Pound-Rupee Outlook: Break Required to Confirm Trend, RBI Decision Looms

The RBI's Shaktikanta Das. Images © G20, Accessed Flickr, Creative Commons Licensing

- GBP/INR at crossroads

- Break higher or lower required for confirmation

- Rupee to me moved by central bank meeting

The Pound-to-Rupee exchange rate is trading at around 87.44 at the time of writing after rebounding 0.96% this week so far, although in the week before the pair fell a substantial 2.46%.

Charts suggest GBP/INR has reached a crossroads and could go in either direction depending on confirmation.

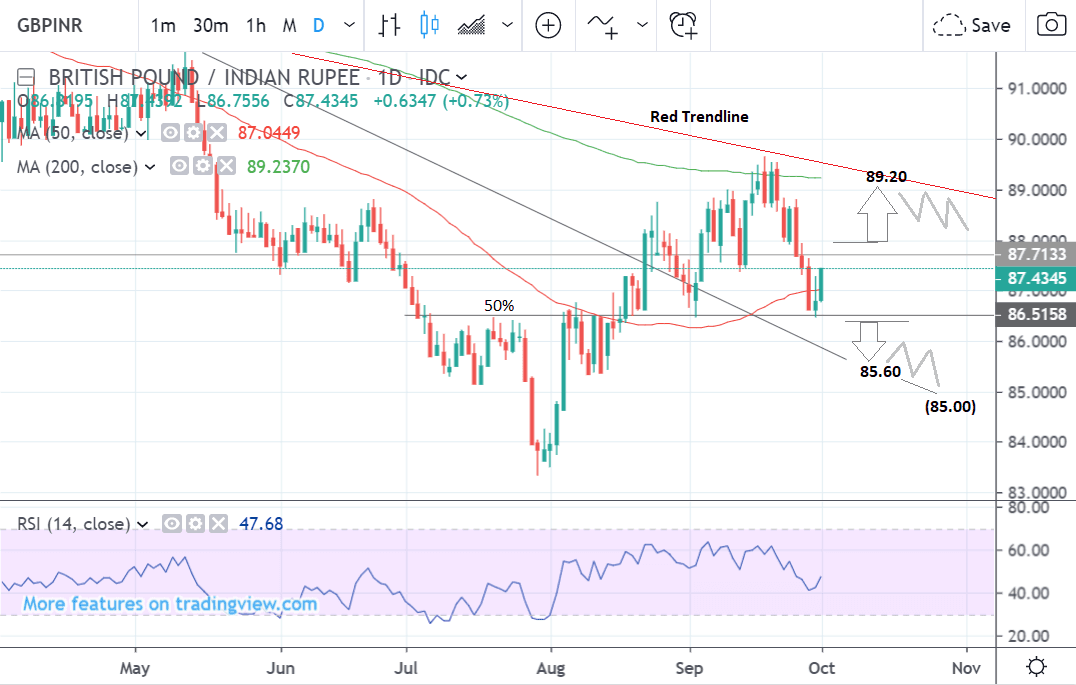

The 4hr chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows the pair having fallen to the 50% retracement level of the previous rally which is often considered a key support level.

It is quite possible it could bounce from here and resume the uptrend which began at the July 30 lows.

The pair has already bounced and started to go higher over the last few sessions and this could be the start of a stronger recovery.

The bounce has been accompanied by steep rising momentum according to the RSI indicator in the lower pane (circled) and this is supportive.

A break above 88.00 would give the green-light to a stronger bullish extension up to resistance at 89.10.

Alternatively, it is also possible the pair could go lower, and a break below the 86.35 level would provide bearish confirmation for a move down to 85.75 at the level of an old trendline.

The daily chart paints a similar picture: the pair has pulled back to the 50% retracement level of the previous rally in August and most of September.

The question is, will it recover from this key support level or will it carry on selling off?

If it recovers and manages to break above 88.00 it will probably go further, rising up to resistance at the ‘red trendline’ at 89.20 and then probably consolidate beneath this trendline.

If it continues to decline, on the other hand, and successfully breaks below the 86.35 level, it will probably continue down to a target at 85.60 initially and then 85.00.

The daily chart is used to give us an indication of the outlook for the medium-term, defined as the next week to a month ahead.

