Pound to Indian Rupee: Forecast, News and Data in the Week Ahead

The Pound continued climbing against the Rupee since our last forecast and has met and surpassed our upside target of 83.175, reaching a high of 83.210 last Friday.

Wheras the outlook used to be very positive for the Indian Rupee it is now less so, and this partly explains the technical rotation from the August 24 lows at 81.820 and the move higher - which is indicative of Sterling outperforming the Indian currency.

The Rupee faces headwinds it didn't have six months ago, chief of which is the strength of the Rupee itself.

"India's stronger currency has become a threat for its growth aspirations, piling pressure on the central bank to aggressively intervene in the foreign exchange market even at the risk of incurring the wrath of the United States," said a Reuters report on the Economic Times of India website.

The strong currency appears to be undermining India's export competetiveness and increasing foreign imports, derailing government efforts to promote a 'made in India' message.

Unlike the Chinese Yuan, which has depreciated by 1.9% versus the Dollar in 2017, the Rupee has appreciated by 6.0%, and this is enough to impact buying decisions by major American clients such as Wal Mart, according to experts.

After taking the crown from China of being the fastest growing economy in the world in 2016, India's poor export sector performance could lead to it losing its top spot, after it shaved 2.6% off growth in the last quarter (Q2).

Research is also showing a slowdown in another major source of Rupee demand and strength: portfolio inflows from foreign investors seeking to buy a piece of India's prosperous future.

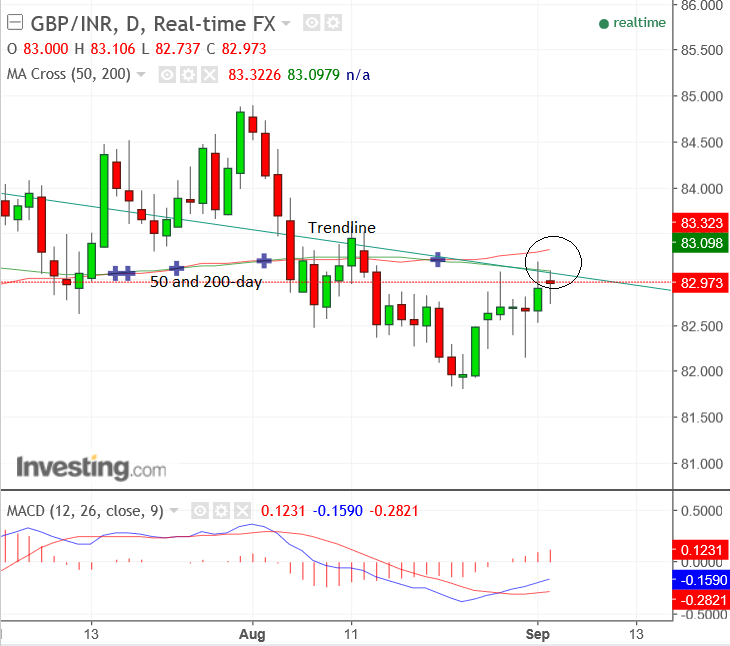

Nevertheless, from a technical point of view, the GBP/INR pair is nearing a major trendline, which could make further gains more difficult, and lead to a pull-back, since trendlines tend to act as barriers to price growth and attract 'supply' .

The 200 and 50-day moving averages (MA) are also situated just above the trendline presenting yet more obstacles to upside growth.

Moving averages are not just indicators of long-term value but also dynamic areas of support and resistance, acting as obstacles to trending prices.

It will be difficult for the GBP/INR exchange rate, therefore, to break above this triad of levels and extend higher.

With tough resistance above the pair may rotate at the trendline and start resuming its downtrend, but until we get more confirmation from price action itself it is difficult to come down on one side of price action or another.

As far as data goes, it is a set to be a quiet week for the Rupee, with only the Foreign Exchange Reserves out on Friday September 8, as of any interest.

This is because a large gain in reserves would be indicative of the central bank intervening in currency markets to try to weaken their own currency (buy using Rupees to purchase other FX).

Currently reserves are forecast to come out at 395.2bn from 394.5bn Dollars previously.

The main factors in the coming week for the Pound may be political, as the outlook for data remains rather mild, with the main release Services PMI on Tuesday morning.

On Thursday, parliament will debate the government's Brexit bill.

There is a risk the government may not be able to vote the bill through in its current form, as many opposition MP's as well as pro-

Europe MPs in their own party, want to make substantial changes to 'soften' the bill.

Recent news has focused on how a growing clique of dissenters from within the Tory party want to make sure trade links with Europe are maintained after a Brexit, and how the government is supposedly trying to use 'strong-arm' tactics to persuade them to fall into line.

This has led to rumours of dissenters planning a plot to oust Theresa May.