Pound Sterling's Undervaluation Becomes More Stark as ONS Announce Surprise Improvement in U.K. Trade Decifit

- Written by: James Skinner

- Pound Sterling is deeply undervalued say BofAML

- Surprise improvement in UK's trade deficit could underpin GBP

- But Brexit and interest rate uncertainty stymy gains in short-term

© Fresh Idea, Adobe Stock

Pound Sterling is still trading at a steep discount to "fair value", according to strategists at Bank of America Merrill Lynch, who argue that improving UK economic fundamentals mean the British currency is well positioned for a rebound to higher levels over the longer term.

A Bank Rate that remains close to a record low as well as political and economic uncertainty relating to Brexit have kept the Pound undervalued relative to many of its developed world peers. But while markets have been fretting over the uncertainties of Brexit and the Bank of England has flip-flopped on the question of interest rates, UK economic fundamentals have been improving.

This has implications for the "fair value" and likely trajectory of Pound Sterling over the medium term and has got strategists at Bank of America waiting for another opportunity to buy the British currency.

"Whilst the recent focus has been on the cyclical drivers which have supported GBP, we think markets have largely ignored the improvement in both the internal and external UK balances. We think this is topical given the increasing market focus on the deterioration in the US fiscal and current account situation (the dual deficit)," says Kamal Sharma, an FX strategist at Bank of America Merrill Lynch.

