End of the Indian Rupee Rally Warn Deutsche Bank

One of the biggest foreign exchange dealers in the world says the Indian Rupee is losing its lustre.

Once the "darling" of the Asian FX universe the Rupee (INR) is set to lose its FX throne, according to Deutsche strategist Mallika Sachadeva and macro strategist Sameer Goel.

Much like many analysts are forecasting the Dollar will be eclipsed by global growth in the 'rest of the world' (RoW), so Sachadeva and Goel see a similar dynamic impacting negatively on the Rupee, with investors finally 'walking away' from INR because of the draw of more attractive alternatives.

The news will have implications for the Pound-to-Rupee exchange rate which has been rising since mid-2017 and is now looking to retake the ground it lost on the night of the EU referendum in June 2016.

"This period of Rupee outperformance may be drawing to a close though. Fundamentals in other EM are improving, even as INR’s begin to de-rate somewhat. And the stronger global cycle is making higher beta currencies stand out as better buys. INR could begin to lag, not lead, other EM FX from here," say the Deutsche strategists.

Higher "beta" currencies - which means those traditionally more volatile - include the Singapore Dollar (SGD), the Korean Won (KRW) and the Taiwanese Dollar (TWD), to name a few.

But it is not just in comparison with other currencies that the Rupee is likely to lose out - its own intrinsic worth is also set to come under pressure.

With little oil of its own, India is more reliant than most countries on oil imports, and these have become increasingly more expensive recently.

Selling greater quantities of Rupee to fund its energy needs weakens the Rupee, and research shows that it is such an important factor that every 10% rise in the price of oil India's current account deficit - a broader measure of the balance of trade - widens by -0.15%.

Of course, one caveat to this factor is that oil prices may be limited in their extension higher by increasing US shale production, which becomes increasingly more profitable after oil rises above the shale break-even price of $50 per barrel.

The Tide is High

Previous INR strength had partly been as a result of increased demand from rising inflows of foreign capital, as international investors and funds sought to purchase a piece of the Indian 'pie' in the form of either financial or other assets and thereby partake of the growth bonanza.

What made India all the more attractive was its seemingly idiosyncratic cycle compared to the rest of the world as it somehow eluded the worst effects of the financial crisis.

Yet Deutsche's Sachadeva and Goel say that this source of Rupee demand is likely to wane due to the now overly high valuation of Indian stocks - basically, India isn't a 'deal' anymore, it has become too expensive.

"Indian equities are one of the most expensive in the region, even slightly richer than US stocks in terms of valuation multiples.

Although earnings growth is moving back up in India, offshore investors are likely to prefer North Asian stocks which are more leveraged to the global tech cycle and trade at much cheaper valuations," say the Deutsche pair.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

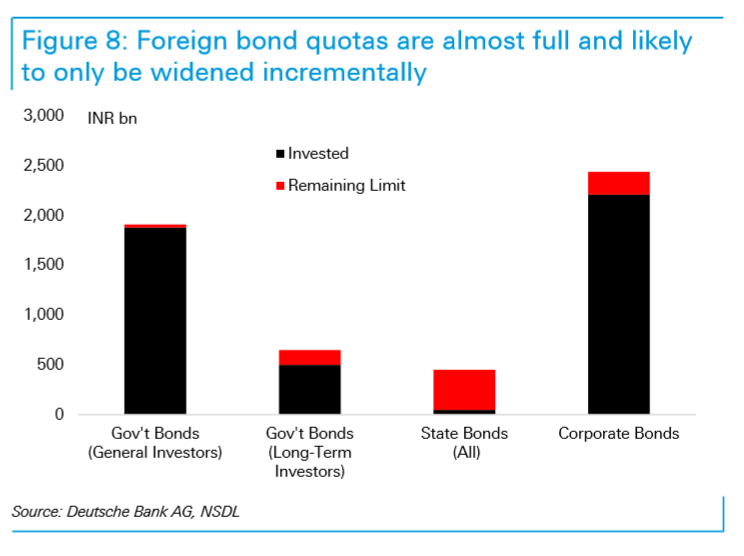

Another major source of demand for the Rupee which is likely to die down is demand for Indian bonds.

Foreign investors have now almost used up their official quota of Indian bonds and although the government has plans to raise the quota, it is only expected to be by around 2.5% from the current low 5.0% level to maybe 7.5 %, so hardly a major increase.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Rupee Overvalued

It is not only stocks and other assets which are expensive now, the Rupee is also expensive itself, says Deutsche.

"On an average of our own valuations models (PPP, DBeer, FEER), INR has moved into slight overvaluation territory. While valuations are not at extremes on an absolute basis, the gap between INR and EM FX valuations has widened to record levels," say Sachadeva and Goel.

Narrow Basic Balance of Payments is Moving Into Deficit

The changes in flow and trade outlined above have already been reflected in a deteriorating current account balance, and, also a deteriorating balance of payments or basic balance for India.

The narrow basic balance is composed of the current account balance adjusted for net foreign direct investment and is highly correlated with the value of the Rupee since it reflects changing aggregate demand and supply of a country's currency.

If a country imports more than it exports and thus runs up a high current account deficit it must borrow increasing amounts of money from outside its borders to settle its growing debts.

The narrow basic balance reflects outstanding surplus or demand for the money required to balance the nation's books and can be a pointer to future currency demand.

Deutsche note the basic balance is falling into deficit and this is likely to be negative for the currency.

"The latest four quarter sum of the narrow basic balance (current account plus net FDI) was less than $1bn, versus a high of almost $30bn in mid-2016. We are projecting the current account deficit to widen further to –$50bn in 2018, versus –$38bn in 2017. This is unlikely to be fully funded by net FDI, which has been averaging closer to $35-40bn, pushing the narrow basic balance into deficit this year," say the Deutsche duo.

Falling Real Interest Rates

A final headwind for the Rupee, according to Deutsche bank is what they call 'real' rates which are interest rates adjusted for inflation.

Real rates are highly correlated with currencies because the higher they are the more attractive the country is to international investors seeking somewhere to place their money.

In India, real rates are falling, and although gains are expected if the Reserve Bank of India (RBI) puts up base interest rates these expected rises have already been priced in, according to Deutsche so probably won't have that much impact on the Rupee.

Trade Recommendation

Although they are bearish the INR Deutsche do not recommend selling it versus the DOllar which they also think will weaken.

Instead, they propose a more complex trading idea using "dual digital puts" which are a type of option, in a complex trade which profits from the de-coupling of USD/INR from other notable Asian FX pairs, which also allows them to work in the theme of relative underperformance to Asian peers.

The other main pair proposed for the trade is USD/SGD, which they expect to de-couple steeply from USD/INR.

"They (Dual Digitals) provide cheapening by selling the correlation between INR and other EM pairs, like SGD (Figure 13). USD/SGD is likely to continue moving lower in an environment of generalized dollar weakness given her basket framework, and the likelihood that MAS tightens at their April meeting by returning to an appreciation bias on SGD NEER," say Sachandeva and Goel, adding:

"A 3M dual digital with USD/INR > 64 and USD/SGD < 1.30 would cost an indicative 12%, at the time of writing."

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.