Pound Getting Carried Away on BoE Expectations, to go Lower vs. Euro and Dollar Over Next Three Months say Nordea

On Thursday the Bank of England will have their rate-setting meeting and probably decide to raise interest rates - few doubt that now with money markets suggesting such an outcome enjoys a 90% likelihood.

Ahead of the move the Pound has strengthened, a reflection of the increased flow of capital into its jurisdiction when banks offer better returns.

Yet looking beyond the first rise there is little consensus as to what might follow - will there be more rate hikes, or will it be a case of 'one and done'?

It will be the 'latter', thinks Nordea Bank AB G10 FX Analyst Andreas Steno Larsen who sees little reason even for the first rate rise, let alone any subsequent hikes.

If anything he sees multiple reasons to hold the rate hike in suspect summarised below.

Several also point to a weakening Pound on the horizon.

Inflation Over the Hill

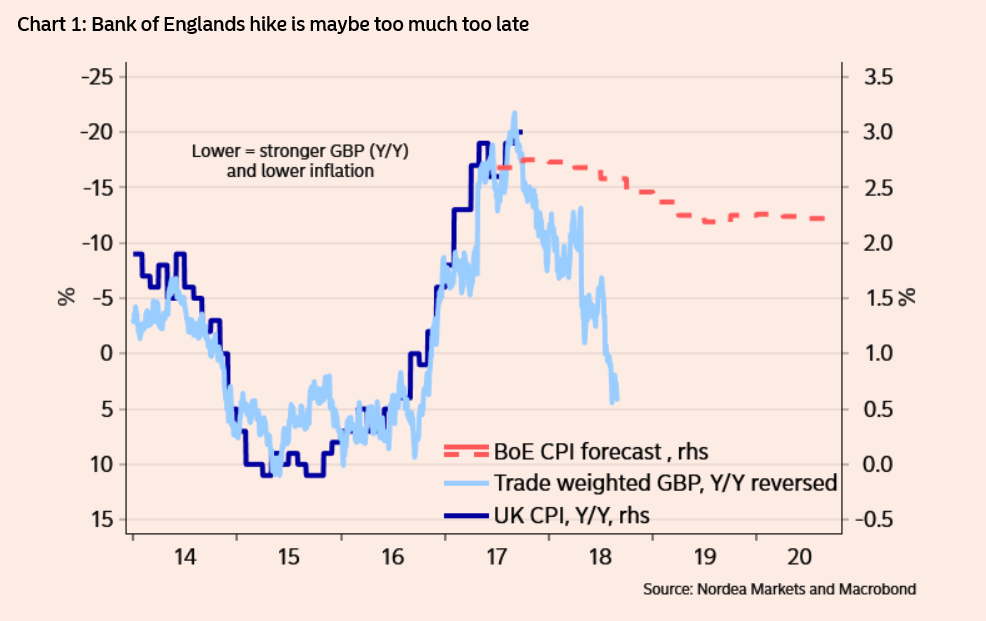

Thursday's hike is probably a late attempt to combat exchange rate volatility, and thereby curb inflation via a stronger Pound, argues the analyst.

"The recent spike in inflation is almost solely a result of FX effects. So is this hike ultimately an attempt to stabilize the Sterling and hence inflation?" Asks Larsen.

Yet if so then it could be "too much too late" since if anything the 'fever will have abated' by the time the BOE 'administers the medicine'.

This is because "FX effects on inflation will start to abate already in the coming quarter," says Larsen.

The Pound has risen substantially from the rock-bottom lows of late 2017 early 2018, and this should now start to reduce inflation by decreasing the cost of exports.

As such, the BOE, if it hikes to bring down inflation, may be acting tardily.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Inflation Expectations Not Priced In

What's more, the lower inflation due to subsiding FX base effects is not yet priced into Sterling, according to Larsen, who notes that inflation swaps are not reflecting lower inflation expectations.

This should result in the Pound eventually falling as they are absorbed.

Inflation volatility may be a further reason to expect the BOE to be 'one-and-done', but eventually, it will also start to push up expectations of a rate hike further into the future to stabilize FX influences.

"GBP will likely weaken, in turn suddenly adding to the case of higher inflation and a firmer BoE stance again," says Larsen, adding:

"Hence expect higher EUR/GBP, but with a limited upside potential after all (our 3-4 month target is 0.91)," says the Nordea analyst.

