Pound vs Australian Dollar: Sterling's Brexit Boost, Aussie's Iron Ore Woes

- Written by: James Skinner

The Australian Dollar is weighed down by a retracement in iron ore prices while a constructive environment in Brexit negotiations has aided Pound Sterling higher.

A possible slowdown in Chinese growth, falling iron ore prices and signs of progress in negotiations between the UK and the European Union could all help push the Pound higher against the Australian Dollar over the coming weeks and months.

In relative terms the Australian currency has enjoyed a good run against Sterling in 2017, sitting largely unchanged against the British currency, as an upturn in the economy down under helped to drive a repricing of Australian interest rate expectations.

Out of the G10 basket the Aussie’s performance against the Pound has been bested by only the Euro and Swedish, as well as Norwegian, Kronas - all of whose fortunes are heavily intertwined.

But clouds could be gathering over the resource dependent Australian economy after the price (futures) of iron ore, Australia’s number one export, has fallen by 25% since late August.

“The correction in iron ore prices is well under way now as speculative money moves out and as fundamentals weaken in the face of oversupply and winter restrictions on Chinese steel mills that will hurt ore demand,” say UniCredit strategists.

This is while some economy-watchers are once again muttering about a possible slowdown in Chinese demand for raw materials and a deceleration of growth in the broader Chinese economy.

“Economic growth in China is about to slow, due to less expansionary fiscal policy, a slowdown in real estate, and tighter credit conditions,” says Ole Kjennerud, an analyst at DNB Markets.

Under domestic pressure to reduce pollution, Chinese authorities have long been expected to take action against some carbon heavy industries.

“Tangshan city, the biggest steel hub in the nation, has suspended half of its iron ore processing plants from November to March to prevent extreme pollution levels in the winter months,” says Kjennerud. “This has not gone unnoticed in the markets, and prices on iron ore imported from Australia have plunged since early September.”

These moves come on top of a broader push to shutter some steel production facilities in response to international criticism, and international deployments of trade defence measures, over alleged state subsidies of the steel industry.

“Combined with the efforts in Zhengzhou to slow aggregate demand and the impact from a reduced credit impulse, a slowing housing market and less expansionary fiscal policy, this could mean that commodity prices, in particular metal prices, are facing a more uncertain outlook than we and the marked have previously envisaged,” says Kjennerud.

None of this is great news for the Australian economy over the short to medium term and all of it underlines the need for Aussie policymakers to continue diversifying the economy away from its reliance on natural resources.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Pound's Brexit Boost

Meanwhile, at a joint press conference in Brussels, Brexit secretary David Davis and EU negotiator Michel Barnier unveiled broad progress toward settling some of the key issues in divorce negotiations.

Although more progress is needed, this means talks could soon move forward onto the subject of the future trading relationship between Britain and the EU.

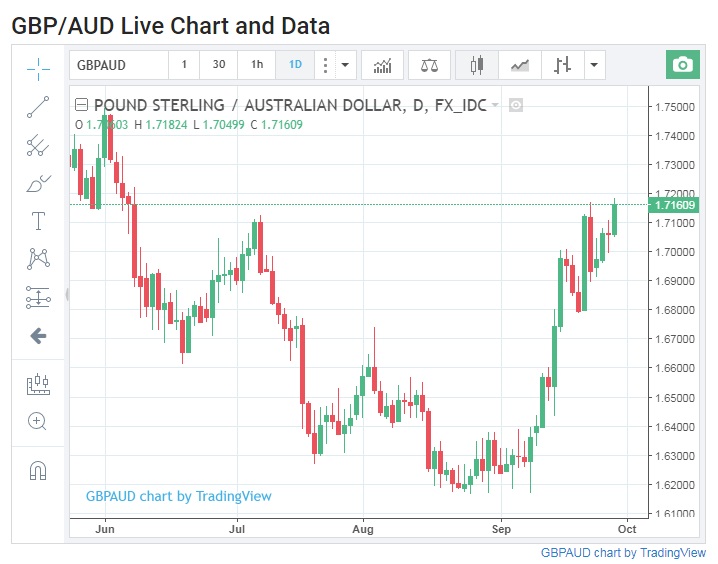

The Pound rose by 0.46% against the Australian Dollar during the Thursday session, for bids and offers to be accepted around 1.7147 going into the London close, while an earlier intraday high saw the pair quoted around 1.7183.