Indian Rupee Takes Fifth RBI Interest Rate Cut in its Stride but There's More on the Way, Analysts Say

- Written by: James Skinner

Images © G20, Accessed Flickr, Creative Commons Licensing

- INR steady against GBP and USD after RBI's fifth interest rate cut.

- RBI cuts cash rate to 5.15% and slashes economic growth forecasts.

- Inflation under control but policymakers fretting about growth outlook.

- Commerzbank and ING say one more cut is likely before year-end.

The Indian Rupee was steady against the Pound and Dollar Friday after taking a fifth interest rate cut from the Reserve Bank of India (RBI) in its stride but analysts say there are more cuts on the way, while the prospects of the currency are uncertain due to the decelerating global economy.

India's central bank announced 25 basis point cut to the cash rate Friday, taking it down from 5.4% to 5.15%, after recent events forced a downgrade of its economic forecasts. The bank says that inflation is under control and the economy in need of support.

"There were some expectations for a bigger cut following the unconventional 35 bps last time, but governor Das argued in the press conference that the 25 bps should be seen as an addition to the 110 bps that were already delivered this year," says Inge Klaver, an economist at Nordea Markets.

Friday's decision follows a 35 basis point cut in August and is the fifth reduction of Indian interest rates this year although there's uncertainty over the likely size of the RBI's future incremental changes to the cash rate.

Above: Pound-to-Rupee rate shown at daily intervals.

"The pop up in bond yields suggests the bond market was probably hoping for a larger cut but the FX market was content with the cut, with USD-INR largely unchanged around 70.90," says Charlie Lay, an analyst at Commerzbank. "We see another 25bp in the final meeting this year in December."

Markets care about the Reserve Bank decision because changes in interest rates, as well as the outlook for them, can have a significant influence over international capital flows as well as speculative short-term trading activity. Capital flows tend to move in the direction of the most advantageous or improving returns, with a threat of lower rates normally seeing investors driven out of and deterred away from a currency. Rising rates have the opposite effect.

The RBI noted Friday that despite previously having cut the cash rate by 110 basis points this year, the weighted-average-lending-rate for new Rupee loans had fallen by just 29 basis points by the end of August. And the the lending rate for outstanding, or old, Rupee loans had actually risen by 7 basis points.

Rate changes are supposed to influence both demand and inflation, but they can't do that if banks don't pass them on to customer in full. The bank has repeatedly expressed concern about the "transmission" of rate cuts into the economy, although it remains to be determined if the 35 basis point cut from August will ever be repeated.

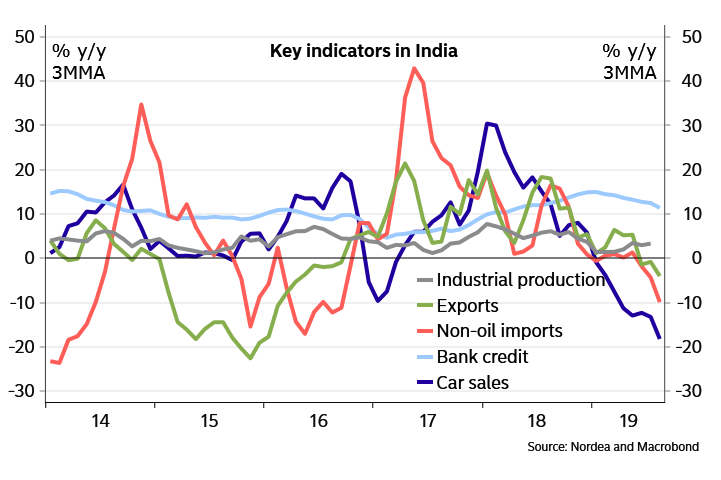

Above: Nordea Markets graph showing Indian economic indicators.

Governor Shaktikanta Das had hinted at an International Monetary Fund conference in April that the RBI could consider interest rate changes of an unvonventional size, and it announced an unconventional rate cut in August, only to revert to cutting by 25 basis points this month. Commerzbank's Lay forecasts the bank will cut its interest rate again this year, by a total of 50 basis points, leaving the cash rate at 4.9%

"We have argued before that the transmission to bank lending rates is weak, limiting the effects of rate cuts so far," says Nordea's Klaver. "Slowing growth prospects remain the top priority of the central bank, as real GDP growth slid to a six-year low of 5% y/y in the June quarter. The slowdown can mostly be attributed to the manufacturing and construction sectors. Household spending growth slowed down to 3.1% from 7.2% in Q1."

The RBI cut its growth forecast for 2019-20 from 6.9% to 6.1% on Friday, saying that "high frequency indicators" had suggested to it that demand remains weak. India's economy is under strain from a global slowdown that's effecting external demand, as well as rising resource prices that risk stoking inflation and crimping consumer spending. Inflation is running at 3.2% thus far in the quarter, below the target of 4% plus or minus 2% in either direction.

However, India's slowdown is not happening in isolation because the entire global economy is in retreat, with even the previously-immune U.S. now appearing to succumb to impact that President Donald Trump's trade war has had on manufacturing sectors the world over. International trade volumes have declined in the last eighteen months and manufacturing sectors the world over have wallowed in recession for months, but that downturn now looks to be spreading into services sectors.

Above: USD/INR rate shown at daily intervals.

"The FX market is seemingly pricing in the familiar scenario of sluggish growth, benign inflation, and further albeit modest cuts. We continue to look for a slightly higher USD-INR by year-end to 72.00," says Commerzbank's Lay. "Heading into year-end, the bigger global picture is likely to remain the key driver for USD-INR. A more cautious risk backdrop could see reduced net portfolio inflows to INR assets and in turn provide a supportive tone for USD-INR."

The Rupee might find itself supported if recent events lead the Federal Reserve (Fed) to become more aggressive, or punctual, with its own interest rate cuts, which could happen given the dire news from the U.S. this week. The ISM manufacturing PMI surprised on the downside Tuesday when it fell to decade low for the month of September, with most components of the survey helping to paint a picture of a U.S. economy that is now being bitten by the trade war.

The ISM services PMI followed suit Thursday, posting an even larger drop than was seen in manufacturing. Taken together, both suggest the U.S. economy might be headed for the rocks, which could soon mean much lower U.S. interest rates and an end to the international bond market pressures that lifted the USD/INR rate to record highs in 2018 and sent the Rupee to record lows.

"Today's RBI policy adjustment should have little-to-no market impact. Yet, there is no end in sight to the unfriendly policy backdrop for the Indian rupee (INR) as at least one more 25bp rate cut looks more certain than not at the next RBI meeting in December. We maintain our end-2019 USD/INR forecast at 73.50. Government bonds have been under selling pressure from a worsening fiscal deficit. Lower interest rates should be some relief to that market, though it's unlikely to be a lasting one," says Prakash Sakpal, an economist at ING.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement