Pound Stretches Legs vs Dollar and Euro as UK Retail Sales Beat Expectations, Cement Case for Nov Interest Rate Rise

- Written by: James Skinner

- FX Market Quotes:

- Pound-to-Euro-exchange rate: 1 GBP = 1.1312 EUR, up 0.08%, day's best: 1.1330

- Pound-to-Dollar-exchange rate: 1 GBP = 1.3557 USD, up 0.22%, day's best: 1.3608

Pound Sterling moved notably higher mid-week following the release of show-stopping August retail sales data wich suggests a November rate rise at the Bank of England is justified.

The Pound turned higher Wednesday after UK retails sales were shown rising at a much faster pace than was expected by economists in August.

The data is what is required to keep the near-term positive impulse seen across the Sterling strip alive.

Retail sales rose by 1.0% when compared with the previous month, according to the latest Office for National Statistics data, up sharply from the 0.3% pace of growth seen in July and better than the consensus forecast of economists for 0.2% growth.

"The BoE recently indicated that it could raise rates over the coming months if the economy continues to perform as expected. Today’s retail sales evidently leave this option perfectly open. EUR/GBP declined about half a big figure upon the publication of the report," says Piet Lammens, analyst with KBC Markets in Brussels.

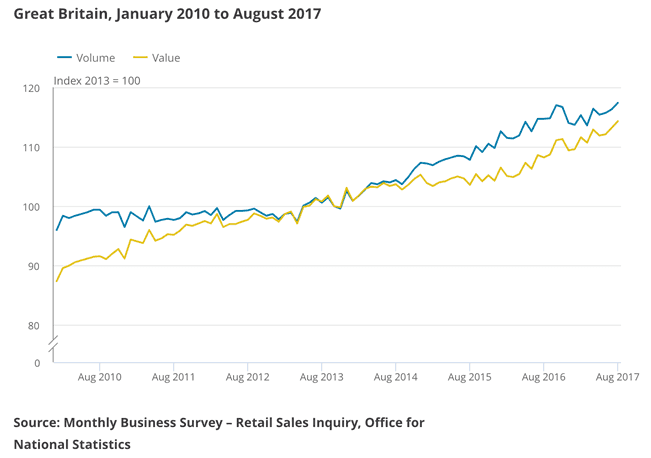

Both volumes and sales are up, confirming a longer-term trend of appreciation:

The increase was broad-based with both non-food stores and non-store (online) retailing seeing an increase, helping to push the annual pace of retail sales growth to 2.4%, far ahead of expectations for a 1.1% expansion.

Sterling rising on retail sales numbers pic.twitter.com/6mYxsTaEgK

— Neil Wilson (@neilwilson_etx) September 20, 2017

“Today’s retail sales figures indicate that consumers are showing an impressive resilience in the face of the ongoing real pay squeeze,” says Ruth Gregory, UK Economist with Capital Economics.

"It seems that consumers may have finally begun to adjust to the post-referendum price shock, and are starting to get back to more normal levels of spending," says Paul Farge, a strategist with TD Securities in London.

But Gregory cautions on getting too carried away by these figures as the retail sales figures are very volatile on a month-by-month basis.

“And high-street spending growth has been on a clear downward trend, with the annual rate of sales volumes at 2.2% in the three months to August – considerably lower than the 5-6% rates seen towards the end of 2016.”

Nevertheless, Capital Economics say even if sales volumes were to fall by 1% in September, sales would post another decent rise of about 0.7% in Q3, following a 1.4% rise in Q2.

Other survey indicators of spending off the high-street have held up well too.

Capital Economics' seasonally-adjusted measure of car registrations suggests that car purchases – which were responsible for a large part of the weakness in consumer spending in Q2 – will rebound in the third quarter.

"As a result, a modest pick-up in household spending should help the economy to re-accelerate a little ahead and adds weight to our view that the MPC will hike interest rates in November," says Gregory.

The data comes on the same day that the Bank of England releases the results of its Agents' summary of Business Conditions survey that confirms consumer goods inflation has picked up further, largely reflecting the fall in Sterling feeding through into retail prices.

But, they believe inflation might have peaked.

If correct, and prices start coming down over coming months, we would expect consumer spending to remain robust.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Positive Tone on Sterling Remains

Concerning the outlook, despite the Pound pulling back from its recent highs the outlook remains bullish but gains will be contested.

Versus the Euro, Sterling appears to be running into solid levels of technical resistance.

"We are coming into a lot of good support in the 0.8700-0.8750 area. There the low from July 14 comes in at 0.8743, while the 200-Day SMA sits down around 0.8700," says Joel Kruger, an analyst with LMAX Exchange.

From a GBP into EUR perspective, this gives us resistance at 1.15-1.1430 where the pair peaked in July at 1.1437 with the 200-day moving average located at 1.15.

The GBP/USD is looking particularly constructive ahead of a key announcement from the US Federal Reserve, due 19:00 B.S.T.

"While the medium to longer-term picture is looking increasingly constructive, short-term, upside should be limited to the 1.3835 area, which represents the next big level of resistance, in the form of the February 2016 low," says Joel Kruger, an analyst with LMAX Exchange.

Further Fuel Thrown on the Rate Hike Expectation Fire

The Pound has performed strongly over the last week since Bank of England policy makers suggested interest rates could be raised over the coming months. Wednesday’s show-stopping figure pretty much seals the deal for a November hike from the BoE.

Gertjan Vlieghe, one of the Monetary Policy Committee's staunchest advocates of lower-for-longer interest rates, helped propel the Pound to the top spot in the G10 performance table last week after he too told an audience that the time for a rate hike could be near. But his support for a hike was contingent on consumer spending having shown signs of stabilising.

Wednesday’s figures come against a backdrop of uncertainty over the trajectory of Brexit negotiations. Reports from Tuesday suggest Prime Minister Theresa May has offered to pay a substantial sum of money to the European Union upon Britain’s exit in order plug a hole that will open up in the EU’s budget after Brexit and to move negotiations forward onto the subject of trade.

The budget offer, said to be at least £20 billion, is expected to be announced by PM May at a key Brexit speech on Friday, September 20. Such an offer might help ease concerns in foreign exchange markets over the prospect for a messy Brexit once made official, and support a continued recovery of Sterling.