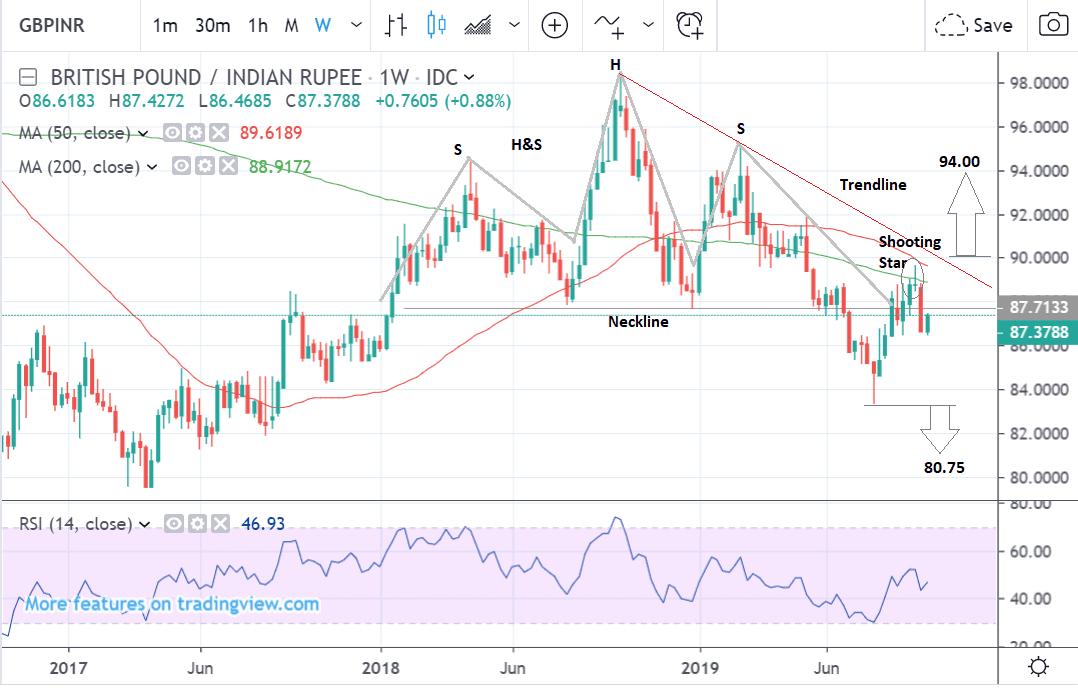

The weekly chart is looking quite bearish for several reasons.

Firstly the pair has formed a head and shoulders (H&S) bearish reversal pattern at the highs, and this pattern has still not reached its full potential downside target at 80.75.

A break back below the July 30 lows could still see a continuation down to the 80.75 target.

The pair would have to break above the red trendline to cancel the H&S.

Such a break would turn the tables and generate an upside target of 94.00 in the long-term.

The bearish ‘shooting star’ Japanese candlestick pattern which formed at the high two weeks ago has been followed by a long bearish down-week which confirms the original signal and indicates more probable downside on the horizon.

The weekly chart is used to give us an indication of the outlook for the long-term, defined as the next few months.

The Rupee: RBI Dominates the Outlook

The main event for the Indian Rupee on the horizon is the Reserve Bank of India (RBI) policy meeting on Friday, October 4.

The RBI is widely expected to cut interest rates at the meeting, scheduled for 7.15 BST, and this should keep the pressure on the Rupee.

“The RBI will declare its policy decision on 4 October amid widespread expectations that it will cut rates for a fifth consecutive time this week to provide added stimulus to India’s economic recovery,” says Jon Harrison, an analyst at TS Lombard.

Lower interest rates reduce foreign capital inflows and are often indicative of lower growth - both factors which are negative for the currency.

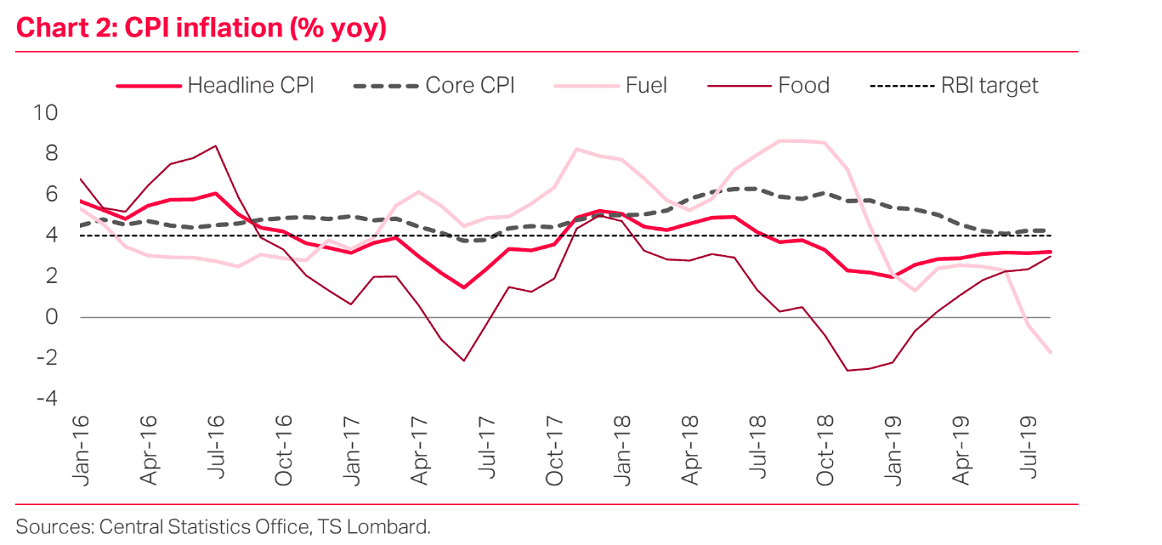

Signs of recovering inflation mean it is possible the RBI could make one more final interest rate cut before ending their easing cycle, according to Harrison.

“The RBI’s policy statement this week will be keenly watched for future monetary action as the central bank is now losing room for further manoeuvre given the fiscal worries as well as rising inflation,” says the Harrison.

One factor which could lead the RBI to question whether it should continue aggressively cutting interest rates is high food inflation.

Inflation is especially acute for onion prices which are a staple of the Indian diet and if this continues it is likely to increase pressure on the RBI to raise interest rates higher again.

Although Harrison sees the RBI cutting its base interest rate down from the current 5.4% to 5.0% eventually there is a risk of the statement revealing increasing caution, which would support the Rupee.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement