Indian Rupee Falls on Stimulus Angst, But Remains Positively Poised Against the Pound

India's Rupee struggles as markets anticipate a US Federal Reserve interest rate hike, but our longer-term studies suggest the currency could continue higher against Pound Sterling.

The Rupee has fallen against the US Dollar as markets continue to anticipate higher interest rates at the US Federal Reserve.

However, the woes that have befallen Sterling on Tuesday the 13th September confirm this is not a currency with any major upside potential.

Indeed, we believe further declines in GBP/INR are likely going forward.

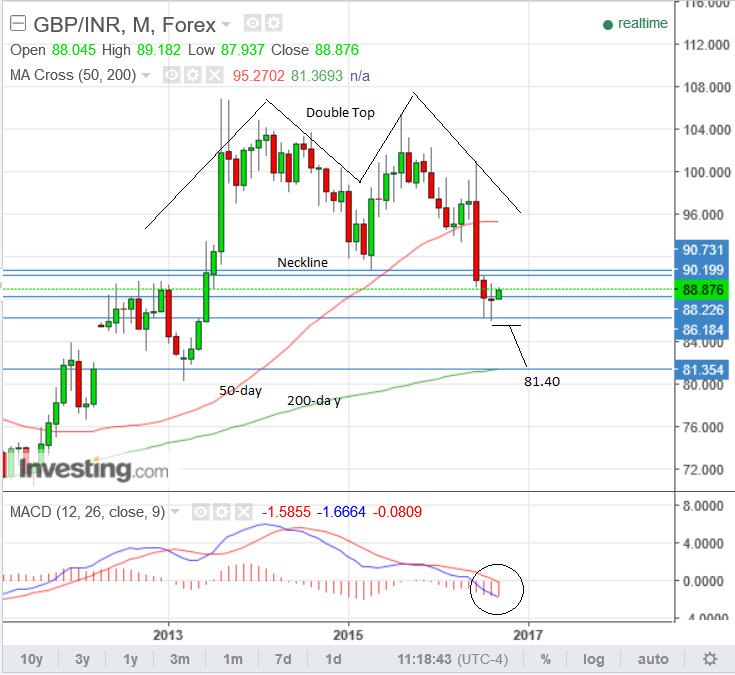

It is not the first time we have shown the rather bearish chart of the GBP/INR pair on a monthly timescale, but it’s so clearly and compellingly bearish that we must put it up.

The chart shows a very large double top pattern stretching across the 2014-15 highs.

Moreover, the exchange rate has now broken below the neckline for the pattern (blue line) confirming it has actually broken to the downside and activated a minimum downside target of 81.40.

There is quite a high probability given the clarity of the pattern that the exchange rate will eventually fall to that target, although there is the possibility that in the short term, there could be a throw-back move to the neckline at 90.19 but, that will just be temporary and lead to an eventual capitulation lower.

On a daily chart, the bearish outlook is less obvious as the pair has been going sideways since bottoming following Brexit.

The potential double bottom pattern seen on the chart however is a bullish sign, especially not the exchange rate has broken above the slanting neckline.

It should now move all the way to its target at 90.19, but a break above the current 89.20 range will lead to a move higher to the target calculated by extrapolating 0.618% of the height of the double bottom higher.

The MACD momentum indicator also remains well above the zero-line.

Rupee to Remain Stable, Despite Market Fears Over Fading Central Bank Stimulus

Heightened expectations that policymakers in Washington will increase US interest rates has seen strong selling pressure placed on Asian currencies over recent days.

A rise in interest rates, and therefore borrowing costs in the US, is likely to have a negative impact on many emerging market countries as well because they have taken on large amounts of dollar-denominated debt, as well as US credit, so their repayments will also rise.

This tends to slow down growth in Asian and Emerging Markets and is therefore INR-negative.

The excerpt from a report by the Bank of International settlements below explains the phenomenon:

“Since 2008, Dollar credit has grown more rapidly outside the United States than inside. Although there is only one dollar yield curve, the two stocks of dollar credit behave differently. Dollar credit to non-US residents grew faster owing not only to more rapid growth in emerging market economies (EMEs) over the last six years.

“Dollar credit also expanded owing to its substitution for local currency credit given favourable dollar interest rates and exchange rate expectations (Bruno and Shin (2015a,b)) as EME firms leveraged up (IMF (2015)).”

Given not just the base interest rate but also the dollar will rise if the Fed ratchets up interest rates, those loans to companies in emerging market countries such as China, Brazil, Indonesia, Turkey and India, will become increasingly harder to repay.

This is why we have seen such a strong sell-off in emerging market shares after Fed officials on Friday talked up the possibility of a near-term rate rise.

For India, however, there are reasons to expect the impact to be more mediated, argues Dr Arun, Sing, Lead Economist at Dun and Bradstreet, who says that strong continued Foreign Direct Investment (FDI) flows are likely to keep the Rupee buoyant despite the EM-Fed rate hike shock.

“I think it is safe to say that rupee will continue to be stable in the coming months. FDI inflows are at an all-time high, global investors are betting on India, forex reserves are robust,” Singh told the Financial Economist Online.

Further adding, “So barring a day or two of volatility and pressure that can be attributed to global uncertainty on the US Federal Reserve and ECB front, rupee will continue to be strong.”

Other experts argue that India’s robust fundamentals are strong enough to withstand the global sell-off – and indeed the country is now officially the fastest growing in the world, having snatched poll position from China in 2015:

“We don’t see the rupee going beyond levels of 68.50. This is a phase of mild depreciation due to global pressure. There is no cause of worry on the domestic front,” remarked Sajal Gupta, head of currencies at Edelweiss Securities.

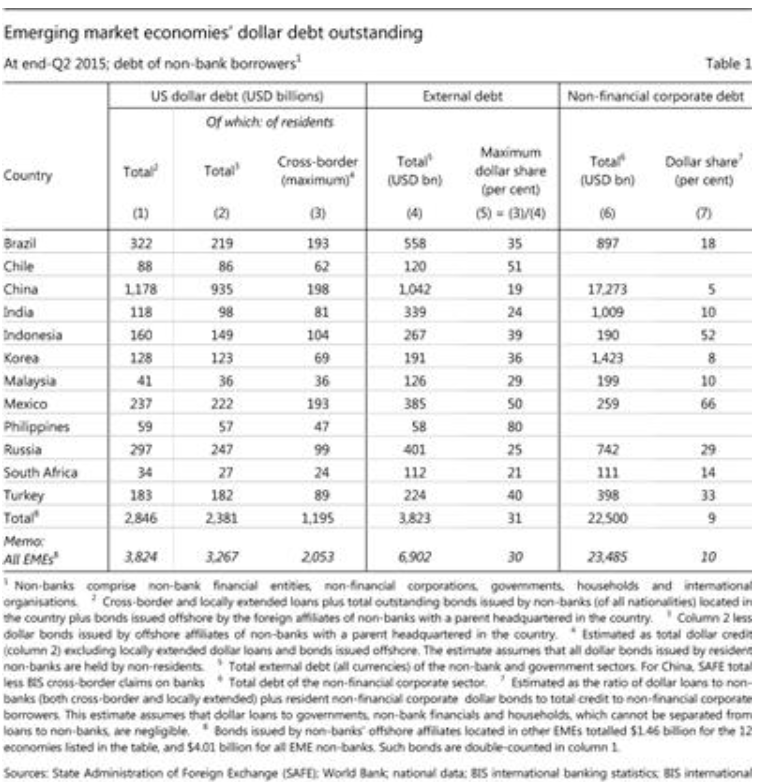

India’s share of either US originated or US denominated debt stands at about 81bn dollars, or 24% of all its external debt and 10% of its total non-financial debt, according to data compiled by the BIS in December 2015.

This is quite lows in the ‘league table’ compared to other countries such as Brazil, Indonesia, Malaysia, Mexico and Turkey which have even larger US debts, and therefore suggests the country may not be quite as exposed to dollar and US interest rate moves as other countries.

Inflation Data Takes Pressure off Patel to Hike rates

Expectations that inflation would be softer due to favourable monsoon rains and the recent pull-back in oil prices appeared to have come true in August after Indian inflation data on Monday showed a deeper-than-expected slow-down to 5.05% when a 5.50% result had been estimated by most economist.

This will lessen pressure on the new governor of the bank of India Urjit Patel to continue his predecessor’s ‘sword and banner’ crusade against inflation.

There were expectations that Patel would continue seeking higher interest rates which tend to dampen inflation. Higher interest rates also tend to be supportive for a currency, therefore such inflation data could be seen as being negative for INR.

Although it is highly unlikely rates will be cut as inflation remains well above the 4.0% target range ceiling introduced in 2015: