May's Poll Bump Could Play Positive for Pound Sterling Longer-Term

- Written by: James Skinner

© Lee Goddard / Number 10 Downing Street

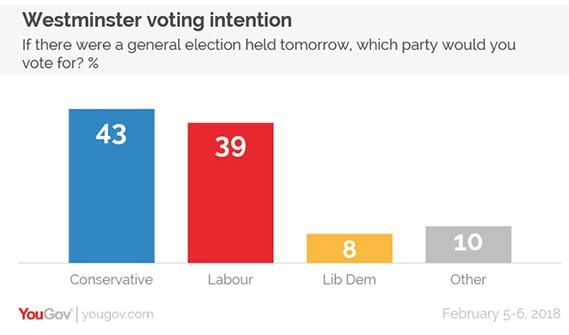

A new poll from YouGov confirms a recent trend - the Conservatives are seeing their standings with the electorate improve. A stronger Theresa May could have implications for the Pound Sterling outlook.

Opinion polls of voter intentions have shifted sharply in favour of Prime Minister Theresa May’s Conservatives heading into early February, with a new poll from YouGov giving the party its largest lead since the disastrous 2017 election.

YouGov is significant in that they were seen as offering the most accurate polls ahead of the June general election.

A boost in the polls could be seen as shoring up the PM’s position in Number 10 at a time when the perceived threat level to her leadership has recently ticked up a notch with members of her own party jockeying for influence as Brexit negotiations enter a crucial stage, with talks on transition under way and the March 21, deadline for an agreement fast approaching.

YouGov's survey for the week ending February 05, assigned the Conservative Party a 43% share of the electoral vote, up one point from the 42% it was given by the same pollster at the end of January.

Meanwhile, YouGov marked down the opposition Labour Party by three points to 39%, while marking up the Liberal Democrats by two points to 8% and the UK Independence Party by one point to 3%. The category of “other” parties shed one point for the week.

The result marks a continuation of a January-long trend of increasing support for the ruling party and has left the Conservatives holding a four point lead over the opposition, the widest of any lead since before the disastrous June 2017 election.

February’s YouGov poll comes alongside a similar survey of voting intentions by ICM, which also showed support for the opposition Labour Party dropping, this time by one point to 40%. That also left the Conservatives will a small lead.

Why this Trend Could Play Positive for the Pound

So far the reaction from Sterling is ambiguous; but what we do know is that concerns over May's leadership of the Conservative party and the country are a key source of uncertainty that has kept the Pound in check since mid-2018.

Sterling dislikes uncertainty and the constant threat of leadership change has been a key risk investors have had to consider in their decision-making.

However, the political mood is important and signs of a recovery in the polls will certaintly aid May's position - political parties tend to back their leader when the mood music is good. A key threat to May's leadership has derived from her MPs who believe she is being too soft, or directionless, with the EU over Brexit.

The Prime Minister's apparent unpopularity has allowed them to flex their muscle and question her leadership.

"The markets are on alert for political risks emanating out of the UK, and if there is a party coup to replace Theresa May then political turbulence is likely to weigh on the Pound further," argued Kathleen Brooks in the wake of news in 2017 that 40 MPs were willing to trigger a leadership challenge.

In 2018, similar headlines have been repeated, and analysts have taken similar views towards the UK currency, but should the assumption that the PM is unpopular dissipate, then we could see this source of uncertainty also disappear

The first positive input into the Sterling outlook is therefore one in which political stability leads to certainty, with the threat level to PM May’s position having ticked higher again in the last month, it might eventually be seen by the market as lessening the prospect of a disruptive leadership challenge during the months ahead.

And then we have the implications for Sterling concerning Brexit to consider.

Should the trend in May's standings in the polls be confirmed it could improve the PM’s hand in ongoing negotiations over a transitional deal with Brussels and allow her to take control of the process.

Whether May is able to push for a hard or soft Brexit is almost of little consequence - what really matters for Sterling at this juncture is that the process is handled smoothly and progress to a transitional deal is secured. Securing the details of the final arrangement will take time, patience and hard work, only a stable domestic environment can achieve this.

"We expect full upside potential to be unleashed once we get greater clarity on a Brexit transition deal," says Viraj Patel at ING Bank. "With our base case that a Brexit transition deal will be agreed, we continue to see deferred gains for the Pound – and reaffirm our 1.45 target for GBP/USD."

For Sterling, crashing out of Europe in 2019 is the worst possible outcome and a more confident Prime Minister can take the reins and move the process forward along a centrist position, ignoring protests from the extremes on both sides in her party.

The Pound has enjoyed a solid run into the New Year, aided by the passing of the “sufficient progress” milestone in December, an economy that has continued to defy expectations and a central bank that has adopted an increasingly hawkish tone.

By mininimising Brexit risks markets can focus on the fundamentals.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.