Pound Sterling is Forecast to See Deeper Losses against the Euro and Dollar by Emboldened Bears

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling's sharp drop against the Euro has emboldened the bears who see further losses ahead.

Foreign exchange analysts who think the Pound has no business being at its current levels against either the Euro or Dollar have wasted no time reacting to Thursday's sharp decline in the currency by saying there is more weakness to come.

Sterling dropped after Bank of England Governor Andrew Bailey said if the news on inflation continued to be good, there was a chance of the Bank becoming "a bit more activist" in its approach to cutting interest rates," Bailey said.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

In those comments, markets saw a pivot from an abundance of caution to enthusiasm about the prospect of lower interest rates at the Bank, and the Pound bore the brunt of the market adjustment.

"We've always thought that once the BoE becomes more comfortable with the path of inflation, it will signal a more aggressive rate cutting cycle. Bailey’s comments are a clear move in that direction," says Nick Andrews, Senior FX Strategist at HSBC.

Bailey's comments come a mere two weeks after he said on a trip to Kent that the Bank would maintain a cautious approach to cutting interest rates. In the interim, there has been no decisive inflation data from the UK to make Bailey "more comfortable with the path of inflation".

Instead, what has changed is his colleague at the European Central Bank (ECB), Christine Lagarde, who indicated last week that the ECB would likely deliver a second consecutive interest rate cut in October following the release of unexpectedly weak Eurozone inflation.

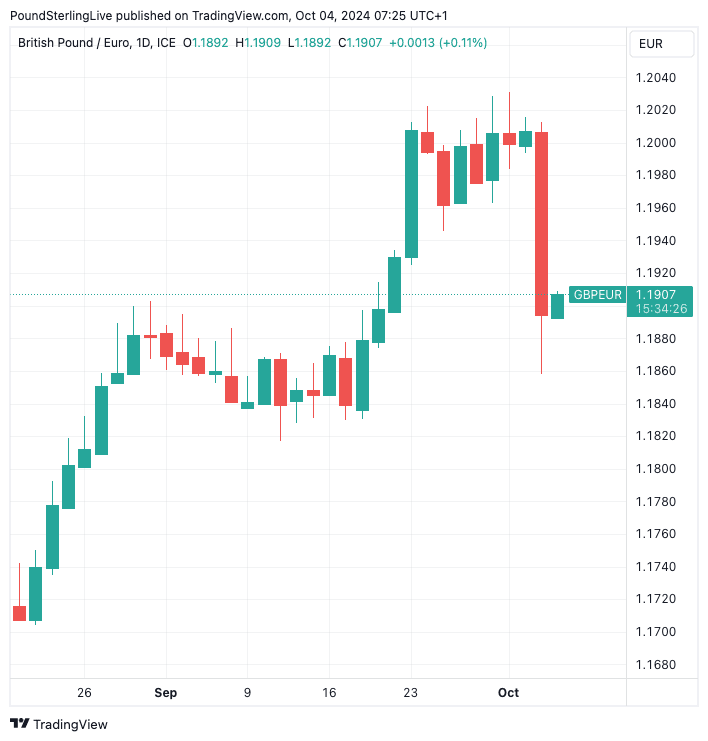

The Pound to Euro exchange rate fell 0.94 on the day to reach 1.1894, the Pound to Dollar exchange rate fell 1.10% to 1.3123. The losses are being sustained at the time of writing Friday.

"We think that over the medium term there is further to go," says Noah Buffam, an analyst at CIBC Capital Markets. "We like short GBP/USD to position for a repricing of the pace of BoE cuts."

Above: GBP/EUR experienced its biggest daily drop since December 2022 on Thursday.

It's been difficult being a Sterling 'bear' over the last two years, given the Pound has been the top performer this year and the second-best in 2023.

But, the sudden drop that follows Bailey's comments has reinvigorated expectations for downside.

