Indian Rupee Supported by Stock Market but Gov Risks Becoming Liability

- Written by: James Skinner

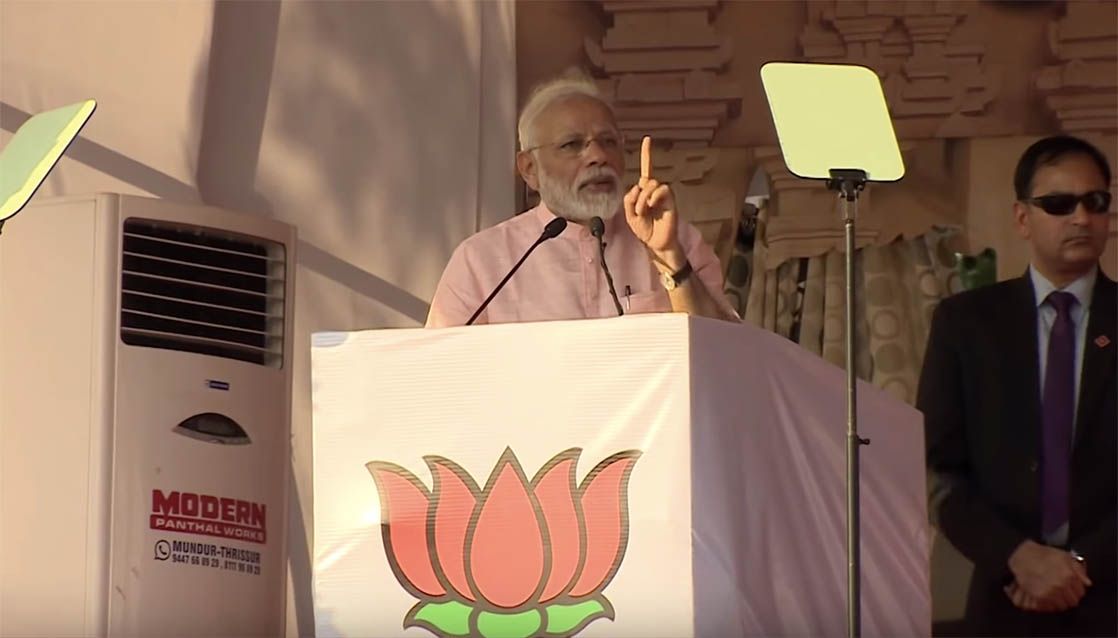

Image © Pound Sterling Live, Still Courtesy of BBC

- INR seen supported this week by stock market inflows.

- As upbeat mood dominates on U.S.-China trade progress.

- But recent Gov policy steps highlight risks ahead for INR.

- Decision to withdraw from RCEP pact "short-sighted" of Gov.

- Largest foreign investor, Vodafone, on strike over Gov policy.

The Rupee ceded ground to a stronger Dollar Tuesday but is being tipped to hold its own through the rest of the week as international flows into the domestic stock market provide an offset to any selling pressures on the Indian currency.

India's Rupee was lower on Tuesday even after the Dollar softened in response to an address from President Donald Trump to the Economic Club of New York that left markets disappointed.

There had been speculation Trump would announce a further delay of a decision on whether to impose tariffs on car imports from Europe, not to mention hope he'd provide an update on the China talks, but the President mostly set out his stall for re-election in 2020 instead.

U.S. and Chinese negotiators are attempting to finalise a 'phase one deal' said on October 11 to be in the pipeline although Trump tempered optimism over it this week by repeating in New York that he won't strike any agreement unless it's the right one. He also criticised European trade policy before saying he's working on a piece of legislation called the "Reciprocal Trade Act".

Appetite for the Rupee may have also been limited Tuesday by Vodafone, which went on strike as India's largest foreign direct investor.

"INR, as one of the high yielders in Asia, will benefit from positive developments in trade talks and better risk sentiment," says Hans Redeker, head of FX strategy at Morgan Stanley, in an earlier note to clients. "We expect near-term inflows to Indian equities to remain strong, and this is a source of support."

Morgan Stanley economists say India's September cut of the 'effective' corporate tax rate from 34.9% to 25.2% should be positive for business investment and the growth outlook even if the impact so far has been muted.

