Pound-Rupee Exchange Rate Breaks Back Above Neckline

Image © Adobe Images

- GBP/INR reverses and establishes new uptrend

- Move higher tipped to continue in short-term

- Rupee to be driven by risk trends and GDP data

The Pound-to-Rupee exchange rate is trading at around 87.67 at the time of writing after falling 0.56% so far since the start of the week.

Despite the declines, our latest studies of the charts continue to suggest the exchange rate is biased to extend its rise over the short-term.

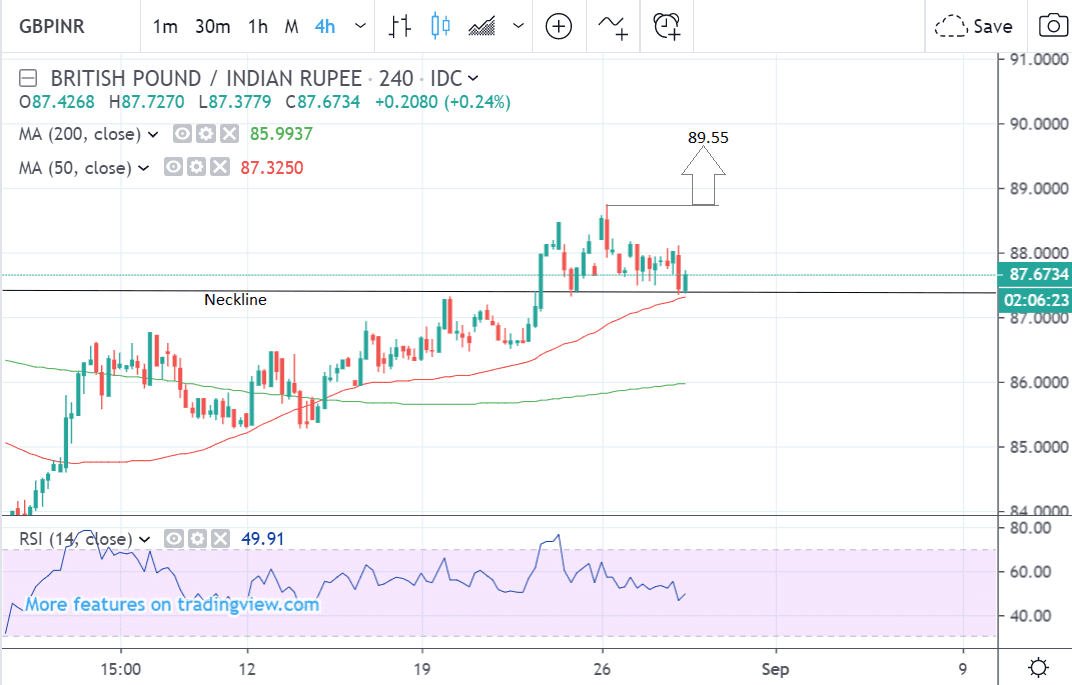

The 4hr chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows the pair continuing to rise after having undergone a strong reversal at the July 30 lows.

Another bullish sign is that it has also now broken clearly above the neckline of a large bearish price pattern which has formed at the highs and is clearly visible on the weekly chart (see below).

A break above the 88.75 August 26 highs would probably confirm a continuation higher to the next upside target at 89.55.

