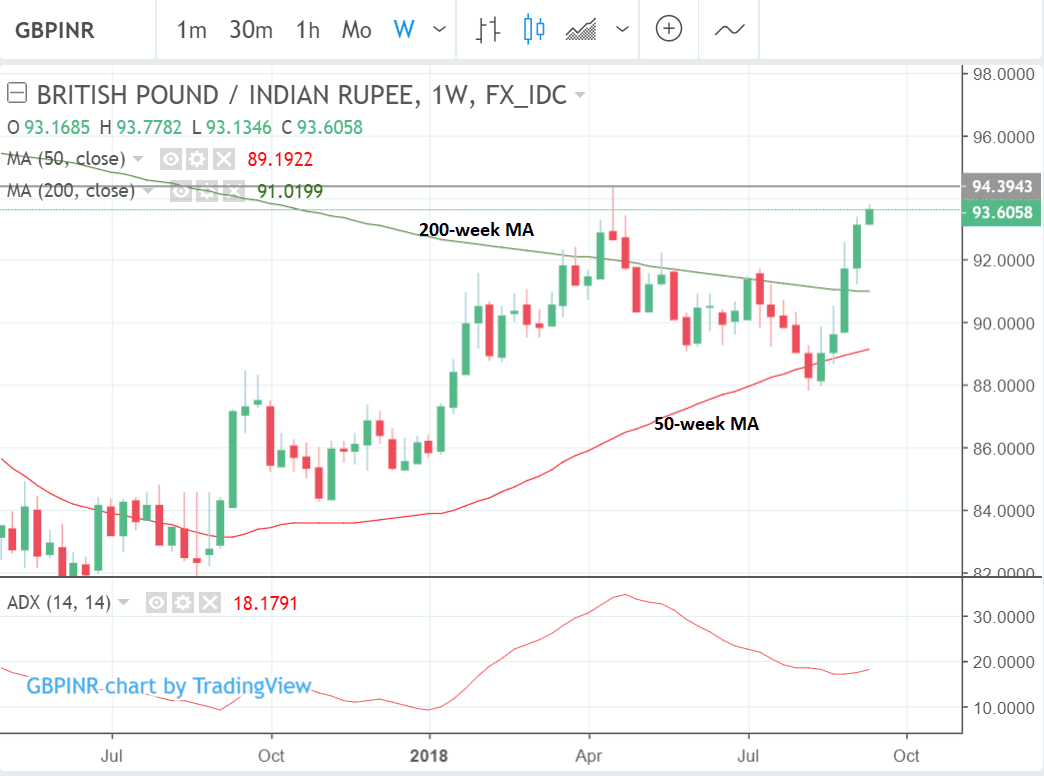

The weekly chart shows how the pair is in a longer-term uptrend which corrected back in an abc three-wave corrective pattern during the summer but resumed its uptrend in August.

The pair formed a bullish three white soldiers Japanese candlestick reversal pattern after the August lows further confirming the bullish reversal.

The pair is trading above both its 50 and 200 day and week moving averages (MAs) which is a bullish indicator that the longer-term trend is very much up.

The Indian Rupee: What to Watch this Week

The main events that could impact on the Rupee over the next five days are likely to be geopolitical in nature.

The currency has been heavily affected by the crisis in Turkey and Argentina and general concerns about how the escalating trade war between the US and China might impact on world trade.

Investors are still waiting for confirmation of whether the US still plans to impose a 25% tariff on Chinese imports and if it does it could have a negative impact on the Rupee, lending fuel to GBP/INR's uptrend.

The US president Donald Trump further inflamed the discourse on trade after saying he was ready to slap tariffs on virtually all Chinese imports, on Friday. This implied an escalation from the $200bn already earmarked for duties to encompass a further $267bn of goods.

The news seems to have weighed on the Rupee on Monday morning and it sparked a sell-off in Asian equity markets overnight.

An announcement of more duties is probable in the week ahead and could hit the Rupee further. It would also probably strengthen the Dollar, putting even more pressure on the Rupee because it raises the cost of servicing the county's half a trillion Dollar external debt-pile.

The main risk to India is that foreign investors will put up lending costs. The country has a twin deficit and so is more reliant on outside financing which becomes more expensive the the weaker its currency becomes.

Nevertheless, India is considered one of the strongest of the EM currencies which might well help it weather the current stresses being suffered by some of its peers.

The country enjoyed a GDP growth rate of 8.2% in Q2, the fastest in the world, and its central bank has large amounts of reserves which can be used to cover all its short term and most of its total debt if required in an emergency.

Indeed, last week we saw signs of intervention taking place at the Reserve Bank of India, and would expect further support should stresses evolve which should provide something of an insurance policy for the currency.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here