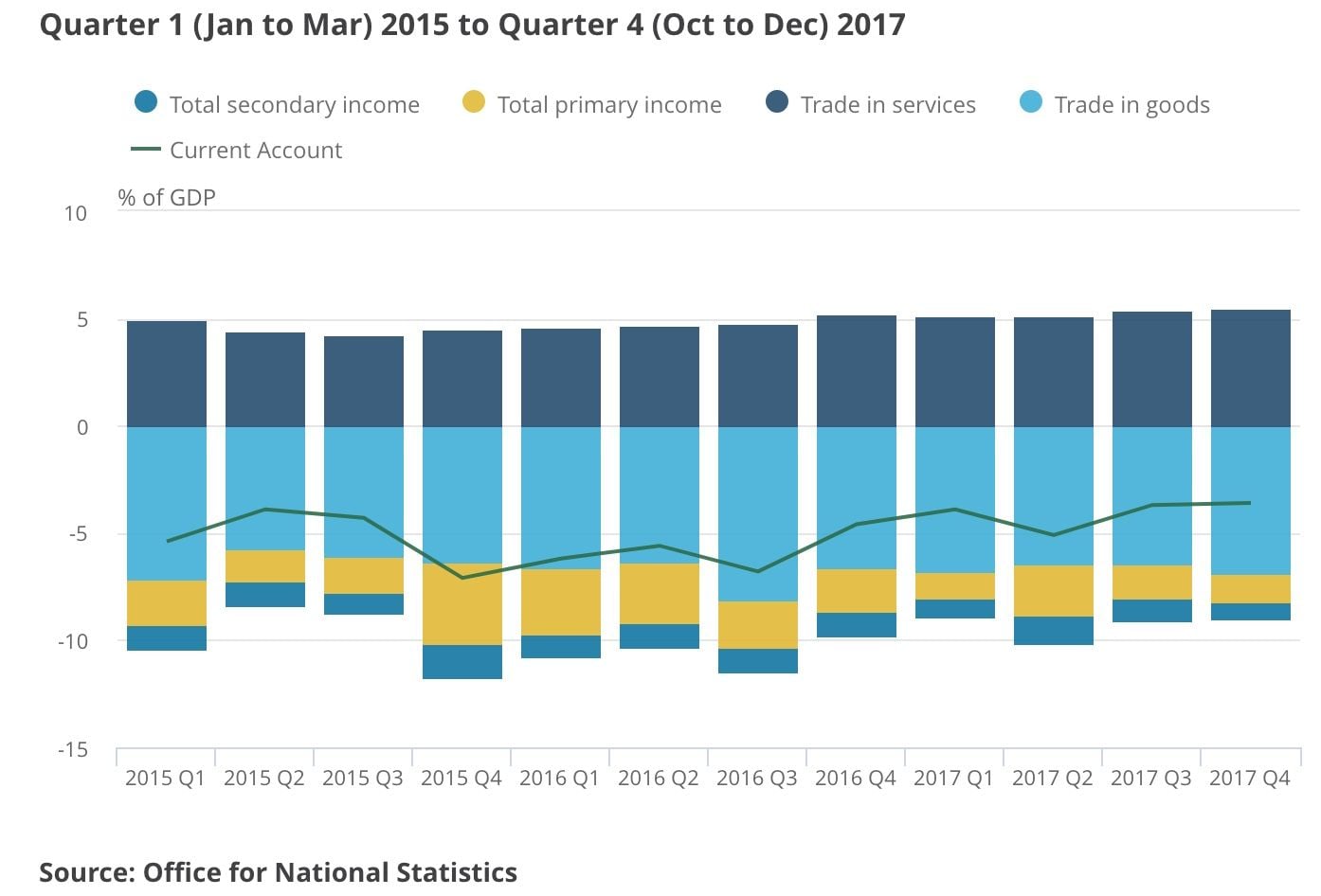

The UK current account deficit fell to its lowest level since 2011 during 2017, coming in at £82.9 billion or 4.1% of GDP, as UK earnings from overseas assets rose during the year and UK government payments to the EU and spending on foreign aid were a fraction lower. This is a marked improvement on the +6% of GDP deficit that was seen in 2015.

Markets care about current account deficits, as has been highlighted by the weakness of the US Dollar between January and April 2018. The greenback fell sharply earlier in 2018 as investors panicked about the implications of President Donald Trump's budget-busting tax cuts that are set to raise the budget and current account deficits.

The current account is a measure of imports and exports of goods and services, payments to foreign holders of a country's investments and payments received from investments abroad.

When the current account is in deficit the implication is that more money is flowing out of the country than coming in, which places downward pressure on the exchange rate UNLESS there is a strong inflow of foreign investments to balance the country's books.

This inflow of investor money is the "the kindness of strangers" Bank of England Governor Mark Carney once referred to when describing how important it was for the UK to remain an attractive investment destination.

The trade balance, exports minus imports, is typically the biggest determinant of the current account surplus or deficit, and for the UK it is a reliance on imports that tends to keep the trade balance and current account in deficit.

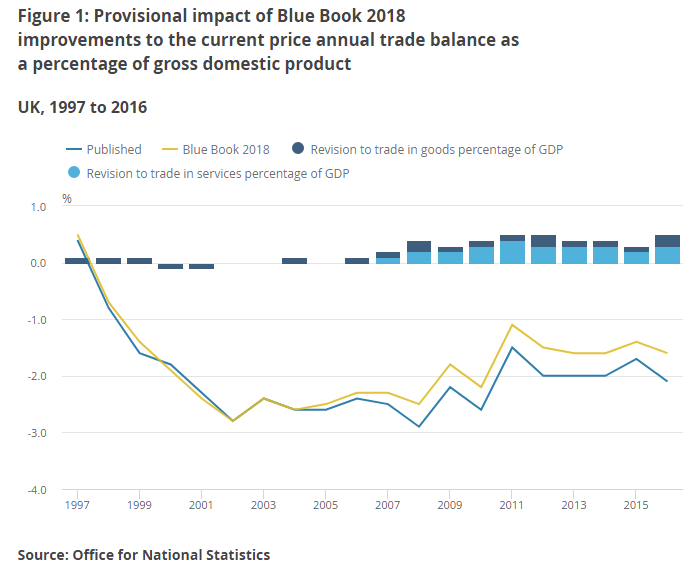

But, data released Tuesday showed the 2016 UK trade deficit was just -£30.9BN or 1.6% of GDP. This is almost £10BN lower than previously thought, with earlier estimates suggesting the deficit was in fact 2.1% of GDP.

The ONS report the improvement was because of a change in the estimate of trading margins at banks and financial institutions that identified more financial service exports.

In short, the UK's trade balance, and by extension its current account balance might be in a healthier-than-expected position, which in turn minimises the 'reliance on strangers' which in turn suggests the Sterling's fundamental underpinnings might be more robust than previously envisaged.

"The current account deficit has already shrunk from over 6% GDP to 4%. Keep this up and maybe we’ll have a trade surplus with the EU before we leave," says Kit Juckes, an analyst with Société Générale.

Above: ONS figures showing previous and revised UK Trade Balance.

"With investors focused on the issue of fiscal and external balances, our analysis shows that the combined UK fiscal and current account balance is likely to improve the most in G10 through 2018/2018," Sharma adds. "All this against the backdrop of a still undervalued currency."

Government borrowing also fell to its lowest level since the financial year ending March 2007, which produced the first "current budget surplus" since 2002. In other words, if public sector investment was removed from the equation, the British government will have ran an actual budget surplus last year.

So all of this should augur for a stronger Sterling - all else being equal - only it hasn't thus far as the Pound has recently erased a near 5% gain over the Dollar and much of a 2.5% profit over the Euro.

Above: Pound-to-Dollar rate shown at daily intervals.

This reversal has left the British currency sitting more or less where it was at the beginning of the year relative to the Dollar and Euro.

Above: Pound-to-Euro rate shown at daily intervals.

Sterling's ill fortune followed a month long period where UK inflation was shown falling faster than anybody expected while economic growth slowed more than almost all economists had forecast during the first quarter of the year. This saw currency traders flip from betting a Bank of England interest rate rise was a near certainty this month to betting, with near certainty, the BoE will now just sit on its hands.

"The intervention from BoE Governor Carney followed by a soft Q1 GDP report have undoubtedly changed the narrative around GBP in the near-term and we believe that sterling remains vulnerable to further weakness. Our decision to close our [GBPUSD] long at 1.4370 has been vindicated by the subsequent price action and for now, our only remaining GBP long is via higher GBP/CHF which was one of our trades of the year," Sharma writes, in a recent note.

Despite Sterling's improving economic fundamentals Sharma and the BAML FX team are minded to avoid buying the Pound until the Bank of England has opined on recent poor economic data and markets are able to assess whether the first-quarter slowdown was simply a one-off event or if it marked the beginning of something more serious. They also flag political uncertainty as another impediment to their backing their backing the currency in the short-term.

"We think the political headwinds for GBP are also mounting as the UK government struggles to find an internal consensus on its future trading relationship with the EU ahead of the 28th June EU Summit. With media reports suggesting discord within the cabinet and backbench MP's also at odds with the government over plans for a customs partnership, we believe that the natural consequence of political and macro uncertainty is higher implied volatility," Sharma writes.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

GBP: Short term Pain, Long term Gain?

Brexit negotiators have only until the October 2018 European Council summit to agree on the future trading relationship between the UK and European Union as any eventual deal will need to be ratified in all parliaments across the EU before it can come into effect.

That process has to be complete before the UK's March 2019 exit date although, given disagreements between UK and European negotiators as well as internal divisions within the UK government, the waters around the trajectory and likely outcome of the talks have become muddier of late.

This has given rise to fresh uncertainty and may see the Pound come under increased pressure during the months ahead. But there may also be a silver lining for in this particular cloud that could boost Sterling over the medium-term.

"With the Labour Party committing itself to voting to stay in the customs union as well the recent House of Lords amendment to the EU Withdrawal Bill to stay in the CU and for Parliament to have a meaningful vote on the final Brexit deal, we feel the institutional constraints to a "cliff-edge" scenario continue to build," Sharma notes.

As the customs union is a cornerstone of the European Union itself, the subject of continued membership has proven a focal point for advocates and opponents of Brexit of late, leading to renewed fears over the stability of Prime Minister Theresa May's leadership.

The ideological divisions over customs union membeship are deep enough that members of both the ruling Conservative Party and parliamentary opposition have acted together in attempts to prevent the government from withdrawing the UK from the bloc.

Irrespective of anything else this means, it may eventually prove a blessing for Sterling as economists have always said an exit from the EU customs union and single market would be damaging for the UK economy, which led markets to price UK assets and the Pound accordingly ever since the referendum of June 2016.

If divisions within government ultimately hinder a complete exit from the EU then this could prove to be the catalyst for Pound Sterling to correct its undervaluation relative to other developed world currencies on a longer-term basis.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.