British Pound is Month's Best Performer and "Further Gains in the Near-Term" Seen Against Euro and US Dollar

- MUFG say near-term gains likely to run further, cite traditional April outperformance

- Credit Suisse say buy dips in the Pound

- But ANZ analysis shows GBP to be capped vs. the Euro

- Pound-to-Euro exchange rate @ 1.1416, Pound-to-Dollar exchange rate @ 1.4068

Image © Adobe Stock

Pound Sterling is February's best-performing major currency, and as we head into April we question whether the good run can extend into another month.

There is some debate on whether Sterling can extend higher, but we do find there to be a consensus that the currency is likely to be protected from any significant weakness over coming weeks.

Sterling strength has been a feature of markets of late, and on momentum alone there is good reason to back the currency; afterall, 'the trend is your friend'.

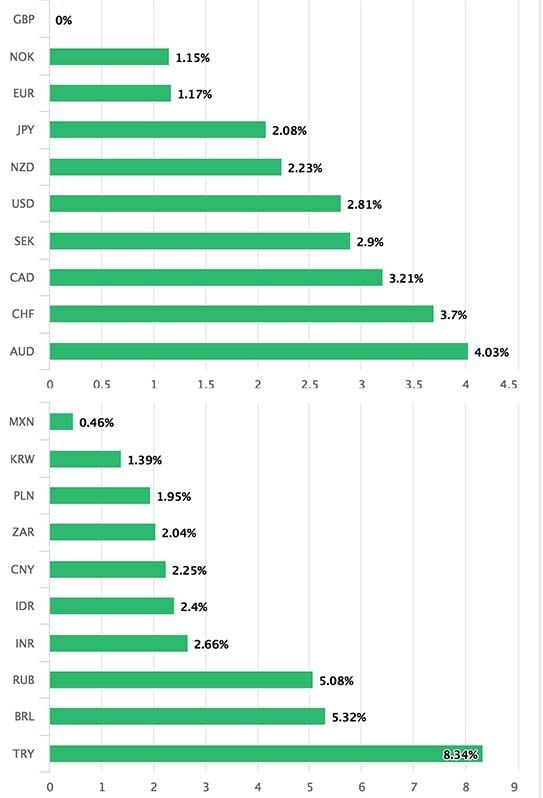

Above: The Pound was the best performer amonst the group of the world's top 20 currencies in March. Image (C) Pound Sterling Live

"The Pound’s strong upward momentum continues to favour further gains in the near-term," says Lee Hardman, currency analyst at MUFG.

Hardman cites an ongoing reduction in Brexit risks and a more 'hawkish' outlook for Bank of England interest rates as being the key drivers behind the Pound’s upward momentum and there is little on the horizon to suggest these two drivers are going to fade.

The Bank of England on Thursday, March 8 signalled that the bar for a delay in hiking rates in May would be high, as the Bank did nothing to push back against market pricing that already implied a +- 90% chance of such an occurance.

The Pound has meanwhile derived some additional support into month-end from a report that Irish officials have been told to expect new plans “imminently” on how Britain plans to avoid a hard border with Northern Ireland.

While short on details, the report has further boosted confidence that the UK and EU can find a workable and timely solution to the Irish border issue to support plans for a “smooth & orderly Brexit”. The key driver of Sterling strength over recent weeks has been the realisation by markets that the EU and UK were on course to sign a transitional Brexit deal on time; something that slashes the risk of a disorderly and disruptive Brexit.

The deal was confirmed on Monday, March 19.

"Nevertheless, it still remains a potential banana skin for the Pound in the coming months if intensified Brexit talks do not progress as well as hoped," warns Hardman.

Shahab Jalinoos, a trading strategist with Credit Suisse in Zurich suggests any weakness in the Pound should be taken as a buying opportunity in current market conditions "as we think the fundamental picture for GBP remains healthy, with strong growth, tightening monetary policy, and FX undervaluation providing tailwinds for appreciation."

Jalinoos does note that Sterling has struggled into month-end, but suggests in a foreign exchange forecast briefing that this is because much of the positive news in BOE and Brexit developments had already been priced in following the agreement on the transition deal, "making GBP vulnerable to month-end and quarter-end rebalancing flows."

Time for Consolidation, Particularly Against the Euro

For some analysts though, it might be time for the Pound to take something of an extended break following its recent higher and they caution we should be wary of continued sideways action over coming weeks.

