Riddle of the Indian Rupee: Will It Continue Higher or Lower After Surprise Rate Hike?

- Reserve Bank surprised by raising rates at their June meeting

- Indian Rupee gave inconclusive reaction after falling on initial news

- Analysts diverging in their views of the future course of the currency

Image © Kriangkrai, Adobe Stock

The interesting thing about the Indian Rupee's reaction to the surprise interest rate hike by the Reserve Bank of India (RBI) yesterday, was that initially it actually fell, in a move contrary to logic and the norm, and it was only after about half an hour that the currency start going 'in the right direction' - strengthening, but only marginally versus the Pound and the Dollar.

The Rupee's atypical reaction was due to the market itself not actually being as surprised by the rate rise as analysts were - there is after all a distinction between an analyst and the market!

The interest rate market, for example, was was already wise to the fact, at least according to Charlie Lay, an analyst at Commerzbank.

"The RBI’s decision caught the economists off-guard but not the interest rate or FX traders: the 3-month short-term rate was already trading at 6.35% vs RBI’s benchmark rate of 6% i.e. the market was fully pricing in a 25bp hike over the next three months," says Lay.

The Rupee's rollercoaster ride is perhaps symbolic, however, in a broader sense, of a wide divergence in bank analyst's views on the outlook of the Rupee, post-RBI-day.

Some like Commerzbank and Asian lender Maybank are conventionally bullish, whilst others such as Singapore based UOB are contrarian and bearish - bearish that is against the Dollar, at least, and probably Sterling too, which is so horrendously undervalued due to Brexititus.

The bullish case for the Rupee is that growth and inflation are on the rise and this is likely to lead to another rate rise in 2018, possibly even as soon as August.

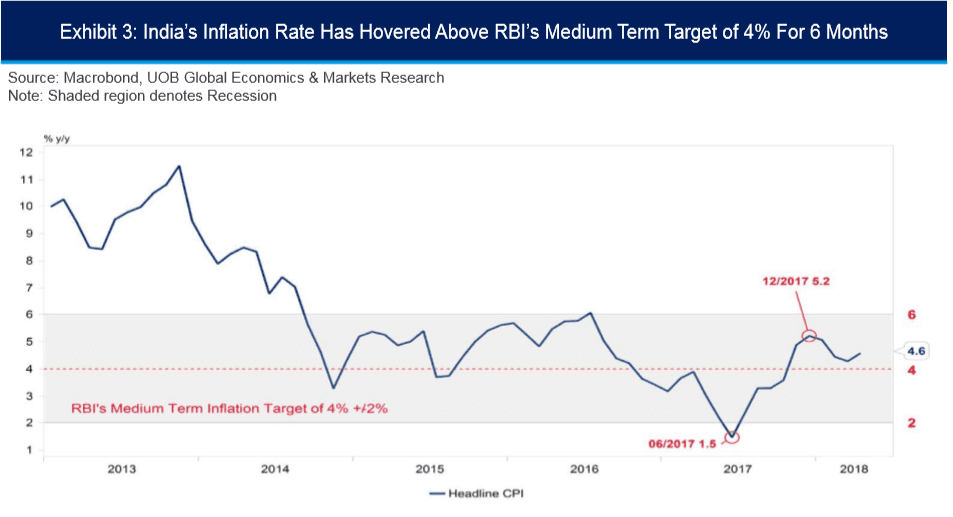

Recent inflation data surprised to the upside, rising from 4.28% to 4.58% in April, and above the 4.4% expected. Although this is still far below the 6.0% upper band of the RBI's target range, the fact that it was driven by a rise in core components - and signaled accelerating consumer spending - was probably the thing that swung it for the RBI.

In fact, non-core food inflation was one of the few components in April to remain unchanged, at 3.0%.

The outlook for food inflation going forward is broadly balanced as a good monsoon is expected to lead to greater supply and lower prices, but this is offset by the government's pledge to increase the minimum price subsidy for farmers to a higher 50% above cost.

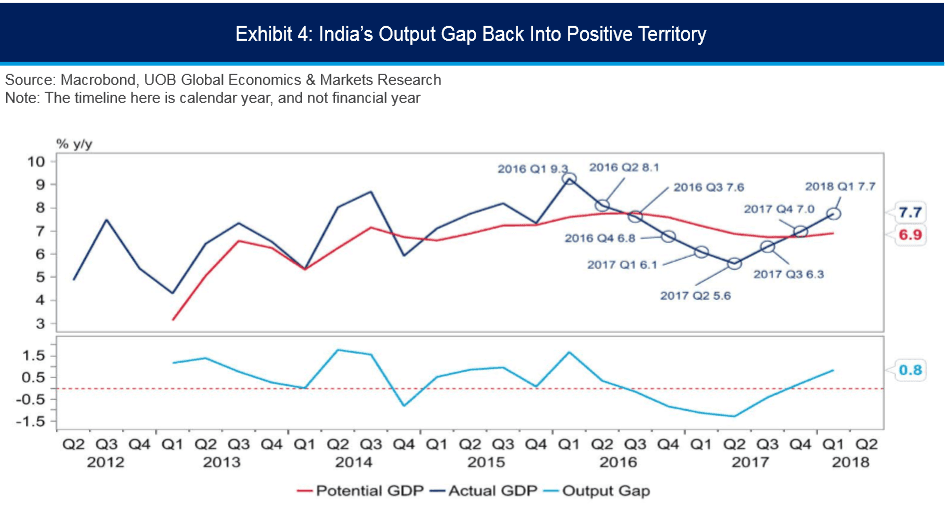

Another factor in favour of a strong Rupee is that the 'output gap' has closed, which is the theoretical difference between the economy's current activity level and its potential. This suggests a 'tightening' in conditions which should put upward pressure on wages, prices and eventually interest rates.

"The strong Q1 GDP also allowed room for RBI to move and the central bank even pointed out that the output gap has “almost closed” and that could add pressure to inflation," says Saktiandi Supaat, an analyst at Maybank.

Of course, it is quite possible the rate hike could be a 'one and done' as is suggested by bears, however, Supaat thinks not.

"Even though RBI did not commit to a tightening cycle, global environment and domestic conditions could still be positive for the rupee," he says.

"On the technical chart, MACD is bearish and stochs are also heading lower. We continue to look for the 1M USDINR NDF to head lower towards 66.70," adds the Maybank analyst.

Commerzbank's Lay also sees a move lower for USD/INR to the 66s as strong Q1 growth (the fastest in the world) means the RBI can take its food off the breaks and put all its energy into targeting inflation.

"The bottom line is that RBI’s focus is now squarely on inflation and away from growth. Going forward, a more hawkish RBI coupled with lower oil prices should see a further pullback in USD-INR to the lower end of the 66-67 range near term," says Lay.

Bears, agree with most of the above but differ in degree. OUB, for example, see inflation remaining higher than the 4.0% midpoint but do not see the inflation rate rising all the way to the 6.0% upper band "anytime this year".

Part of their flatter outlook for inflation rests on their view that oil may now have peaked and, "due to the abilities of US shale oil producers to bring to international markets more supply at a double-quick pace," says Francis Tan, an economist at OUB.

Another factor is the Dollar's rampant strength and its positive outlook, which remains a potential spoiler to the strong-rupee (and stronger EM) story.

"With the US Federal Reserve expected to tighten monetary policy at a faster pace, we expect the INR to continue weakening, albeit at a slower pace. We expect the INR to trade towards 67.8/USD by the end of 2018 and onward to 68.5/USD by 2Q 2019," concludes Tan.

In regards to rising oil prices, they are, of course, expected to lead to petrol inflation but this is probably not a factor which will appreciate the Rupee.

Firstly, that oil will continue to rise is debatable given the increasing supply from US shale operators, reports of a Saudi-Russian decision to end the supply cap, and c) a technical break below a major long-term trendline.

India has to import most of its oil and so higher oil prices are a depreciator for the Rupee, thus offsetting any gains from heightened rate expectations.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.