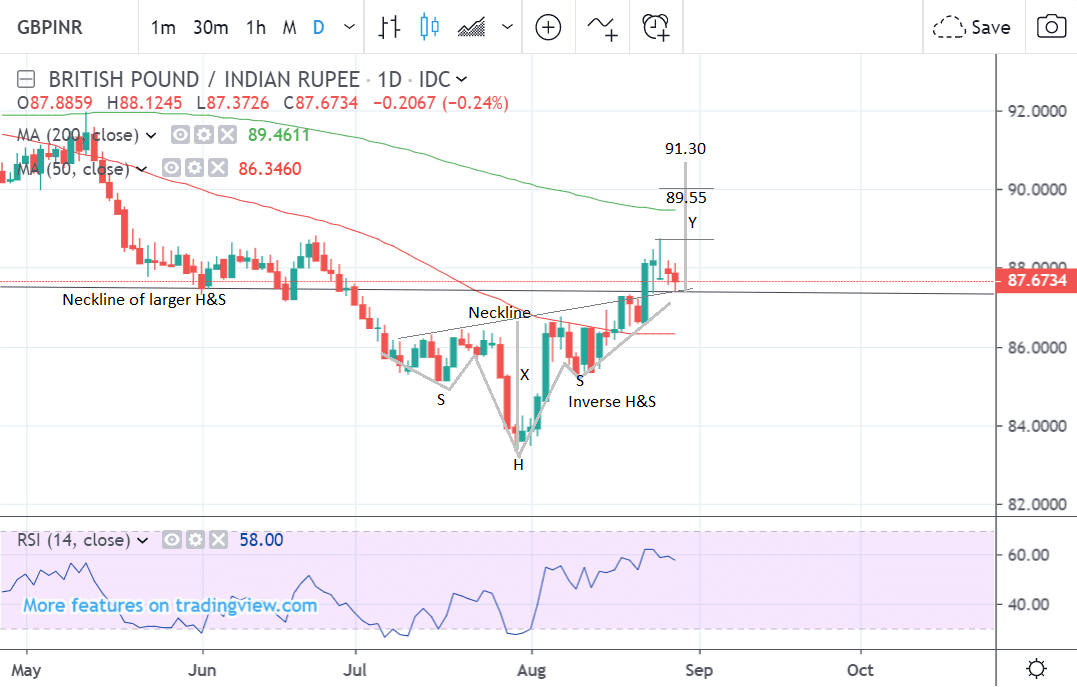

The daily chart shows the pair rising after having broken out of a bullish inverse head and shoulders (H&S) reversal pattern.

The breakout above the neckline suggests a follow-through higher of a similar height as the pattern itself, which would indicate a move up to an upside target of 89.55 initially, where the 200-day Moving Average (MA) is situated, followed by 91.30.

Inverse H&Ss look like upside-down ‘head and shoulders’ and are composed of a deep trough (the head) and two shallower troughs either side (the shoulders).

The daily chart is used to give us an indication of the outlook for the medium-term, defined as the next week to a month ahead.

The weekly chart - which is used to give us an indication of the outlook for the long-term, defined as the next few months - shows the pair having made quite a substantial recovery after bottoming in July.

The recovery has taken it back above the neckline of the bearish H&S pattern which is a bullish sign and strengthens the case the pair may have reversed the previous downtrend.

For really strong confirmation of a reversal of the trend from down to up, we would ideally like to see a break above the red trendline joining the top of the peak of the pattern (the head) and the right shoulder.

Such a break higher would probably lead to a continuation up to a target at 94.00.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Rupee: Key Drivers to Watch

The main factors influencing the Rupee on the horizon are trade war dynamic and their impact on risk sentiment, the strength of the U.S. Dollar, and Indian GDP data out on Friday.

On the trade war front, both the U.S. and China threatened to increase the rate and scope of existing tariffs last week. President Trump then suggested talks had improved over the weekend at the G7. This was then disputed by the Chinese who said there had been no significant breakthroughs.

Markets await the next twist and turn. Any further worsening of the trade war would be expected to weigh on the Rupee.

Risk appetite may get a small boost from a resolution of the Italian political situation. Commentators say there is a good chance M5S and the democratic party will eventually announce a new coalition deal. If so this should help global risk appetite at least marginally.

Brexit remains a highly uncertain event with opposition forces currently gathering to thwart a potential ‘no-deal’ Brexit and Boris Johnson reportedly preparing to call on the Queen to prorogue Parliament (meaning close it down) so he can decide Brexit without the interference of the commons.

The U.S. Dollar continues to trade quite robustly despite ‘negative treasury yields’ which would normally be expected to weigh on the currency. This may be because of relatively strong consumer confidence data which beat expectations on Tuesday. Regardless, a strong Dollar is likely to weigh on the Rupee and other emerging market currencies.

“The strong dollar undermines world trade, damages the balance sheets of international USD debtors, restricts cross-border lending and spreads ‘secular stagnation’ around the globe,” says Dario Perkins, an analyst at TS Lombard.

The need for a weaker Dollar may have prompted French president Macron to suggest the currency should ‘share’ its global reserve currency status more equally with the other major currencies.

If implemented, such an initiative would weaken the greenback yet it seems far from likely. Such a move would make the U.S. look weak, making it difficult to promote politically.

In the short-term, U.S. Personal Consumption Expenditure (PCE) data out on Friday could impact on the U.S. Dollar and therefore the Rupee.

PCE is the favoured gauge of inflation for the Federal Reserve, which sets interest rates in the U.S. to which the Dollar is highly sensitive.

An unexpected rise in PCE would likely push back expectations of rate cuts in September and support the Dollar; a fall in PCE would cause the opposite.

On the domestic front, Indian GDP data is expected to show a 5.7% rate of growth in the second quarter when it is released on Friday, at 13.00 BST.

This would represent a decline from the 5.8% registered in Q4 and a continuation of the downtrend in data since the peak in August 2018.

A higher than expected reading should be taken as positive for the Rupee, while a lower than expected reading should be taken as negative for the Rupee.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement