Pound Sterling's Bitcoin Moment? HSBC Trader Urges Caution as Big Dip in Pound-to-Dollar Rate Could be Nigh

- Written by: James Skinner

Beware a Bitcoin moment for the British Pound warns a trader at HSBC.

Hawkish comments from the Bank of England in its latest rate statement have lit a fire under Sterling that could perpetuate a continued recovery of the British currency.

But pricing in the options market suggests otherwise.

Indeed, if history repeats, the Pound-to-Dollar rate is vulnerable to a sharp fall over the next month, according to a foreign exchange trader at HSBC, while an actual rate hike from the Bank of England is far from guaranteed.

“My only suggestion is that long GBP will be about as fun over the next few months as short GBP was over the previous few,” says Brent Donnelly, a US based spot fx trader with HSBC based in New York. “And don’t be too shocked if the BoE never ends up hiking this year.”

Traders who were short the Pound-to-Dollar rate over the last few months were caught on the hop after a sustained weakening of the Dollar drove the pair to a 6% gain for the year to date.

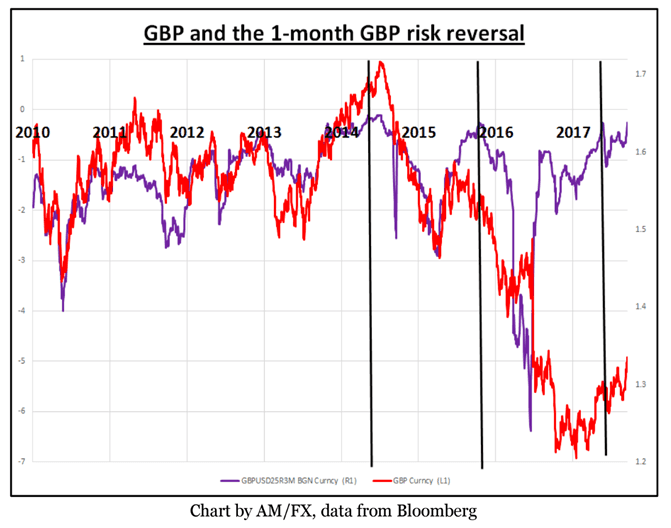

“While much is made of the CME short in GBP, I think risk reversals tell a more complete story. CME is only one segment of the market - just about everybody trades options,” says Donnelly who briefs clients with his thoughts on a daily basis.

His views are seperate to the house views of HSBC and the bank's wider analyst community. They provide useful insights and counter-trend views that look to get traders thinking.

Donnelly notes that recent price action in the FX options market shows the number of investors who are still carrying protection against further upside in the Pound-to-Dollar rate remains at the elevated levels seen immediately after the Brexit referendum in 2016.

"I urge extreme caution... When the options market is ripping cable calls it has not been a great time to be long GBP," Donnelly says.

Pricing of the GBPUSD one-month risk reversal suggests speculators are still heavily invested in short positions against the Pound and what's more, the currency pair is now knocking on the door of a key, very large, strike price.

"In terms of levels, they don't get any bigger than 1.3500 in GBPUSD," the trader adds.

The "level 1.3500" refers to the strike price from where speculators will be able to exercise their option to buy GBP/USD. Once the price is above this level the options are "in-the-money" and liable to be exercised at any time.

This would result in a series of major trades in Cable that will mean volatility, at the least, and could ultimately end with speculators dumping a large volume of sterling on the market in order to crystallise their profits.

“At the risk of missing a major move higher in GBP, I am staying away. It is also not prudent to go short right now after such a hawkish announcement but note the huge levels in UK yields and GBJPY around here,” Donnelly says.

The Pound-to-Dollar rate rose sharply over Thursday and Friday morning, to trade at a fresh one-year high of 1.3421, while Sterling also gained rapidly against its other G10 counterparts making it the best performing currency in the basket for the week.

Price action came after the Bank of England said interest rates could need to rise earlier and faster than the markets are expecting, possibly before the year is out, while Governor Mark Carney told media at a seperate appearance that the possibility of an interest rate hike has “definitely increased”.

"The majority of members of the (Monetary Policy) Committee, myself included, see that that balancing act is beginning to shift, and that in order to ... return inflation to that 2 percent target in a sustainable manner, there may need to be some adjustment of interest rates in the coming months," Carney said, at an event marking the release of the new ten Pound note.

Traders are now betting on a rate hike from the BoE in November 2017 while strategists have said the odds of action from the Monetary Policy Committee have increased notably.

“We expect the Bank of England to hike Bank Rate 25bps in November, and again by May 2018, most likely at its February meeting,” says James Rossiter, a senior strategist at TD Securities. “Beyond this, policy again reverts to “wait and see” mode as the MPC assesses the effects of Brexit uncertainty on the economy,”

But Donnelly flags that Mark Carney “has a history of wearing flip-flops” and comparisons between the BoE and other hiking-central-banks are misguided.

The analyst observes comparisons suggesting the Bank of England is behaving like the Bank of Canada in signalling upcoming rate hikes.

"I disagree," Donnelly says. "Stephen Poloz is highly committed and massively bullish on the economy while the Bank of England is reluctantly hiking into a possible stagflation scenario."

In addition, Canada’s GDP growth has picked up rapidly in recent months while the UK economy is slowing and inflation is high but set to fall.

“Don’t be too shocked if the BoE never ends up hiking this year… Bitcoin!” he concludes.

This is a incisive comparison chosen by Donnelly.

Bitcoin prices are famously volatile with huge swings seen over recent weeks that have caught the attention of markets and burnt many investors - experienced and novice alike - following a 24% decline in August alone.

While Sterling is unlikely to experience such volatility the message implied by Donnelly is that this rally in GBP/USD might be prone to a pullback which would give a rude punch to traders riding the move higher.

While Donnelly throws up some interesting pointers, we would be wary of the view that the Bank won't raise rates.

The intervention of the Bank of England’s Gertjan Vlieghe in the rate debate ahead of the weekend could be significant as he is a noted dove on the Bank's Monetary Policy Committee.

Vlieghe told an audience at the Society of Business Economists' Annual Conference in London that "we are approaching the moment when bank rate may need to rise" and the "appropriate time for a rise in bank rate might be as early as in the coming months."

That one of the most dovish members of the MPC is eyeing a rate rise is notable and suggests consensus might have already been reached on a November hike.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.