Traders Increase Bets Against British Pound, but Euro Bulls Starting to Book Profits, US Dollar Negativity Starts to Ease

The latest insight into the positioning of traders on the vast foreign exchange market place confirm sentiment towards Pound Sterling remains negative.

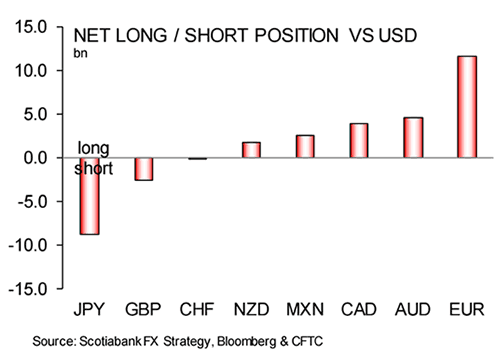

According to data from the US Commodity Futures Trading Commission - the most comprehensive data set on FX investor positioning - bets in favour for more Euro strength have eased somewhat having been at its highest level since 2011 in the previous week.

The cooling in enthusiasm for the Euro comes as the currency’s strong run against the Dollar hits resistance in the vicinity of 1.18.

The Euro’s gains against Pound Sterling however appear to be ongoing as the UK currency and Yen continue to see investors hold a net negative position.

And, the bearish sentiment on Sterling appears to be increasing having seen a weekly change of $520MN added to the overall bet against the currency. The total position is now at $2.563BN.

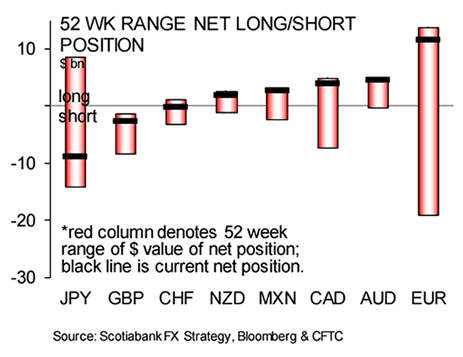

This is the only currency to see an increasing negative bet, and as we can see in the below, the position could well grow further:

So the Pound is certainly liable to weaken further on the basis of positioning data.

However, the Euro does look vulnerable to a deeper decline as the long bet in favour of the single-currency is looking increasingly stretched.

Perhaps the most useful aspect of CFTC positioning data is its ability to tell us where trades are overextended. Typically when overextended we find that the potential for further gains become limited and the risks of a sharp reversal increase.

“EUR bulls also took profit this week, reducing gross longs by $1.6bn and driving the bulk of the $2.1bn w/w deterioration in the net long to $11.6bn. Gross longs have been pushing to fresh record highs since March. The net long position remains somewhat extended, leaving EUR vulnerable to further adjustment,” says Shaun Osborne, a FX strategist with Scotiabank in Toronto.

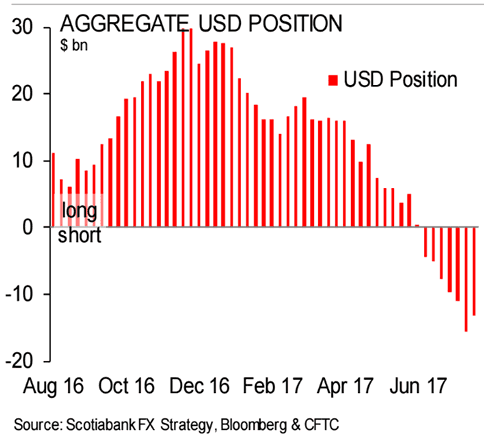

Elsewhere, the bearish bet against the US Dollar appears to be easing:

“This week’s positioning adjustments appear to be dominated by profit-taking among CAD, EUR, and NZD bulls alongside an accelerated pace of short covering for JPY bears. The cumulative impact has provided for a modest narrowing in the aggregate USD short, the first following an unbroken run of deterioration since mid-June,” says Osborne.

Quotes and % Changes:

The Pound to Euro exchange rate settled at 1.0941 in the previous week having fallen 0.55% on the week.

The Pound to Dollar exchange rate settled at 1.2861, having fallen 1.07% on the week.

The Euro to Dollar exchange rate settled at 1.1751 having fallen 0.52% on the week.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.