Pound / Swedish Krona: Retail Sales, Technical Uptrends and Heightened UK Risks

Swedish shoppers pulled back their spending in July confirming a worrying trend in the trajectory of Swedish retail sales which could aid the mini uptrend noted on the GBP vs SEK charts.

The Swedish Krona has been undermined after the posting of a below-expectation fall in retail spending.

The July data showed a -0.9% decline versus expectations of +0.7%.

Sweden’s weak retail data confirms a notable down-trend developing which may start to concern policymakers.

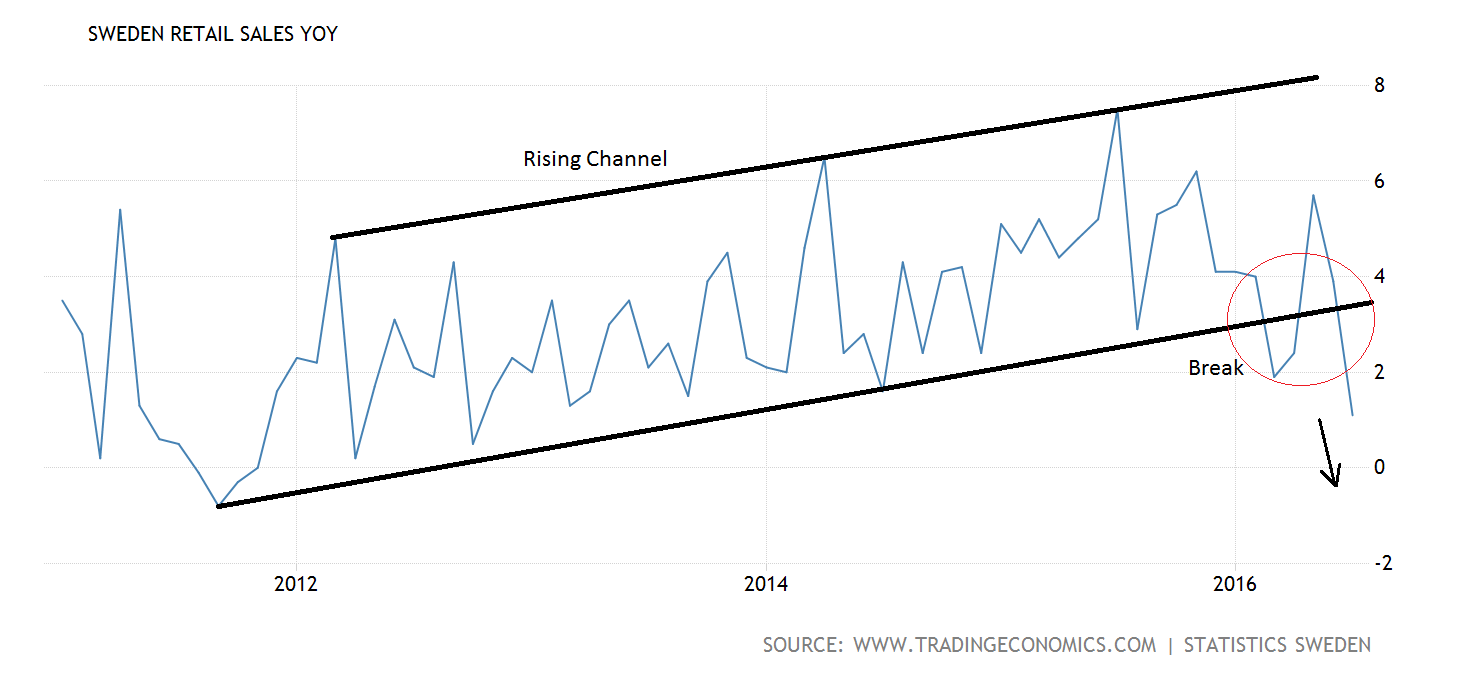

The chart below shows annualised Retail Sales, with the latest print at 1.1% in July.

As can be seen from the chart the most recent result marks a clear breakdown from the five year rising channel which began in 2011.

This breakdown does not bode well for further results which are likely to deteriorate or remain at present low levels in months to come, perhaps signifying a retrenchment from the previous up-trend.

This will not be great for GDP and given the Swedish central bank's already ultra-loose stance supports the possibility of more monetary stimulus in the future.

Further stimulus would be negative for SEK as it increases supply and therefore dilutes unit value.

Inflation is, however, looking up in Sweden and may keep the probabilities that the Riksbank will cut rates or increase QE down.

The chart below shows a clear recovery in inflation to its most recent 1.1% result, and presents a clear rounding bottom basing pattern, which seems to forecast more upside on the horizon.

Technical analysis of GBP/SEK

Turning now to a technical analysis of GBP/SEK itself, and we see that the pair has established a mini-uptrend on the four-hour chart, which is biased to continuing higher given the absence of any reversal signs.

A break above the current highs at 11.1667 would probably lead to a move up to the next resistance level at the 50-day moving average at 11.2500.

The 50-day is, however, expected to act as a ceiling blocking further upside, given exchange rates often stall or even reverse when they encounter them due to an increase in supply in the direction counter to the trend.

The MACD indicator in the lower pane is languishing and looks weak and is the only sign of doubt in the up-trend although it is an insufficient marker alone to undo the forecast.

Pound Falls in Anticipation of September Data and Return of Politics

The Pound fell on Monday as investors looked ahead with trepidation at two major events for the currency in the week ahead.

The first is the announcement from Philip Hammond of a plan on how to negotiate a new deal with the EU.

With politicians returning from their summer holidays we would expect this risk factor to grow somewhat.

The second driver of Serling will be the two PMI releases at the end of the week.

Manufacturing and Construction PMI’s in August are released on Thursday and Friday respectively and promise to be the highlight of the trading week for the currency.

In July PMI’s slumped steeply to below 50 after Brexit fears paralysed the outlook for many businesses.

A similar reading is suspected in August, although some analysts such as Nordea Bank’s Bo Jacobsen sees Manufacturing moderating higher to 49 from the current 48.2.

According to KBC Markets the Pound was also weighed on by news over the weekend from Germany which showed a diplomatic but tough stance to negotiations with the UK over Brexit.

“During the weekend, German officials were downbeat about Brexit. Vice chancellor Gabriel said the UK vote to leave is a huge political problem which makes Europe unstable Also Schaüble showed irritation with the UK government and its approach to Brexit.

So Sterling is under some pressure at the start of the session,” said KBC.

Nevertheless, separate reports stressed the German Finance Ministers eagerness to. “form a new relationship rather than have a messy divorce.”

Nevertheless the perceived negativity from Germany is not a good sign as they are major exporters to the UK and therefore have much to lose from a deterioration of the relationship - but appear to placing principle ahead of economic interest.