British Pound's Big Reaction to Bailey Comments Could be Overdone

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling's big reaction to an apparent switch in thinking at the Bank of England might be overdone.

"The move in FX is sufficiently aggressive," says Shreyas Gopal, a strategist at Deutsche Bank. "When the dust settles however, it's quite possible that the bigger picture for sterling will not have changed as much as current currency price action implies."

Bank of England Governor Andrew Bailey said the Bank could be "more activist" in cutting interest rates going forward, signalling it would speed up the pace it cuts interest rates.

This looks to be a pivot away from a carefully nurtured and unambiguous message from recent months that the Bank will proceed slowly on interest rate cuts owing to still-high inflation.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

With markets highly sensitive to interest rate expectations, the Pound fell sharply.

GBP/USD is down by more than one big figure at 1.3119, having started the day at 1.3267. The GBP/EUR is down by a per cent at 1.1887, having started the day at 1.2012.

"The move in the UK currency today is a reminder of FX sensitivity to expectations of interest rate differentials. It follows the reference by the Bank of England’s Governor to the central bank becoming "a bit more activis" in its interest rate policy," says Mohamed A. El-Erian, advisor to Allianz and Chair of Gramercy Funds Management.

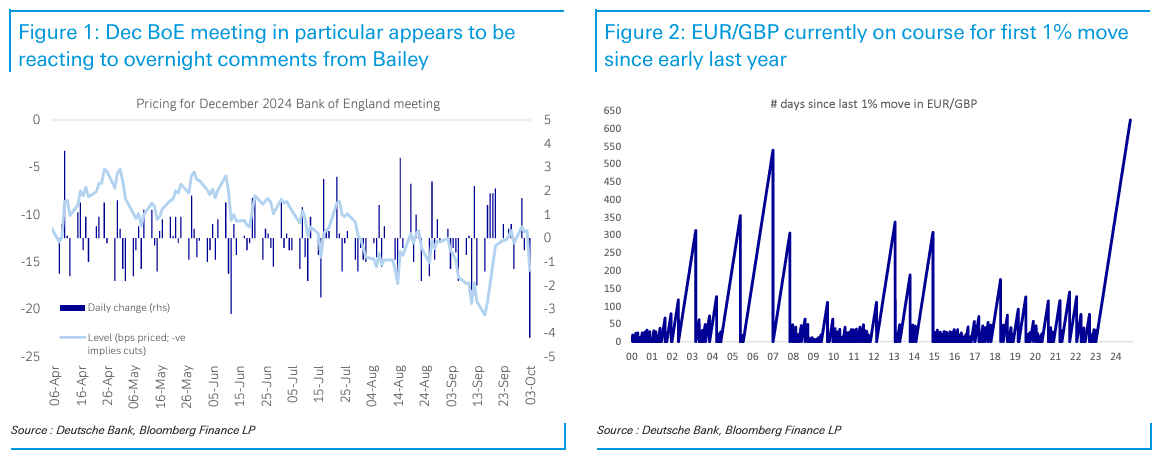

Deutsche Bank's Gopal says this is the first 1% move in GBP/EUR in over 600 days, marking the end of the longest stretch of time that the exchange rate has not delivered a 1% daily move.

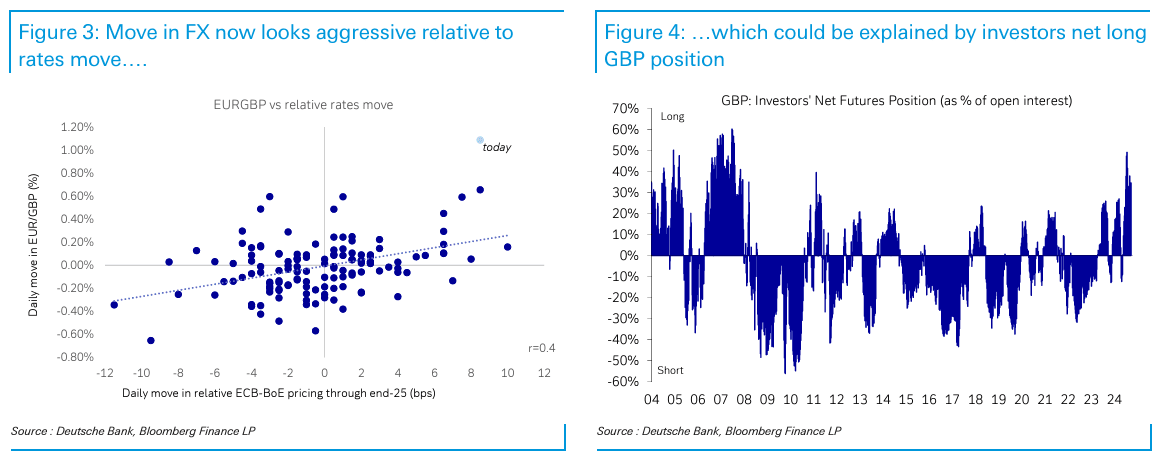

Why is the market move so extraordinary? Positioning.

The market is positioned overwhelmingly 'long' on all things Pound Sterling, meaning that a significant portion of the market is invested in the expectation the Pound will continue to rise.

When positioning gets heavily involved in a certain direction it gets crowded. This leaves a currency vulnerable to a 'washout' of these positions. A jolt to the Pound, such as that provided by Bailey, means a lot of positions have been caught looking the wrong way.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

As participants exit the market, they are required to sell GBP to cover their positions, creating a snowball effect that catches more and more traders out.

"One could now argue that the FX move is comparatively aggressive to the magnitude of the move in rates. The most obvious rejoinder to this would be to point to positioning, which to be sure shows a net long in the pound amongst investors," says Gopal.

The Pound is 2024's best performing currency courtesy of expectations the Bank of England would be slow to cut rates. This assumption is now challenged and it is understandable the Pound has fallen.

Positioning muddies the waters as to whether the scale of losses is warranted, but Bailey's stated desire to get more "activist" on rates will be constrained by rising inflation, which is forecast by the Bank and other economists to steadily rise to 2.7% by year-end.

"When the dust settles however, it's quite possible that the bigger picture for sterling will not have changed as much as current currency price action implies," says Gopal.