The Indian Rupee is at Risk of Depreciation after Surprise RBI Rate Cut

- Written by: James Skinner

© Adobe Stock

- INR resilient after surprise RBI interest rate cut to 6.25%.

- But INR at risk of depreciation as RBI credibility in question.

- Further cuts may also be likely later in 2019 say economists.

The Rupee was resilient Thursday even after the Reserve Bank of India (RBI) took the market by surprise with a cut to the official interest rate.

India's currency is now at risk of depreciation as a result of the move, according to economists, because the central bank's credibility is now under threat and further cuts could be likely in the months ahead.

New governor Shaktikanta Das and fellow policymakers cut the cash rate from 6.5% to 6.25% at what was Das' first meeting as head of the bank, when markets had looked for only a hint that a cut could be in the cards.

The bank also changed its monetary policy stance to "neutral" from the "calibrated tightening" that was adopted under previous governor Urjit Patel, who left the bank late last year following a dispute with the government over financial regulation and monetary policy.

"We think the markets will view such a policy move as premature and the rupee will be the main victim," warns Prakash Sakpal, an economist at ING Group. "Lower domestic rates will sustain the INR's underperformance throughout 2019. We maintain our view of the USD/INR rate re-testing 73."

Above: USD/INR rate shown at daily intervals.

The RBI told markets that a steep fall in the headline rate of inflation during recent months justified the bank's decision to cut interest rates, but economists have rejected that idea because of resilience seen in core inflation, which they say is a more reliable measure of price pressures.

Indian inflaion fell from 3.7% to just 2.2% between September and December of 2018, but once volatile food and energy prices are excluded from the goods basket inflation was actually much higher at 5.6% at year-end.

The Reserve Bank is obligated to use monetary policy to ensure inflation remains in line with the official target, which is to keep the consumer price index at 4%, plus or minus a 2% dreviation on either side of that level.

"Core inflation is a better gauge of where headline inflation is likely to be in a few months’ time," says Mark Williams, chief Asia economist at Capital Economics. "Core inflation (excluding food and fuel) stood at 5.6% in December. Inflation expectations also remain high."

The USD/INR rate was quoted -0.20% lower at 71.38 Thursday, denoting a Rupee that was stronger even in the face of a buoyant greenback, while the Pound-to-Rupee rate was down -0.46% at 92.09.

Above: Pound-to-Rupee rate shown at daily intervals.

"Shaktikanta Das has closer ties with the government. This leaves room for speculation about whether the rate cut, a welcome move ahead of the general election in May, was inspired by the government’s wish," says Amy Zhuang, an analyst at Nordea Markets.

Zhuang flags that inflation has only fallen because of a decline in food prices, which are highly volatile on a month-to-month basis, and that this move could be easily reversed during the months ahead. That might then see headline and core inflation threaten the upper end of the RBI's target band again this year.

Nordea's Zhuang, ING's Sakpal and Capital Economics' Williams all say Indian inflation will rise notably in 2019 of its own accord, although Thursday's rate cut and a mammoth government spending plan announced in the budget last week mean prices may rise faster than previously thought.

Governor Das said Thursday that a "neutral" monetary policy stance gives the RBI "flexibility" in dealing with future inflation developments. Technically such a statement does not rule out a reversal of Thursday's cut at a later date, although economists are divided in their outlook for RBI policy.

"Now that elections are just around the corner, we aren’t expecting the RBI to move policy again this year. However, as inflation accelerates above 5%, the tightening pressure will return. We believe the next RBI policy will be a 25 basis point tightening by the end of FY2020," says ING's Sakpal.

Capital Economics' Williams is forecasting another two cuts from the RBI this year, which would leave the cash rate at a multi-year low of 5.75%, given the headline rate of inflation, a slowing economy and election just months away.

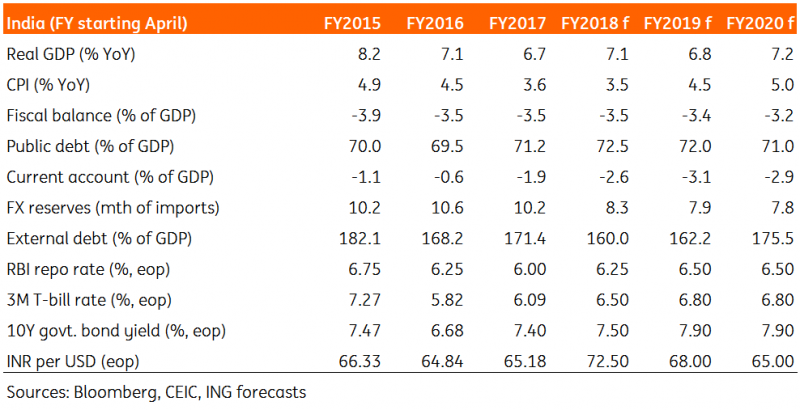

Above: ING Economics forecasts for India.

Thursday's decision follows a conflict between the RBI and government of India late last year, which saw finance ministry officials pressure the bank for a higher dividend to be paid to the Treasury and for it to abandon other efforts aimed at addressing the growing pile of toxic debt in the banking sector.

Political pressure on the RBI is widely believed to have been geared at securing monetary support for the economy ahead of 2019's election and helping the government to plug a larger-than-expected hole in its budget that has resulted from increased subsidies paid out to rural farmers in recent quarters.

But political pressure has stoked concern in the market about the independence of the bank, which is seen as an essential tool for keeping inflation under control and maintaining financial stability.

The Turkish Lira crisis of 2018, which saw the Lira fall by 60% at one point, how markets can respond to compromised central banks.

"The RBI’s new governor Shaktikanta Das has delivered what the Modi government was hoping for," says Williams at Capital Economics. "Mr Das has proved more amenable to the government’s wishes than his predecessor in other ways too. For example, he wasted little time after his appointment in easing the lending restrictions that had been imposed on some of the worst-performing local banks."

Williams says Thursday's decision from the RBI could have long-term consequences for India in that it will harm confidence in the RBI's ability to control inflation, leading to higher inflation expectations and increased prices over the longer term. That in turn means higher interest rates and, potentially, slower economic growth.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement