Pound vs. Indian Rupee Outlook: Falling Towards Key Technical Floor

Image © Adobe Stock

- GBP/INR is selling off but it is now quite close to support in the form of the 50-week MA

- A clear break below 50-week required to signal continuation lower

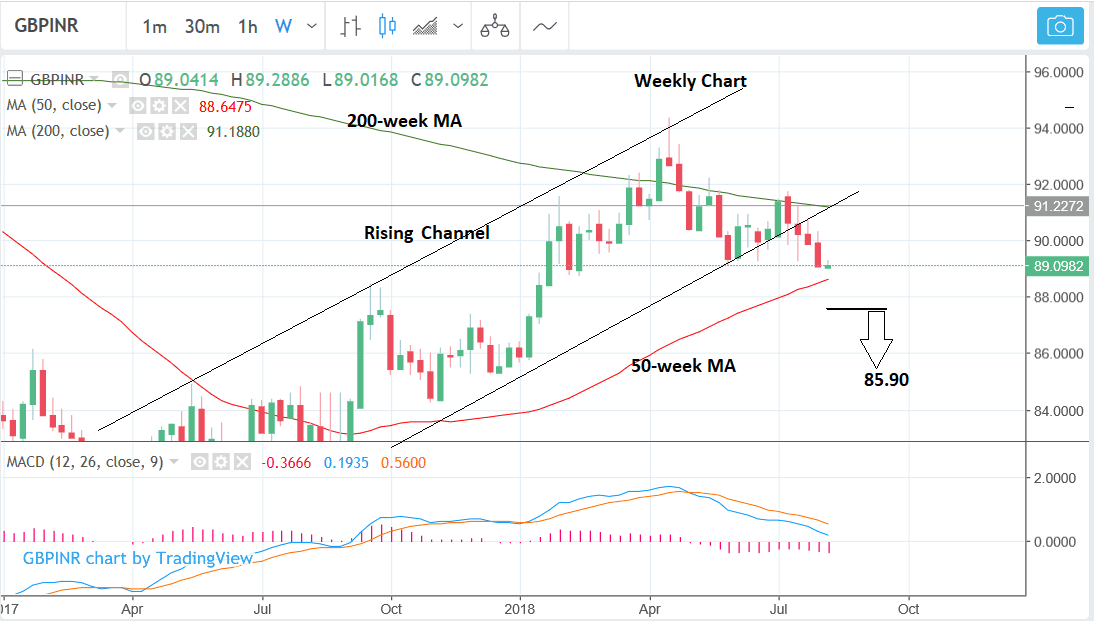

The longer-term trend is still down for the British Pound against the Indian Rupee after the pair pivoted after touching the 50-month MA (circled), in April, and this suggests more downside on the horizon.

The weekly chart is showing the pair has now successfully broken below the 89.24 lows confirming a breakdown from the channel and making the outlook more bearish.

GBP/INR is likely to fall from here, however, the 50-week MA, at 88.65, not far below the current exchange rate, is likely to present an obstacle to further downside progress, and ideally we would want to see a clear break below it for confirmation of more downside.

A break below 87.75 would confirm a clear break below the 50-week MA and indicate a probable continuation to the bearish target at 85.90, calculated using the height of the channel extrapolated from the breakout point lower as a guideline.

What to Watch for the Indian Rupee this Week

There are no major economic data releases for the Indian Rupee in the week ahead.

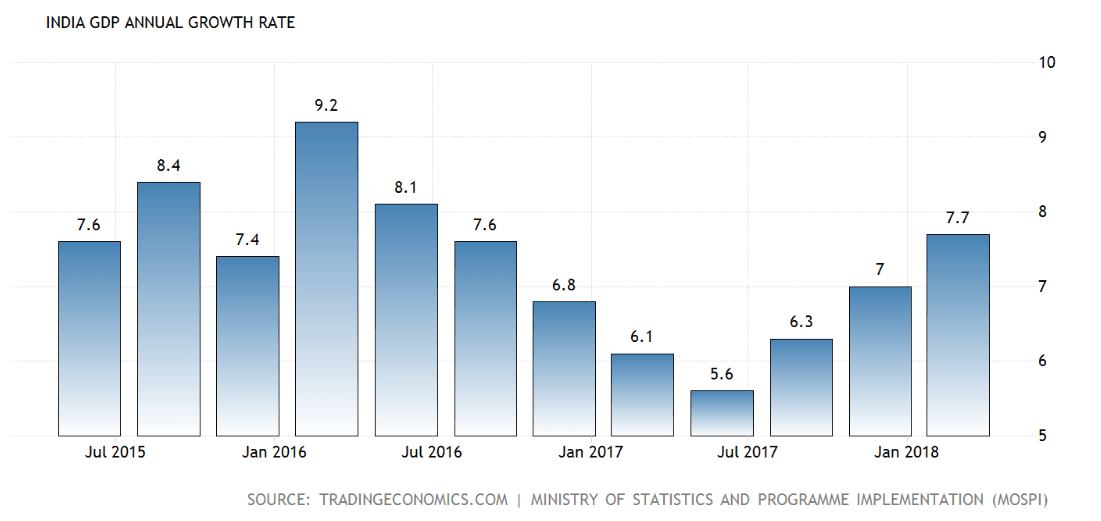

One fundamental factor which could impact, however, are trade war tensions which some analysts are arguing are creating a headwind for emerging-markets, but growth remains strong in India with GDP rising at an annualised pace of 7.7% in Q1.

High exporting EM nations will be worst hit by a trade war but India is a net importer so may be less affected. The exact impact may also depend the country's own specific trade links.

Speculation around interest rates and inflation could also impact on the Rupee in the week ahead.

Last week the Reserve Bank of India (RBI) increased the base interest rate (repo rate) to 6.50% and the reverse repo or deposit rate to 6.25%, in its ongoing battle with rising inflation and there is a possibility of a further rate rise at the end of 2018 according to some economists.

Shilan Shah senior India economist at Capital Economics thinks India's central bank will raise interest rates for a third time, probably in December 2018. December's anticipated hike will be as far as the current RBI tightening cycle goes, however, so it's a case of 'one more and done'.

A further rate hike would be dependent on growth and core inflation maintaining their current trajectory higher.

Nevertheless, expectations of higher interest rates in the future drive up currencies so hints of a hike at the end of the year would probably support the Rupee (and be negative for GBP/INR).

Higher interest rates appreciate currencies because they increase inflows of foreign capital drawn by the promise of higher returns.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here