"We suspect that it will weaken more over the next year or so given our dovish view of Bank of England policy, the currency’s still-high valuation, and stretched speculative positioning," says Hubert de Barochez, Senior Markets Economist at Capital Economics.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Capital Economics thinks the sharp fall in the value of the Pound following Bailey's comments reflects an overvaluation in the Pound that might be unwinding.

Furthermore, most economists and strategists commenting on the events of the past 24 hours think the move has also been exacerbated by excessive positioning in the Pound.

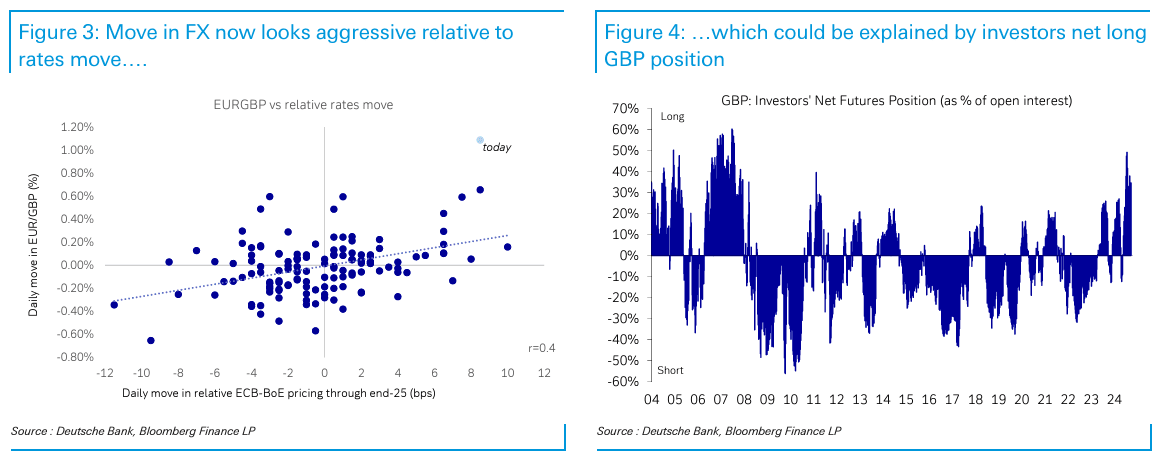

"The move in FX is sufficiently aggressive that the longest streak without a 1% move in EUR/GBP now looks set to end. In the micro, one could however now argue that the FX move is comparatively aggressive to the magnitude of the move in rates. The most obvious rejoinder to this would be to point to positioning, which to be sure shows a net long in the pound amongst investors," says Shreyas Gopal, a strategist at Deutsche Bank.

Some analysts think the fundamentals behind the Pound's 2024 outperformance remain intact and that Bailey simply won't have the luxury of cutting as fast and far as his peers in America and Europe.

But Capital Economics thinks the market is unprepared for the quantum of cuts to come and expects Sterling will fall further, "particularly against the euro".

"This is because, unlike the ECB, we expect the BoE to cut rates by even more than is now priced in; sterling still appears highly valued; and positioning remains stretched," says de Barochez.

Capital Economics forecasts the Pound will depreciate from 0.84/€ now to 0.88/€ by the end of next year. (This gives a move in the Pound to Euro rate from 1.19 to 1.1360).

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Money market pricing shows investors now see a 25 basis point cut from the Bank of England in November as being fully priced again.

Bets are being added further down the horizon, with 125 basis points now priced by June next year.

"We expect markets to continue to price a more aggressive UK monetary easing cycle pushing GBP-USD lower possibly to 1.31 and a break of 1.30 would open up our year-end target of 1.28," says HSBC's Andrews.

HSBC thinks the Bank of England will cut Bank Rate by 25bps in November followed by 25bps per meeting in 2025. This would take the Bank rate to 2.75% by December 2025.

"We expect GBP faces challenges as the market begins to reprice towards HSBC economic forecasts," adds Andrews.