Latest Pound Sterling Predictions vs. the Dollar and Euro following the Bank of England Sell-Off

- Written by: Gary Howes

"We were surprised to see such a sharp drop in Sterling and gilt yields, suggesting traders’ positioning may have run ahead of events" - Alastair George, Edison Investement Research.

Sterling was sold after the Bank of England raised interest rates but failed to offer any concrete guidance as to the potential for future interest rates.

As we have noted here, it appears the sell-off is a “sell the fact” type reaction by traders to the news of a 0.25% interest rate as there was nothing explicit in the Bank’s guidance to explain the hefty falls. The Bank reckons at least one more interest rate rise is likely in 2018 and another the following year, news that more-or-less gels with market expectations for such.

If the sell-off is indeed ‘sell the fact’ in nature it is largely technical, and we could perhaps see Sterling settle near current levels:

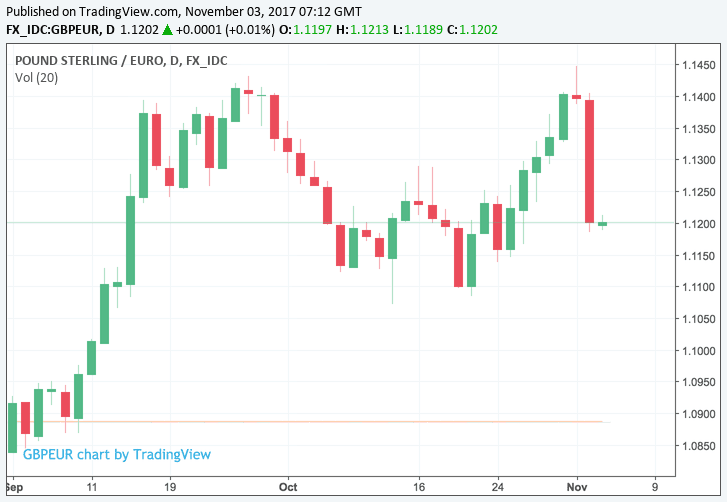

The Pound-to-Euro exchange rate is seen at 1.1207 but had been as low as 1.1185 in the past 24 hours:

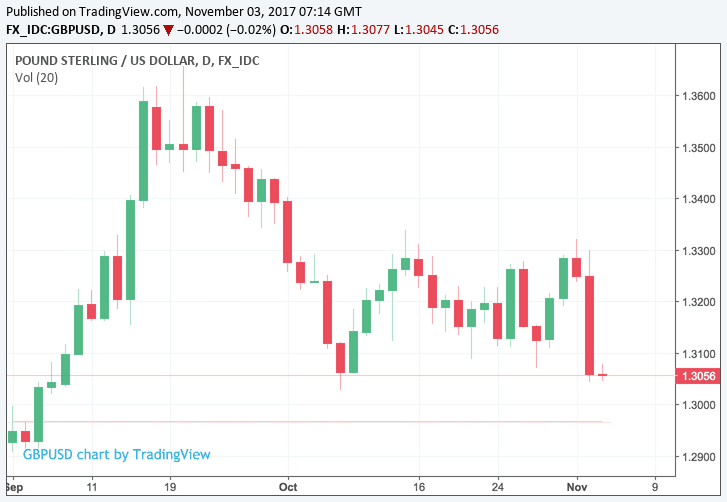

The Pound-to-Dollar exchange rate is seen at 1.3072 and had gone as low as 1.3042 in the wake of the Bank of England event:

What Analysts are Saying About the Outlook

Concerning the outlook, there are a number of divergent views to consider as to where Sterling is ultimately headed in the wake of the BoE event.

"The Pound's 1% sell-off to Bank of England is an overreaction. Don't underestimate role of GBP in policy thinking. 'Carney Put' means GBPUSD 1.35 is still on,” says analyst Viraj Patel at ING Bank who believes Sterling should end the year higher against both the Euro and US Dollar.

“We think the dovish market reaction looks a bit overdone, given that the MPC’s growth forecasts are broadly unchanged from August,” says Paul Hollingsworth, Senior UK Economist at Capital Economics having pored over the latest set of economic forecasts from the Bank released alongside news of the rate rise.

“The decision to raise UK interest rates by 0.25% was widely anticipated and we were surprised to see such a sharp drop in Sterling and gilt yields, suggesting traders’ positioning may have run ahead of events,” says Alastair George, Chief Investment Strategist at Edison Investment Research.

Overall, we see limited downside for GBP because of the UK’s improving balance of payments backdrop and encouraging economic activity,” says Elias Haddad at The Commonwealth Bank of Australia. “Technically, important support for GBP/USD is offered at the 200‑day moving average (currently at 1.2853).”

However, Georgette Boele at ABN Amro falls into a camp of analysts who reckon Sterling should be heading lower saying she believes the Bank of England will leave interest rates on hold in the coming months.

“Given this macro and BoE outlook, we expect Sterling to soften further,” says Boele. “It is likely that EUR/GBP will again rise towards 0.90 in the coming weeks. Moreover, Sterling will probably weaken versus the US Dollar as well. GBP/USD could drop towards 1.30 in the near-term.”

EUR/GBP at 0.90 gives a GBP/EUR exchange rate at 1.11.

It should take some time for the market to settle and the near-term noise to clear out and therefore volatility could be the only guarantee.

"After being trounced overnight, the GBP/USD may remain vulnerable post-BOE MPC. Short-term implied valuations are also seen soggy as investors continue to digest the dovish hike," says Emmanuel Ng, currency strategist with OCBC Bank in Singapore.

ING now expect GBP "to settle" at softer levels following the Bank of England event with the next near-term catalyst for a change in Sterling being cited as the 2017 Autumn Budget (November 22).

For analyst Antje Praefcke at Commerzbank the key catalyst is not so much the budget, but rather Brexit:

"In the BoE’s defence it has to be said: with Brexit as a mandate or even task for life, a task entailing huge political uncertainty and effects on the economy that are difficult to predict, one cannot blame the MPC members for taking a very cautious approach despite an inflation rate well above target - that will remain well above target also medium term.

"It seems a sensible approach in view of the difficulties until March 2019 and beyond. Should the market sell Sterling due to the continued uncertainty the BoE would risk a depreciation spiral in Sterling and thus even higher inflation rate. Yes, the BoE is independent, but it also depends on the diplomats and they will finally have to deliver now."

Praefcke is not alone in expecting Brexit to return as a driver for Sterling over coming months as the Bank of England story starts to fade.

Analyst Manuel Oliveri at Crédit Agricole says he expects Brexit negotiations should ultimately result in a deal involving a transitional period and a trade agreement that allows UK firms to access parts of the single market.

"This is what is behind our generally positive long-term view on the GBP especially against the USD. That said, Brexit-related uncertainty could persist in the coming months," says Oliveri.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Services PMI Lifts the Mood, UK GDP Forecasts Upgraded

The British Pound edged higher against the Euro and Dollar during early trading Friday after the all-important Services PMI from IHS Markit and the CIPS rose faster than was expected for October.

The services sector accounts for about 80% of the UK economy and news that it is now growing at its fastest pace in six months understandably lent support to Sterling which has suffered notably over the past 24 hours.

October’s purchasing manager’s index (PMI) reading came in at 55.6, up from 53.6, when it had been forecast by economists to edge downward by a fraction.

Activity in the services industry, Britain’s most important commercial sector, rose at its fastest pace since April. Resilient client demand and a solid rate of new orders were cited as being among the factors behind the move.

“The good news was that October saw business activity across services, manufacturing and construction grow at its fastest rate for six months,” says Chris Williamson, chief business economist at IHS Markit.

The news confirms the UK economy is looking to end the year on a stronger-than-anticipated note, and while data is unlikely to propel the Pound to notable new highs, it does at least provide the grounds for a strong base to form.

"The pound managed to find stability overnight, and with this morning’s blockbuster services PMI reading, we are finally seeing the pound regain some ground. The surprise jump in services sector growth in October brought about the highest PMI reading in six-months, causing Markit to upgrade their Q4 GDP estimate to 0.5%," says Joshua Mahony at IG.

RBC Capital Markets are also upgrading their GDP forecasts on the basis of the latest survey data saying their PMI-based GDP modles suggest that if these levels were to prevail for the rest of 2017, Q4 GDP growth would be 0.5% q/q.

"This is significantly above our current forecast of 0.2% q/q, and after a stronger-thanexpected Q3 growth rate, we acknowledge that there is now some upside risk to that Q4 forecast," says Sam Hill, Senior UK Economist with RBC Capital Markets.