Bets Against British Pound Surge as Traders Turn Even More Positive on the Euro

Traders raised bets against Pound Sterling by $1.1BN in the space of a week according to the latest available data on foreign currency market positioning from the US Commodity Futures Trading Commission.

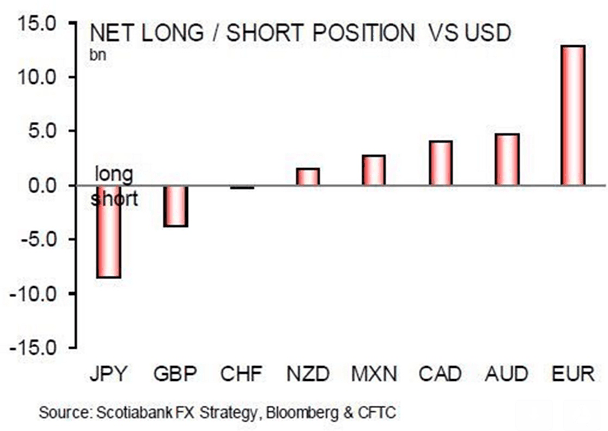

The CFTC reports the addition of $1.1BN-worth of extra contracts taken against the British Pound takes the overall outstanding against the currency to $3.7BN.

The data comes amidst an ongoing loss in value for the UK currency which remains beset by uncertainty surrounding Brexit.

“Bears were responsible for roughly $0.9bn of the deterioration as they added to gross shorts while bulls reduced their gross longs by $0.2bn. GBP sentiment has deteriorated in four of the past five weeks,” says Shaun Osborne, an analyst with Bank of Nova Scotia in Toronto.

Only the Japanese Yen suffers greater negativity.

The Euro meanwhile remains the darling of the foreign exchange trading community who continue to add exposure to a currency boosted by a fast-improving Eurozone economy.

“EUR’s net long position was up $1.3bn w/w to $12.9bn, recovering a portion of last week’s decline. The improvement was almost entirely driven by EUR bulls as gross longs climbed $1.2bn w/w. EUR gross longs are just shy of the record high from two weeks ago,” says Osborne.

The sentiment amongst traders goes some way in explaining the fall in the Pound to Euro exchange rate to fresh 8-month/8-year lows over the course of the past week. (8-month if you choose to observe the flash-crash of October 2016).

Concerning the outlook - the data tells us bets against the Pound are not necessarily extended and can therefore be added to.

Neil Dwane at Allianz Global Investors warned this week that while Sterling is looking oversold on a fundamental basis, the currency could absorb further selling pressures owing to neutral market positioning.

The more interesting currency is however the Euro which could be said to be stretched in terms of positioning.

These are historically large bets in favour of the Euro and what tends to happen when extreme levels are reached is that some retracement occurs as the market is unable to substantially add to the position.

It could be that the Euro/Dollar and Euro/Pound rally is constrained by the market’s positioning going forward.