Pound Sterling Finds no Saviour in Decent Set of Retail Sales Data

- Written by: Gary Howes

- Pound to Euro exchange rate: 1 GBP = 1.1150

- Pound to Dollar exchange rate: 1 GBP = 1.2971

The British Pound experienced a day of selling despite some positive news for the UK economy on the economic front.

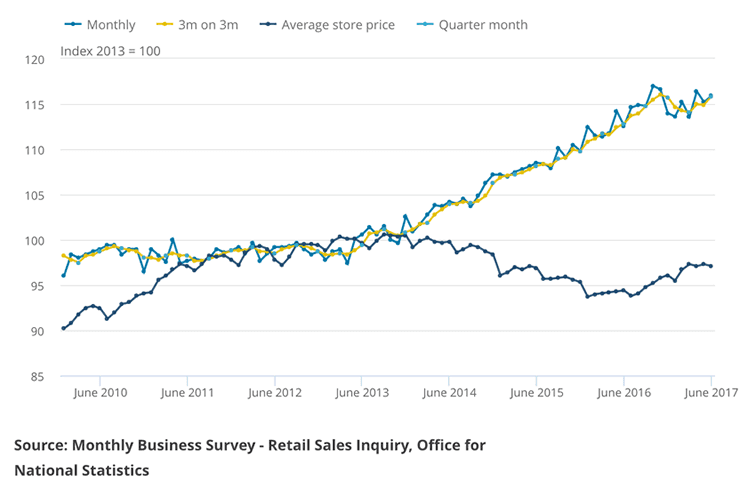

The ONS released their latest set of retail sales data showing that in June consumers opened their wallets and spent a little more than they had in the previous month.

Markets are keen to find out how the all-important UK consumer is performing amidst a squeeze in consumer earning power; recall inflation is now running ahead of wage rises which should suppress expenditure.

Month-on-month retail sales grew by 0.6%, better than the 0.5% growth forecast by economists. However, the previous month's reading was downgraded to -1.5% from -1.2%.

The annualised year-on-year reading came in at 2.9%, well ahead of the 2.5% growth.

Excluding auto fuel, increases were recorded in most of the main categories of spending - the largest being in sales at household goods stores (3.3%m/m), which may be indicative of some stabilisation in housing market activity.

A warmer June – relative to seasonal norms – was expected to have boosted sales in those areas that are more sensitive to changes in weather patterns.

Sales at clothing sales rose 0.4%m/m, but the expected boost to food sales did not transpire with sales at predominantly food stores slumping 0.5%m/m.

The data will come as confirmation that the second-quarter will have seen the economy pick up growth after a soft start to the year.

"Ahead of next week’s preliminary estimate of Q2 GDP, the 1.5% rise in retail sales in the second quarter alone, should add around 0.1% points to GDP growth in Q2," say analysts at Lloyds Bank in response to the data.

However, the general trend remains one of a slowdown in consumer activity and this trend could extend.

"Although we take heart from the better June retail sales data we note that the series is highly volatile on a month to month basis," says Victoria Clarke at Investec in London. "We remain of the view that this year will be one in which consumer spending growth will remain weak with consumers under pressure as the squeeze to household real spending power persists and even intensifies."

Neverthless, the data could also keep alive expectations for the Bank of England to raise interest rates, which in turn will likey support Sterling.

The Pound's reaction has been rather muted, perhaps signalling that it is the ECB meeting at mid-day and updates on Brexit negotiations that will be of most importance.

Get up to 5% more foreign exchange by using a specialist provider. Get closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Sterling has Other Matters to Contend with

The Pound is falling at the time of writing suggesting that economic data will play second-fiddle to political and external drivers.

Already mentioned is the ECB policy decision that should have a bearing on GBP/EUR in particular.

However, it is the ongoing Brexit story that will be central to Sterling's present weakness.

Remember that Thursday also brings an update on Brexit negotiations.

This week has seen negotiators poring over the finer details of the first stages of the negotiation - issues pertaining to citizen rights, the Irish border and the UK's exit payment.

The UK's David Davis and Michel Barnier are likely to adress the media and while details will likely be thin the tone set by the two negotiators will be important for currency markets.

Traders will want to hear that progress is being made. Any stumbling blocks will almost certainly deliver Sterling a nasty punch on the nose.

No time for the appearance has been given as of yet.