Indian Rupee Slated to Fall in New Post-Sintra Hawkish Era, Says HSBC's Makel

The market was surprised by the majority of leading central banker’s taking a hawkish view in Sintra.

The change seems to spell the start of a new era for central banks in which they may be beginning an upcycle from a policy cycle-low.

All the major currencies whose central bankers became more hawkish in Portugal rallied on the new rhetoric – the Euro, the Pound, and the Canadian Dollar, but equally there were also some that got left behind.

One such currency is the Rupee, which, like many emerging market currencies, seems to be at a different point in the policy cycle.

Rather than being poised to hike rates – or at least cut stimulus - the Reserve Bank of India (RBI) appears to be about to cut rates.

“Out of the currencies in Asia, we believe the INR is relatively more exposed to the risk of weakening in this current market environment. After all, talk of additional rate hikes and tapering from the G3 central banks stands in stark contrast to the RBI which looks poised to cut its policy rates at its upcoming meeting on 2 August,” said HSBC’s Paul Mackel.

The release of CPI data on July 12 could be especially important in this respect as it could be the deciding factor as to whether the RBI actually goes ahead and cuts rates or not.

For forecasters there is also the added complication of the fact that the INR does not always weaken when RBI cuts rates.

“Historically the immediate reaction of the INR to RBI rate cuts has been a mixed bag and on occasion the currency has strengthened as investors try to position for the subsequent rally in bond and equity prices.”

However, this is unlikely to be the reaction this time around as strict government quotas for foreign bond ownership have reached their limit, and equity markets may have peaked.

“This time round, however, we suspect the reaction could be different. For one, the room for further foreign bond inflows is limited with investors already nearly maximising their bond quotation,” said Mackel.

Thus, this time round a straight cut from the RBI should result in weakness for the INR.

Slowdown in Portfolio Flows

One of several major drivers of the Rupee’s appreciation has been demand from portfolio managers for Indian stocks and bonds, however, these flows are set to decline, either because they have reached their limit as in the case of bonds or because market are changing as in the case of stocks.

The loss of demand, however, regardless of the reasons, is likely to weigh on the Rupee.

Mackel says that a slow-down in Portfolio inflows could see USD/INR hit 66.00 by the end of the year – the current rate is 64.74.

“This also comes at a juncture when the outlook for foreign portfolio investment is looking less supportive and positioning in the INR market appears stretched, leaving the currency more exposed to a pullback,” noted Mackel.

A lot of foreign investment has gone into the Indian Banking stocks, due to the authorities attempts to an improved outlook for the sector after the authorities’ attempt’s to address the problem of non-performing loans, however, this has slowed recently and may be set to fall even more.

“It’s not just about debt inflows for the INR. At nearly USD8.5bn year-to-date, India has been amongst the largest recipients of equity investment in Asia. A large chunk of this (nearly USD6bn) went into the financial sector and banks as a result of the governments and the RBI’s progress in recapitalising the banking sector and attempts to address the high levels of non-performing loans,” said Mackel.

The demand for Indian equities, however, is set to slowdown unless something reinvigorates investor interest.

“But with credit growth falling to record lows and the latest GDP numbers hinting that the economy is feeling some side-effects from the government’s demonetisation scheme, increased economic activity may be needed to help reinvigorate foreigners’ equity investment that has slowed lately.”

The change of leadership at the RBI could also be a factor in the outlook for the currency, as unlike his predecessor Urjit Patel is less focused on inflation targeting and therefore more tolerant of a weaker INR.

Current Account Deficit Widening

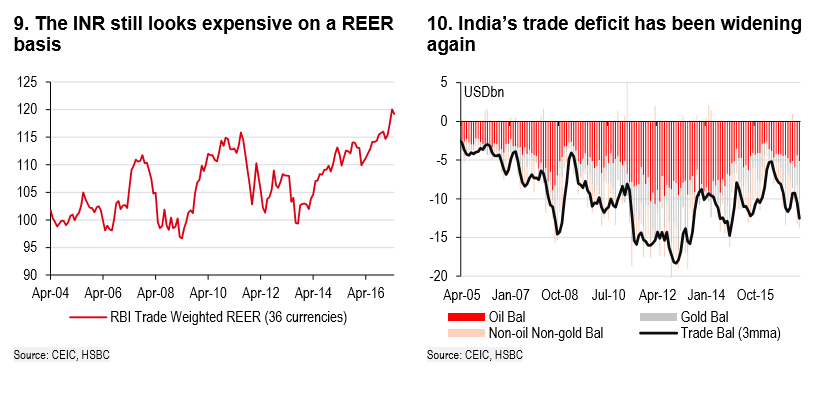

A rise in gold imports has caused the current account deficit to widen, further potentially weighing on the Ruppee.

“Another potential source of volatility for the currency is the re-widening of the current account deficit. Indeed, the trade deficit (goods) has deteriorated recently, reaching its widest levels in 30 months in May. This was primarily due to a surge in gold imports which since February have been more than doubling compared to a year ago.”

But there may be ‘technical’ reasons for the rise.

“For example, gold imports slowed during the demonetisation scheme and this may just be the subsequent bounce. Additionally, fears that the GST could slap a 5% tax on gold could have also resulted in demand ahead of its implementation (ultimately the GST rate for gold was less than expected at 3%). “

The improvement in the current account may have now passed its peak.

“It has been our view for the last few months that the best has passed for the currency: the trade balance is once again deteriorating, and the momentum in foreign direct investment is starting to slow,” said Makel.

“Portfolio flows have been a large factor behind the currency’s resilience in Q2, but moving into the second half of the year it appears that this is another factor that has ultimately passed its best. With the RBI set to lower its policy rates in August, this comes at a delicate time when major central banks are moving in the opposite direction,” added the economist.

Charts are Marginally Bearish for INR

From a technical standpoint, Makel’s fundamental analysis chimes with charts which show upside risk for the currency as GBP/INR touches range highs since October 2016.

The pair has just hit a trendline at 84.00, joining the tops of the December 2016 and January 2017 highs.

This is labelled Trendline A on the chart below.

Whilst it is possible the pair could reverse and move back down into the middle of the range the recent up move was so steep it also looks likely to continue and breakout of the top of the range.

For confirmation of a breakout we would look for a move definitively higher, signalled by a breach above the 84.63 highs.

Such a move would be expected to reach a target at 87.00, at the December highs, possible even higher, as breakouts from ranges often move at least the same distance as the height of the range at its widest point again, or at least the 61.8% of that height.

61.8% is a Fibonacci ratio which corresponds with the Golden Mean, or Golden Ratio, which governs proportions in nature and it is said in financial markets too.