Market Nieve About Interest Rates

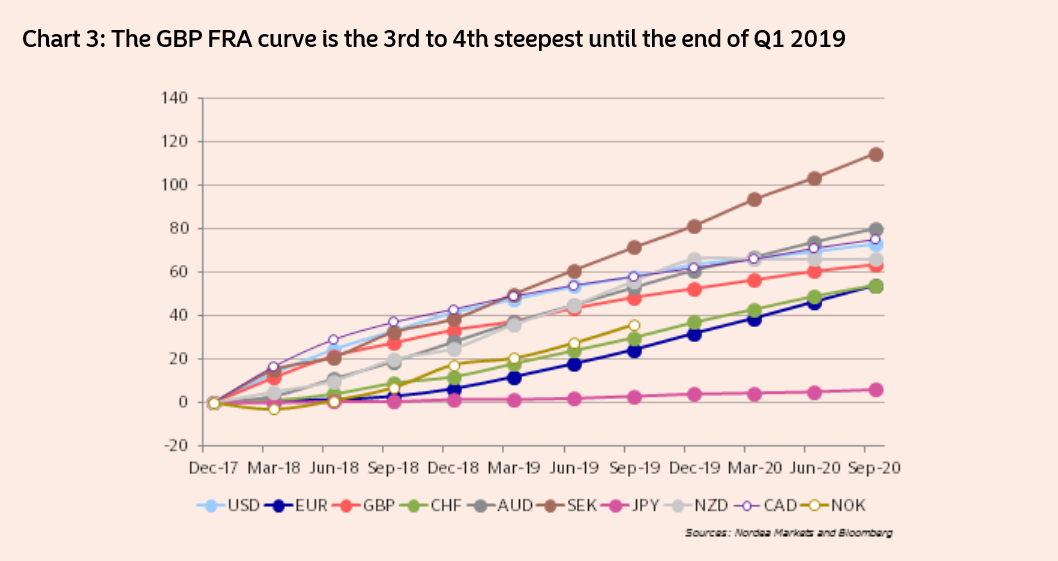

Market interest rate expectations are pitched higher than would be expected in the case of a 'one hike only' scenario, which is currently the most likely scenario.

This is shown by the GBP FRA curve, which measures the cost of guarding against interest rate appreciation on a loan (FRA stands for Forward Rate Agreement) denominated in Sterling.

Note from the graph below how GBP FRA is rising more steeply compared to most other currencies.

This is explained by the market (probably falsely) extrapolating the promise of further rate hikes beyond Thursday's.

The Pound could also be hit by the unwinding of overly optimistic inflation expectations.

Overly Optimistic About a Wage Rise

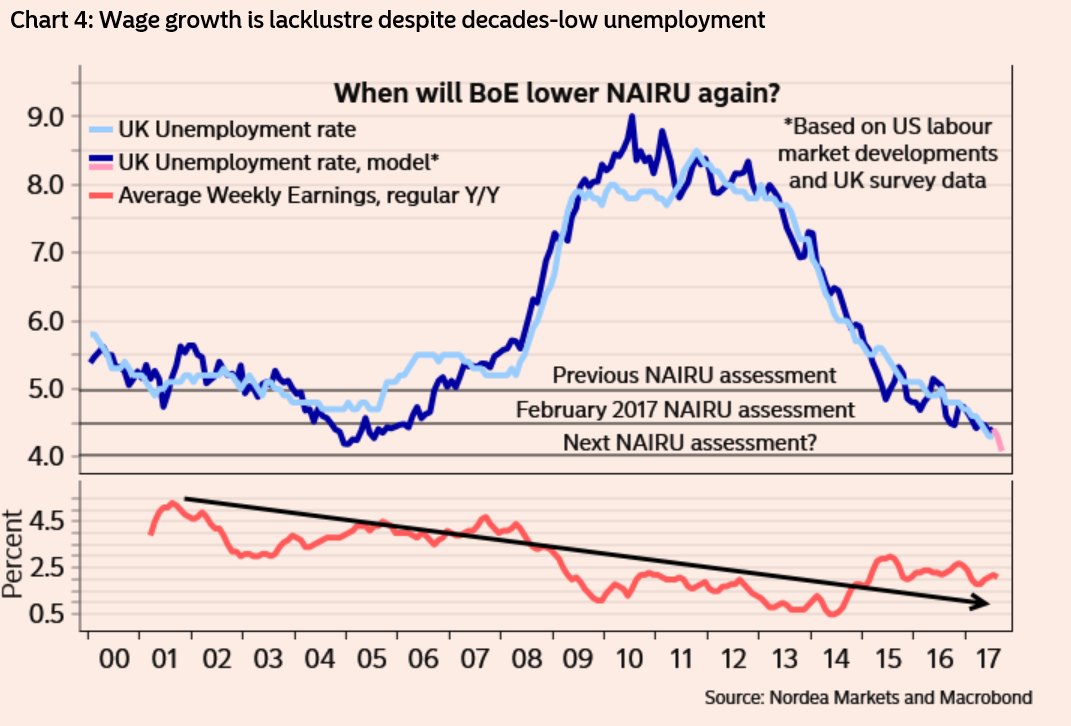

Wages remain stubbornly low and have uncoupled from their former functional relationship with the labour market.

"Looking at the current wage-momentum (red line in chart 4) in combination with the decade-lows in unemployment, it is kind of hard to get excited by the wage developments. At best, the current wage-growth trend is sideways since 2015, despite the unemployment dropping from 5.5% to 4.3%," said Larsen.

The BOE has lowered the level at which low unemployment will cause inflation (due to rising wage costs), known as NAIRU, from 5.0% to 4.5% and it may have to lower it again, thinks the Nordea analyst.

There is also already a growing chorus of dissenters inside the BOE for this very reason:

"Some Bank of England MPC members, such as Silvana Tenreyro and Dave Ramsden (both will likely vote against a hike on Thursday) have already started to cite risks that wage growth will not pick up, as the Phillips Curve otherwise suggests," says Steno Larsen.

Pound Forecast Lower, but Higher into 2018

Taking the above into account, it should come as no surprise that Nordea are bearish Sterling moving forward, particularly over the nearer-term timeframes.

"We remain sceptical towards the GBP on a 4-6 month horizon and hence see upside in EUR/GBP and downside in GBP/USD," says Larsen.

However, Nordea are conscious that upside risks abound should progress on Brexit negotiations be forthcoming and the medium-term picture is therefore more positive.

The Pound-to-Euro exchange rate is forecast at 1.10 on a three month horizon and 1.15 by mid-2018.

The Pound-to-Dollar exchange rate is forecast at 1.26 in three months, ahead of a recovery to 1.38 by mid-2018.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.