"The GBP has shed its downside tail for now, but that justifies current levels rather than motivating additional bullishness," says Daniel Been, an economist with ANZ Bank.

In a monthly currency forecast note Been says the British Pound has shed its "downside tail for now", but this justifies the Pound's current levels rather than motivating additional bullishness.

"We see limited scope for GBP appreciations vs EUR," says Been adding, "domestic political risks are high in the UK." By contrast, the strong economic underpinnings of the Eurozone and expectations for an end of the European Central Bank's asset purchase programme maintain the Euro as an attractive proposition.

As mentioned, the Brexit transitional deal agreed on March 19, and then ratified by EU leaders at the European Council meeting on March 23, is widely seen as being the central driver of Sterling's good March. A good number of analysts are arguing that the good news presented by the event is now incorporated into Sterling's valuations, and a pause is required until the market finds fresh stimulus points.

"While positive, it is not the game changer and in any case a deal was widely expected," says Mikael Olai Milhøj, Senior Analyst with Danske Bank. "The negotiations on the future relationship are going to be much more complicated, not least with respect to the outstanding Irish border issue."

Economist Chiara Silvestre with UniCredit Bank in Milan confirms the announcement on a Brexit transition is "good news that should support the currency over the medium term" but reminds clients that the Euro is also likely to remain supported by the positive economic narrative in the Eurozone.

As a result, the GBP/EUR exchange rate is expected to remain "relatively stable" and it "looks unlikely to break out of its established range which is identified as being between 1.15 and 1.11.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Seasonality: The Pound Does Remarkably Well in April

But looking beyond Sterling's traditional drivers of the Bank of England and Brexit, a third player tends to come into the frame at this time of year - seasonality.

Seasonality is the idea that a currency moves in a predictable fashion at a certain time of the year, and for Sterling seasonality could be a factor to watch in April as history tells us the currency is the all-out best performer in this month.

"Market participants are increasingly paying attention to the seasonal performance of the Pound. The Pound has strengthened against the US dollar in April for the last thirteen years by an average of 2.3%," says Hardman.

Various reasons have been put forward to explain the seasonal outperformance of the Pound, including repatriation flows to pay dividends.

But, Hardman notes, the seasonal dynamics could have become self-reinforcing as well, given market participants are increasingly encouraged to buy the Pound in anticipation of further gains in the coming month.

"April seasonality is approaching again for GBP, which tends to rally no matter what the political/macro backdrop," says Kamal Sharma, FX Strategist with Bank of America Merrill Lynch Global Research in London.

The call is given further weight if we consider that it does not come in isolation, indeed Sharma is the second major FX analyst whom we report as having a "tactically" bullish stance on the British Pound heading into the month of April.

We have also reported Deutsche Bank analyst Oliver Harvey was turning "tactically bullish" on Sterling against the Euro citing - amongst other reasons - that April tends to be a month in which the Pound outperforms its major rivals, and April 2018 should be no different.

Bank of America have told clients they too are looking to "take advantage of this strong trend" and enter a short-term tactical trade that looks to benefit on further gains by Sterling against the Dollar.

Above: Seasonality can be a good predictor of Sterling performance in April.

"Within the G10 FX complex, there is no stronger seasonality than in GBP through April," says Sharma. "GBP/USD has rallied every single year for the past 14 years."

Sharma says this "remarkable outperformance" covers major events such as the financial crisis, general elections and the Brexit referendum, and suggests to him a consistently strong underlying flow which has trumped these idiosyncratic factors.

"A combination of the end/start of the UK tax year and a heavy month of dividend payments by UK corporates are factors which we think are at play driving GBP strength during April," says Sharma.

Furthermore, the underlying domestic environment appears to be a little more favourable to the Pound at this juncture now that the EU/UK have agreed on the contours of a transition agreement and the MPC sounding hawkish.

"With a strong print on average hourly earnings and with reports that the public sector wage cap will be lifted in the coming months, market expectations are likely to maintain further policy tightening in 2018," adds Sharma. "A reduction in near-term political uncertainty should see GBP focus on its near-term macro drivers."

Bank of America are looking to bet on a rise in Sterling against the US dollar in particular and are entering a trade at 1.4080 eyeing gains as far as 1.4445.

Risks to the trade are increased protectionist concerns which will weigh on "high beta" GBP. At the time of writing it appears that the rhetoric around global trade is starting to settle down again, and if the US administration doesn't throw out too many surprises on the matter going forward this risk should recede.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.