The bank has been using derivatives to bet on a fall in the USD/INR rate since mid-September in anticipation the tax cuts would bring an economic, and Rupee, recovery. The Rupee is up since then but October's PMI surveys, which measure confidence in the corporate sector, showed both manufacturing and service industries remained under pressure last month. So far the tax cuts have done little to lift the economic fog hanging over India.

Above: Pound-to-Rupee rate shown at daily intervals alongside NIFTY index of Indian stocks (orange line, left axis).

The stock market may be able to keep the Rupee propped up this week but an Indian economic recovery will be necessary if it's to remain afloat beyond the short-term and with progress toward de-escalating the trade war aside, the newsflow on that score has been decidedly downbeat of late.

"The recent moaning from New Delhi, however, over the Regional Comprehensive Economic Partnership—or RCEP—risks further dampening business confidence and delaying the recovery," says Freya Beamish, chief Asia economist at Pantheon Macroeconomics.

India's government pulled out of the Regional Comprehensive Economic Partnership (RCEP) last week just as its 16 signatories were preparing to draw a seven year period of negotiations to a close. The government is alleged to have made additional demands of the other countries involved at the very last minute just days after Prime Minister Narendra Modi was reported to have told their national leaders the pact is not in "the interest of Indians".

The RCEP has sought to merge the ten member Association of South East Asian Nations trade accord with China, Japan, Korea, India, Australia and New Zealand for seven years. The agreement reduces tariff and non-tariff barriers, its signatories say, which could lead to lower prices for consumers further down the line, more exports for some countries and greater market opportunity for all.

Above: USD/INR rate shown alongside NIFTY index of Indian stocks (orange line, left axis).

"India's withdrawal is short-sighted, bringing back to the fore long-held concerns over its protectionist inclinations. Fortunately, the government's push to include safeguards, such as an automatic trigger mechanism to shield against sudden surges in imports—namely from China—looks to have faltered. Such provisions run fundamentally counter to the goal of trade liberalisation and would have muted the impact of the deal," Beamish says.

Businesses and financial markets tend not to look very fondly upon governments and national leaders who've 'protectionist' instincts so Modi's decision to withdraw from the RCEP is a blow to his sometimes-contested but generally good economic credentials. It's also likely done little to instill confidence in would-be international buyers of the Rupee.

The RECEP story has unfolded in the press just as India's largest foreign direct investor, Vodafone, was preparing to go on strike in the country.

Vodafone, which owns 45.1% of India's largest mobile telecoms firm Vodafone Idea, suggested Tuesday it hold off on any further investments in the country until it gets a satisfactory resolution to a dispute over license and regulatory fees that's raged for years between the telecoms industry and government.

The financial cost of the dispute has become crippling since October when the Supreme Court found against the industry, leaving firms on the hook for significant penalties and pushing Vodafone Group to a first-half loss of €1.9 bn.

Above: USD/INR rate shown alongside Vodafone Idea share price (orange line, left axis).

"Vodafone Idea is now liable for very substantial demands made by the Department of Telecommunications in relation to these fees. We are actively engaging with the government to seek financial relief for Vodafone Idea," Vodafone says. "Significant uncertainties exist in relation to VIL's ability to generate the cash flow that it needs to settle, or refinance its liabilities and guarantees as they fall due, including those relating to the AGR judgement. VIL is seeking relief from the Indian Government."

Vodafone has now written the balance sheet value of its investment in the Indian company down to nil and the group's chief executive said Tuesday it will not put any further capital into the country until the issue is resolved with the government. Vodafone has long been a significant investor in India so Tuesday's developments coming hard on the heels of the RCEP decision, might risk denting the market's appetite for the Rupee in the months ahead. Perceptions of the government's economic credentials are certainly at stake.

The rift between the government and India's largest investor comes at a inconvenient time for the economy, which is competing with others in Asia for business that's fleeing China in light of risks posed to supply chains there by U.S. trade policy. India was said Tuesday to have done well out of the exodus so far but perceptions of the government's approach to investors will matter in decision making processes that are yet to be undergone.

"China is bearing the brunt of the trade war, according to panellists at the UBS European Conference. China relies more on trade from the US than the other way round. The cumulative impact on China's GDP has been 100bp. Companies are moving their supply chains out of China with many moving to South East Asia and India," says Tricia Wright, an editor at UBS Knowledge Network, from the bank's European Conference gathering of CEOs.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement