UK Manufacturing in Rude Health, PMI Numbers Nudge Pound Higher vs. Euro and US Dollar Ahead of Key BoE Event

- Written by: James Skinner

Wednesday's data comes ahead of similar surveys of the construction and services industries, as well as an eagerly awaited monetary policy announcement from the Bank of England Thursday.

The Pound rose against the Euro and US Dollar Wednesday after the latest IHS Markit data showed a surprise acceleration in UK manufacturing activity during the month of October.

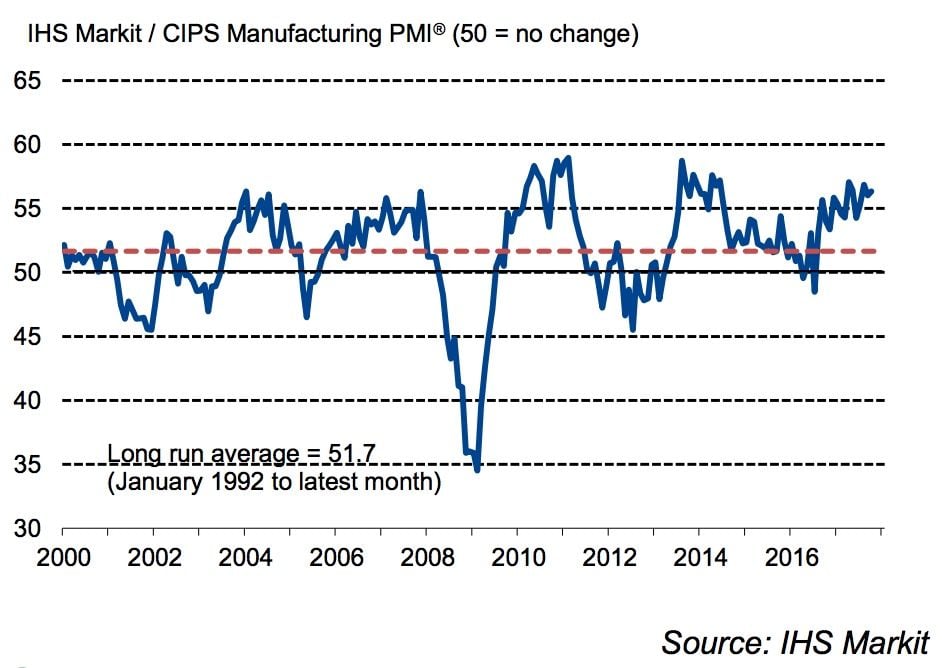

October’s IHS Markit Manufacturing index rose to 56.3, up from 55.9 in September, when economists had forecast it to edge down by a fraction.

New order volumes remained solid during the month, aided by healthy levels of domestic demand and rising inflows of new export business, with UK firms seeing rising demand from customers in the USA, Europe, Australia and South America.

“UK manufacturing made an impressive start to the final quarter of 2017 as increased inflows of new work encouraged firms to ramp up production once again,” says Rob Dobson, a director at IHS Markit. “The sector looks to be achieving a quarterly rate of expansion close to 1%, therefore sustaining the solid pace of growth signalled by the official ONS estimate for the third quarter.”

The Pound-to-Euro rate was quoted 0.21% higher at 1.1428 a short time after the release, while the Pound-to-Dollar rate was marked 0.06% higher at 1.3296.

Above: Sterling's recent run higher against the Euro extends in the wake of stronger-than-forecast UK manufacturing data.

Manufacturing output levels rose in line with the strong pace of growth seen for September, with gains recorded across consumer goods, intermediate goods and investment goods sub-sectors.

“Price pressures continued to build, however. Input costs rose at the fastest pace in seven months, leading to the steepest rate of selling price inflation since April,” says Dobson. “Higher demand for raw materials, combined with increased supply-chain constraints, mean annual input price inflation is moving back into double-digit rates.”

"Perhaps reflecting firms’ confidence in future demand, the employment balance reached its highest in 40 months, despite the recent rise in oil prices seeing input prices pick up," says Andrew Wishart, an economist at Capital Economics.

The industrial segment of the economy has been a relative bright spot for the UK during recent quarters, with the post-referendum devaluation of Sterling helping to lift export order books to a six and a half year high in September.

"Meanwhile, the output expectations balance – which offers the best correlation with the official data – was unchanged at 56.6, remaining consistent with quarterly manufacturing output growth of around 1%, the same pace as that recoded in Q3," Wishart adds.

Official Office for National Statistics production data for the third quarter also showed signs that the sector is picking, which is notable because the manufacturing upturn highlighted by IHS Markit surveys had been absent from the official data ever since the referendum.

"Overall, then, today’s survey does nothing to alter our expectation that the MPC will increase Bank Rate by 0.25% tomorrow," says Wishart.

Dobson agrees:

"The continued robust health of manufacturing and rising price pressures will help cement expectations of the Bank of England hiking interest rates for the first time in a decade as Thursday’s announcement approaches.”

The BoE is widely expected to raise the cash rate by 25 basis points to 0.50%, reversing the rate cut it announced in August 2016 but what matters for the Pound's outlook is what the Bank says about subsequent interest rate rises. Is this a one-off or the start of a soft cycle of rate rises?

If the Bank communicates the latter, then expect Sterling to hold recent gains and maybe extend them.

Based on the strength of the manufacturing figures from Markit the Bank would be justified in raising rates again in 2018 if we consider the strong hiring intentions mentioned in the report.

The day's data also comes closely on the heels of an agreement between UK and EU negotiators to speed up the pace of Brexit talks.

Sterling has risen strongly in the last week after third-quarter GDP data showed the UK economy regaining some of the momentum it lost in the first half of the year, which was seen sealing the deal on a Bank of England rate hike Thursday.